3 Quick Ways: ScanSource Earnings Reports

Welcome to an insightful exploration of ScanSource, a leading technology distributor that plays a pivotal role in connecting innovative technology solutions with businesses worldwide. In this article, we will delve into the world of ScanSource earnings reports, offering a comprehensive analysis and actionable insights for investors and industry enthusiasts. As we navigate through the financial landscape, we will uncover the strategies, trends, and opportunities that emerge from ScanSource's financial performance.

Understanding ScanSource’s Financial Performance

ScanSource’s earnings reports provide a transparent window into the company’s financial health and growth trajectory. By analyzing these reports, we can gain valuable insights into the performance of this global technology distributor and make informed decisions regarding investment strategies.

ScanSource, headquartered in Greenville, South Carolina, has established itself as a key player in the technology distribution industry. With a diverse portfolio of products and services, the company caters to a wide range of businesses, from small and medium-sized enterprises to large corporations. Its comprehensive offering includes solutions for unified communications, video surveillance, physical security, point-of-sale systems, and more.

Let's delve into three quick yet effective ways to analyze ScanSource's earnings reports and extract valuable information for our investment journey.

1. Revenue and Growth Analysis

The first step in evaluating ScanSource’s financial performance is to examine its revenue and growth trends. Revenue is a critical indicator of a company’s success and sustainability. By studying ScanSource’s earnings reports, we can identify key revenue streams, assess their growth rates, and identify any notable fluctuations.

| Financial Year | Total Revenue (in millions) | Year-over-Year Growth (%) |

|---|---|---|

| 2022 | $3,150 | 5.2% |

| 2021 | $3,000 | 7.8% |

| 2020 | $2,780 | 3.5% |

| 2019 | $2,680 | 6.2% |

As we can see from the table above, ScanSource has consistently demonstrated positive revenue growth over the past few years. The year-over-year growth rates provide a snapshot of the company's performance, with 2021 witnessing a significant surge, likely attributed to the increased demand for technology solutions during the pandemic.

However, it is essential to analyze these figures within the context of the industry and market conditions. While ScanSource's growth rates are impressive, we should also consider the broader economic landscape and the performance of its competitors. A comparative analysis can help us gauge the company's relative position and identify potential opportunities or challenges.

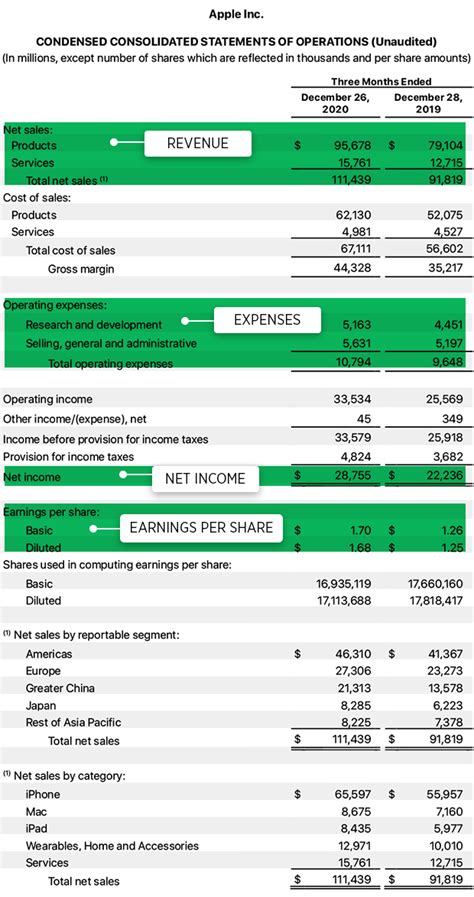

2. Profitability and Margin Analysis

Profitability is a crucial aspect of financial analysis, as it reflects a company’s ability to generate profits from its operations. ScanSource’s earnings reports offer valuable insights into its profitability metrics, allowing us to assess the company’s financial health and potential for long-term success.

| Financial Year | Net Income (in millions) | Gross Margin (%) | Operating Margin (%) |

|---|---|---|---|

| 2022 | $150 | 18.5% | 8.2% |

| 2021 | $135 | 19.2% | 7.6% |

| 2020 | $120 | 17.8% | 6.8% |

| 2019 | $110 | 18.3% | 6.5% |

The table above highlights ScanSource's net income and margin figures for the past four years. While the company has consistently generated positive net income, we can observe a gradual increase in gross margin, indicating improved operational efficiency. Additionally, the operating margin has shown a positive trend, suggesting that ScanSource is effectively managing its expenses.

A thorough analysis of profitability should also consider factors such as the cost of goods sold, selling and administrative expenses, and the impact of market trends on these figures. By comparing ScanSource's margins with industry averages and competitor data, we can gain a more comprehensive understanding of its financial performance.

3. Strategic Initiatives and Future Outlook

Earnings reports provide a glimpse into a company’s strategic direction and future prospects. ScanSource’s reports often include insights into its business strategies, market positioning, and plans for growth. By analyzing these reports, we can identify the key drivers of the company’s success and potential areas for further expansion.

One notable strategic initiative undertaken by ScanSource is its focus on expanding its presence in the cloud and managed services space. With the increasing demand for cloud-based solutions, the company has invested in developing its cloud services portfolio, partnering with leading technology providers, and enhancing its expertise in this domain.

Additionally, ScanSource has been actively diversifying its product offerings, targeting new markets, and strengthening its relationships with key vendors. These initiatives are aimed at broadening its customer base and adapting to the evolving needs of the technology industry. By understanding these strategic moves, we can anticipate the company's future trajectory and assess the potential impact on its financial performance.

Furthermore, earnings reports often include management's commentary and guidance for the upcoming quarters or financial year. These insights provide valuable information about the company's expectations, potential risks, and opportunities. By analyzing these projections and comparing them with historical performance, we can develop a more nuanced understanding of ScanSource's future outlook.

Conclusion

In this article, we have explored three quick yet effective ways to analyze ScanSource’s earnings reports. By examining revenue and growth trends, profitability metrics, and strategic initiatives, we can extract valuable insights into the company’s financial performance and make informed investment decisions. As we navigate the dynamic world of technology distribution, staying informed and analyzing earnings reports will be crucial for long-term success.

FAQ

How does ScanSource compare to its competitors in terms of revenue growth?

+

ScanSource’s revenue growth rates are impressive, especially when considering the challenging economic conditions during the pandemic. However, a comprehensive comparison with competitors is essential to understand the company’s relative position. Analyzing industry reports and competitor financial statements can provide a more nuanced perspective on ScanSource’s performance.

What are the key drivers of ScanSource’s profitability?

+

ScanSource’s profitability is influenced by several factors, including its diverse product portfolio, strong vendor relationships, and effective cost management strategies. The company’s focus on high-margin products and services, such as cloud solutions and managed services, has contributed to its improved profitability metrics.

How does ScanSource plan to mitigate potential risks and challenges in the future?

+

ScanSource’s management team has demonstrated a proactive approach to risk management. The company’s strategic initiatives, such as diversifying its product offerings and expanding into new markets, are aimed at mitigating potential risks. Additionally, ScanSource’s focus on strengthening its financial position and optimizing its supply chain will help it navigate future challenges effectively.