The Georgia Incorporation Guide

Step-by-Step Process for Incorporating Your Business in Georgia

Incorporating your business in Georgia is a straightforward process that sets the foundation for your entrepreneurial journey. This guide will walk you through each step, ensuring you understand the requirements and can navigate the process with confidence.

Step 1: Choose Your Business Structure

The first step is deciding on the legal structure of your business. In Georgia, the most common options include:

Sole Proprietorship: This is a simple structure for single-owner businesses. You don’t need to register with the state, but you’ll be personally liable for any business debts or legal issues.

Partnership: Suitable for businesses with multiple owners, a partnership is easy to establish but also comes with personal liability.

Corporation (C-Corp or S-Corp): Corporations offer limited liability protection, allowing owners (shareholders) to be separate from the business. This structure is more complex and requires more paperwork and ongoing compliance.

Limited Liability Company (LLC): An LLC combines the tax benefits of a partnership with the liability protection of a corporation. It’s a popular choice for small businesses as it offers flexibility and ease of management.

Step 2: Select a Unique Business Name

Your business name is a crucial element of your brand. It should be unique, memorable, and representative of your products or services.

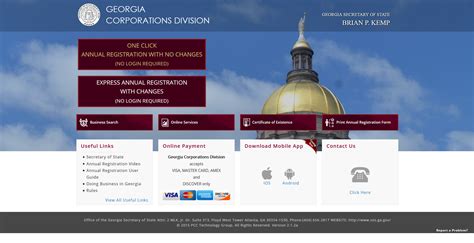

To ensure your desired name is available, you can search the Georgia Secretary of State’s Business Entity Search to check for existing businesses with similar names.

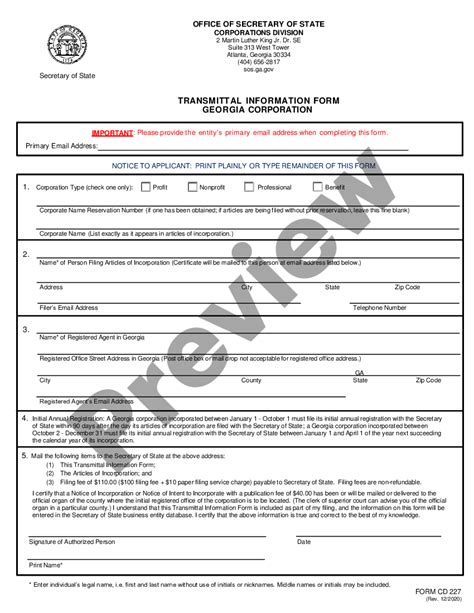

Step 3: Appoint a Registered Agent

A registered agent is a person or entity authorized to receive legal documents on behalf of your business. This could be a lawyer, a professional service provider, or even yourself if you meet certain criteria.

Your registered agent must have a physical address in Georgia, and they must be available during regular business hours to receive important documents.

Step 4: File the Articles of Incorporation

The Articles of Incorporation is a legal document that officially forms your business as a corporation. It includes essential information such as:

- The business name and principal address.

- The purpose of the business.

- The names and addresses of initial directors.

- The number of authorized shares of stock the corporation is allowed to issue.

You can file the Articles of Incorporation online through the Georgia Business Filings portal or by mail. The filing fee is $60.

Step 5: Create Corporate Bylaws

Corporate bylaws are the internal rules and regulations that govern the operation of your corporation. They outline important aspects such as:

- Meeting procedures for shareholders and directors.

- Voting rights and shareholder rights.

- Procedures for electing officers and directors.

- Record-keeping requirements.

While not required in Georgia, creating corporate bylaws is highly recommended as it provides a clear framework for running your business.

Step 6: Hold an Initial Board of Directors Meeting

The initial board of directors meeting is where key decisions about the business are made. This meeting should cover topics such as:

- Election of officers (president, vice president, treasurer, secretary).

- Adoption of the corporate bylaws.

- Approval of stock certificates.

- Discussion of business goals and strategies.

Step 7: Obtain Necessary Licenses and Permits

Depending on your business type and location, you may need specific licenses and permits to operate legally.

You can use the Georgia Business One-Stop portal to search for and obtain the necessary licenses and permits. This portal provides a comprehensive list of requirements based on your business activities.

Step 8: Register for State and Federal Taxes

Once your business is legally formed, you’ll need to register for various taxes, including:

State Taxes: Register with the Georgia Department of Revenue for sales tax, employer taxes, and any other applicable state taxes.

Federal Taxes: Register with the IRS for an Employer Identification Number (EIN), which is required for tax purposes. You can do this online through the IRS website.

Step 9: Open a Business Bank Account

Opening a separate bank account for your business is crucial for maintaining clear financial records. It helps keep your personal and business finances separate, which is essential for tax purposes and financial management.

Step 10: Maintain Ongoing Compliance

Incorporating your business is just the beginning. To maintain your legal status, you must adhere to ongoing compliance requirements, such as:

- Filing annual reports with the Georgia Secretary of State.

- Maintaining proper corporate records and minutes.

- Staying up-to-date with tax obligations.

- Ensuring your business insurance coverage is adequate.

FAQ Section

What are the benefits of incorporating in Georgia specifically?

+Georgia offers a business-friendly environment with low corporate tax rates and a range of incentives for businesses, particularly in the technology and innovation sectors. Additionally, Georgia's strategic location and transportation infrastructure make it an attractive choice for companies looking to expand their reach.

<div class="faq-item">

<div class="faq-question">

<h3>Can I incorporate my business online in Georgia, or do I need to visit a government office?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Georgia offers a convenient online filing system for incorporating your business. You can complete most of the process online through the Georgia Business Filings portal, saving you time and the need to visit government offices physically.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What are the ongoing compliance requirements for a Georgia corporation?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Georgia corporations must file an annual registration with the Secretary of State, which includes updating any changes in the business, such as addresses, directors, or officers. Additionally, corporations must maintain proper corporate records and minutes, and ensure they are up-to-date with state and federal tax obligations.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any tax benefits for incorporating my business as an LLC in Georgia?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, LLCs in Georgia benefit from pass-through taxation, which means profits are taxed only once at the personal level, avoiding the double taxation that corporations often face. Additionally, Georgia offers a range of tax incentives and credits for eligible businesses, particularly those focused on innovation and job creation.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How long does it typically take to incorporate a business in Georgia?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>The incorporation process in Georgia can take anywhere from a few days to a couple of weeks, depending on the efficiency of your paperwork and the volume of applications the state is processing at the time. Online filing can speed up the process, as it eliminates the need for postal delays.</p>

</div>

</div>

</div>

Incorporating your business in Georgia is a significant step towards establishing a successful and legally compliant enterprise. By following this comprehensive guide, you can navigate the process with ease and set your business up for long-term success.