Mastering NPV Calculations: 3 Easy Steps

In the world of finance and investment analysis, the Net Present Value (NPV) is a fundamental concept that plays a pivotal role in decision-making. Understanding how to calculate NPV accurately is essential for anyone involved in evaluating investment opportunities or financial projects. This comprehensive guide will walk you through the process of mastering NPV calculations in just three easy steps, ensuring you have the tools to make informed financial decisions.

Step 1: Understanding the NPV Formula

The Net Present Value is a powerful metric that helps assess the profitability of an investment or project by discounting future cash flows to their present value. The formula for calculating NPV is as follows:

NPV = PV_{1} + PV_{2} + ... + PV_{n} - Initial Investment

Here's a breakdown of the components:

- PV_{1}, PV_{2}, ..., PV_{n}: These represent the present values of each future cash flow, discounted at a specific discount rate or required rate of return.

- Initial Investment: This is the amount invested at the beginning of the project or investment period.

The key to a successful NPV calculation lies in accurately estimating future cash flows and choosing an appropriate discount rate. The discount rate reflects the time value of money and accounts for the opportunity cost of investing in a project or the required rate of return for investors.

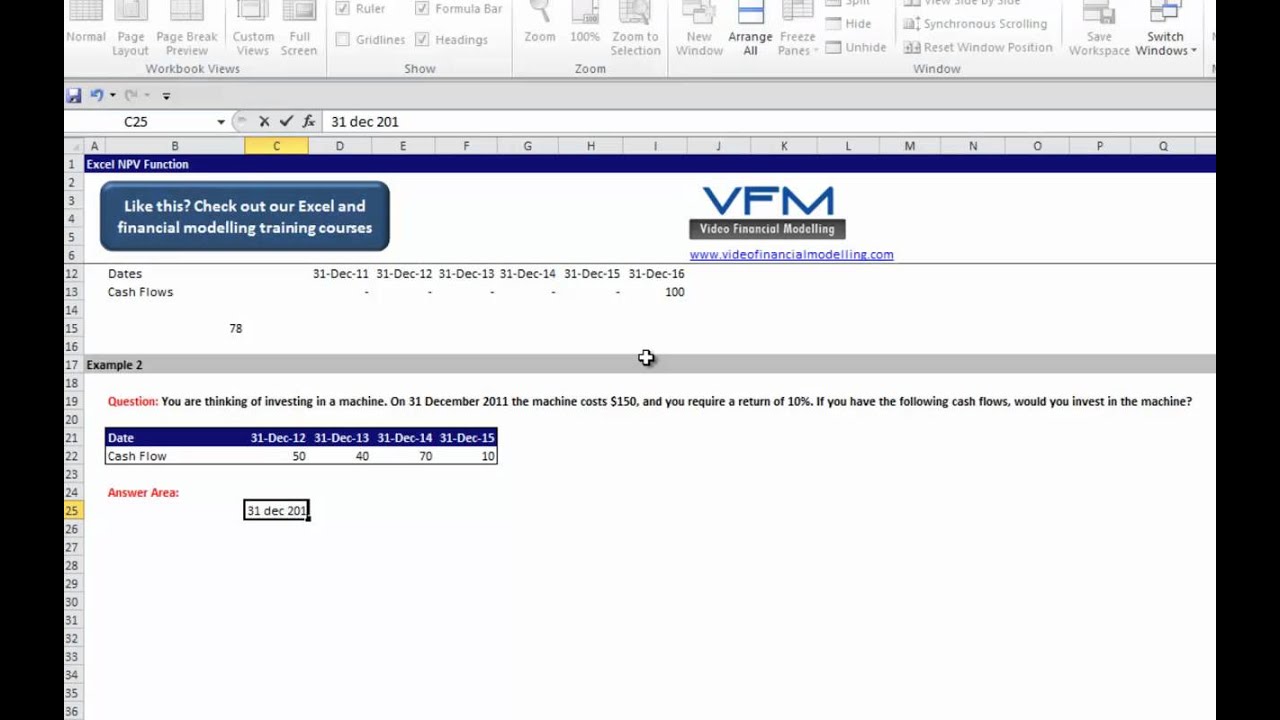

Example: NPV Calculation for a Real Estate Investment

Let’s consider a scenario where an investor is evaluating a real estate development project. The project has an initial investment of \1,000,000$, and the investor expects the following cash flows over a period of 5 years:

| Year | Cash Flow (\$) |

|---|---|

| 1 | 150,000 |

| 2 | 200,000 |

| 3 | 250,000 |

| 4 | 300,000 |

| 5 | 350,000 |

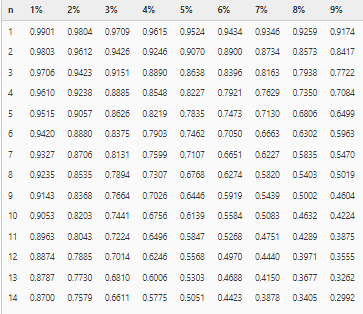

Given a discount rate of 8%, the investor can calculate the NPV as follows:

NPV = PV_{1} + PV_{2} + PV_{3} + PV_{4} + PV_{5} - $\$1,000,000$

Where PV_{n} is calculated using the formula:

PV_{n} = CF_{n} / (1 + r)^n

Here, CF_{n} represents the cash flow in year n, and r is the discount rate.

Calculating PV_{1}, PV_{2}, PV_{3}, PV_{4}, and PV_{5}, and subtracting the initial investment, we get an NPV of $\$120,149.33$.

Step 2: Choosing the Right Discount Rate

Selecting an appropriate discount rate is crucial for an accurate NPV calculation. The discount rate represents the minimum acceptable return for an investment, considering the risks involved. Here’s how to choose the right discount rate:

- Cost of Capital: For a business, the discount rate often reflects the weighted average cost of capital (WACC), which considers the cost of equity and debt financing.

- Risk-Free Rate: In some cases, a risk-free rate, such as the yield on government bonds, may be used as a baseline for discounting.

- Adjust for Risk: Since future cash flows are uncertain, the discount rate should be adjusted to account for the project's risk profile. A higher risk typically warrants a higher discount rate.

- Competitive Returns: Consider the returns offered by alternative investment opportunities. The discount rate should be competitive to ensure the project is financially viable.

In our real estate example, a discount rate of 8% was chosen, reflecting a balance between the risk of the project and competitive market returns.

Common Discount Rate Scenarios

The choice of discount rate can vary based on the investment context:

- Internal Projects: For projects within a company, the WACC is often used as the discount rate.

- External Investments: Investors may use a risk-adjusted rate based on the project's industry, market conditions, and their own risk tolerance.

- Social Projects: In cases where financial returns are not the primary goal, a lower discount rate might be appropriate to encourage socially beneficial outcomes.

Step 3: Interpreting the NPV Result

Once the NPV is calculated, interpreting the result is essential for making informed decisions. Here’s how to interpret the NPV:

- Positive NPV: A positive NPV indicates that the present value of future cash flows exceeds the initial investment. This suggests the project is profitable and worth pursuing.

- Negative NPV: A negative NPV means the initial investment is higher than the present value of future cash flows. Such a project may not be financially viable and should be reconsidered.

- Zero NPV: A zero NPV suggests that the project's profitability is exactly equal to the initial investment. This might be acceptable in certain scenarios, but a positive NPV is generally preferred.

In our real estate example, the positive NPV of $\$120,149.33$ indicates that the project is likely to be profitable, providing a solid basis for the investor's decision to proceed.

NPV vs. Other Metrics

While NPV is a powerful tool, it’s important to consider it alongside other financial metrics. Here’s how NPV compares to some other commonly used metrics:

- Internal Rate of Return (IRR): IRR is the discount rate at which the NPV becomes zero. It's useful for comparing projects but may not always align with the actual cost of capital.

- Payback Period: The payback period calculates how long it takes for an investment to recover its initial cost. It's a simpler metric but doesn't account for the time value of money like NPV does.

- Discounted Cash Flow (DCF): DCF is a broader term encompassing NPV calculations. It emphasizes the importance of discounting future cash flows to their present value.

Advanced Considerations

When working with more complex projects or investments, several advanced considerations can enhance the accuracy of NPV calculations:

- Inflation: In scenarios with high inflation, adjusting cash flows and the discount rate for inflation can provide a more accurate NPV.

- Taxes: For taxable entities, accounting for taxes in cash flows and choosing an after-tax discount rate can yield more realistic results.

- Uncertain Cash Flows: In cases of uncertain cash flows, sensitivity analysis can be used to understand how NPV changes with variations in key assumptions.

- Multiple Discount Rates: For projects with varying risk profiles over time, using multiple discount rates can better reflect the dynamics of the investment.

Conclusion

Mastering NPV calculations is a cornerstone of financial decision-making. By understanding the NPV formula, choosing the right discount rate, and interpreting the results, investors and financial analysts can make informed choices about the viability and profitability of projects. While the process may seem complex, with practice and a solid understanding of the underlying principles, NPV calculations become an invaluable tool for navigating the world of finance.

How do I choose the right discount rate for my NPV calculation?

+The discount rate should reflect the cost of capital or the required rate of return for investors. Consider factors like the project’s risk, market conditions, and competitive returns. For internal projects, the weighted average cost of capital (WACC) is often used, while external investments may require a risk-adjusted rate.

What if my NPV calculation results in a negative value?

+A negative NPV suggests that the initial investment exceeds the present value of future cash flows. In such cases, the project may not be financially viable, and it’s advisable to reconsider the investment or explore alternative options.

How does NPV compare to other financial metrics like IRR and payback period?

+NPV provides a more comprehensive assessment of an investment’s profitability by discounting future cash flows to their present value. IRR is useful for comparing projects but may not align with the actual cost of capital. The payback period is simpler but doesn’t account for the time value of money like NPV does.