Binance's Moving Average: The Key to Success

In the world of cryptocurrency trading, choosing the right tools and strategies is crucial for success. One of the most popular and trusted indicators among traders is the Moving Average (MA). This technical analysis tool has proven its effectiveness time and again, especially when utilized on platforms like Binance, one of the leading cryptocurrency exchanges.

Binance's Moving Average has become a go-to resource for traders, offering valuable insights and guiding their decision-making processes. In this article, we will delve into the intricacies of Binance's Moving Average, exploring its various aspects, applications, and the reasons behind its popularity. By understanding the power of this indicator, you can enhance your trading strategies and potentially increase your chances of success in the dynamic cryptocurrency market.

Understanding Binance’s Moving Average

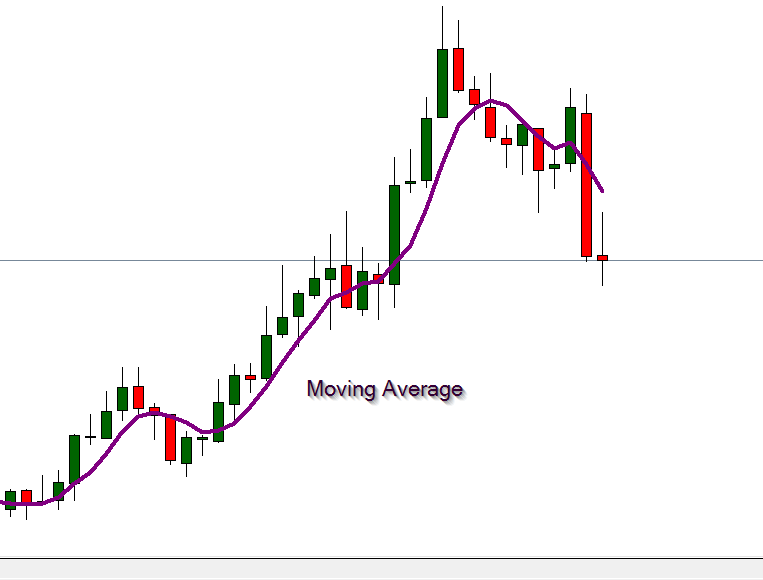

At its core, the Moving Average is a widely used technical indicator that smooths out price data by creating a continuously updated average price. It helps traders identify trends and potential reversals by averaging a set number of past price points. Binance, being a cutting-edge cryptocurrency exchange, offers an advanced implementation of the Moving Average, tailored to the needs of its users.

Binance's Moving Average calculates the average price of a cryptocurrency over a specific period, providing a clear visual representation of the trend. Traders can choose from various timeframes, such as 15-minute, hourly, daily, or weekly charts, to align with their trading strategies. This flexibility allows traders to analyze price movements at different scales, catering to both short-term and long-term investors.

One of the key advantages of Binance's Moving Average is its adaptability. Traders can customize the indicator's settings to suit their preferences and trading style. By adjusting the period over which the average is calculated, traders can fine-tune the sensitivity of the indicator. A shorter period, such as 10 days, captures short-term price movements, while a longer period, like 200 days, smooths out the data and highlights the overall trend.

Additionally, Binance's platform offers a range of Moving Average types, including Simple Moving Average (SMA), Exponential Moving Average (EMA), and Weighted Moving Average (WMA). Each type calculates the average differently, emphasizing certain price points more than others. Traders can experiment with these variations to find the one that aligns best with their trading strategy and market conditions.

The Role of Moving Averages in Technical Analysis

Moving Averages are a fundamental component of technical analysis, a widely used approach in cryptocurrency trading. Technical analysis involves studying historical price data and trading volumes to identify patterns and predict future price movements. Binance’s Moving Average plays a crucial role in this process, providing valuable insights and guiding traders’ decision-making.

One of the primary uses of Moving Averages is to identify trends. When the price of a cryptocurrency consistently stays above its Moving Average, it indicates an uptrend, suggesting that the asset is in a buying phase. Conversely, if the price consistently trades below its Moving Average, it indicates a downtrend, signaling that the asset is in a selling phase. Traders can use this information to make informed decisions, such as entering or exiting positions based on the direction of the trend.

| Moving Average Type | Description |

|---|---|

| Simple Moving Average (SMA) | Calculates the average price over a specified period by adding up the closing prices and dividing by the number of periods. |

| Exponential Moving Average (EMA) | Gives more weight to recent price data, making it more responsive to price changes. It assigns a higher value to the most recent price data, providing a smoother curve. |

| Weighted Moving Average (WMA) | Assigns a higher weight to more recent price data, similar to EMA, but with a different calculation method. It places more emphasis on the most recent data points. |

Moving Averages also serve as dynamic support and resistance levels. When the price approaches the Moving Average from below, it often acts as a support level, indicating a potential buying opportunity. Conversely, when the price approaches the Moving Average from above, it can act as a resistance level, suggesting a potential selling opportunity. Traders can use these levels to set stop-loss orders or determine entry and exit points.

Real-World Applications and Success Stories

Binance’s Moving Average has proven its effectiveness in real-world trading scenarios, helping traders make profitable decisions. Let’s explore some success stories and practical applications of this powerful indicator.

Long-Term Investment Strategies

For long-term investors, Binance’s Moving Average can provide valuable insights into the overall trend of a cryptocurrency. By analyzing the 200-day Moving Average, traders can identify the prevailing direction of the market. If the price consistently trades above the 200-day MA, it indicates a strong uptrend, suggesting that the asset is in a bull market. This information can guide investors to maintain their positions or even consider buying more during pullbacks.

Conversely, if the price trades below the 200-day MA for an extended period, it signals a potential bear market. In such a scenario, long-term investors may consider reducing their exposure or implementing risk management strategies to protect their capital.

Short-Term Trading Opportunities

Short-term traders can leverage Binance’s Moving Average to identify intraday trading opportunities. By using shorter timeframes, such as 15-minute or hourly charts, traders can analyze the relationship between the price and the Moving Average in real time. When the price crosses above the Moving Average, it signals a potential buying opportunity, while a crossover below the Moving Average suggests a potential selling opportunity.

For example, imagine a scenario where Bitcoin's 15-minute chart shows the price crossing above the 50-period Moving Average. This could indicate a potential upward momentum, and traders may consider entering long positions. Similarly, if the price crosses below the Moving Average, it could signal a potential downward move, prompting traders to exit long positions or even enter short positions.

Portfolio Management and Risk Mitigation

Binance’s Moving Average can also be a valuable tool for portfolio management and risk mitigation. Traders can use multiple Moving Averages with different periods to create a comprehensive view of the market. For instance, combining the 50-period and 200-period Moving Averages can help identify potential reversals or confirm the strength of a trend.

When the shorter-term Moving Average crosses above the longer-term Moving Average, it suggests that the uptrend is gaining momentum. Conversely, when the shorter-term Moving Average crosses below the longer-term Moving Average, it indicates a potential reversal or the beginning of a downtrend. By monitoring these crossovers, traders can adjust their portfolio allocation and manage risk more effectively.

Advanced Techniques and Strategies

While Binance’s Moving Average is a powerful indicator on its own, traders can enhance its effectiveness by combining it with other technical analysis tools and strategies. Here are some advanced techniques and strategies that traders often employ alongside the Moving Average.

Moving Average Crossovers

Moving Average crossovers occur when one Moving Average crosses above or below another. Traders often use these crossovers as signals to enter or exit positions. For example, when the 50-period Moving Average crosses above the 200-period Moving Average, it is considered a bullish crossover, suggesting a potential buying opportunity. Conversely, when the 50-period MA crosses below the 200-period MA, it is a bearish crossover, indicating a potential selling opportunity.

It is important to note that Moving Average crossovers can generate false signals, especially in volatile markets. Therefore, traders often combine crossovers with other indicators or confirmations to improve the accuracy of their signals.

Moving Average Envelopes

Moving Average Envelopes are bands that are placed above and below the Moving Average, creating an envelope-like structure. These bands are calculated by adding and subtracting a percentage or multiple of the Moving Average’s standard deviation. Traders use these envelopes to identify potential overbought or oversold conditions.

When the price moves outside the upper envelope, it suggests that the asset may be overbought and due for a correction. Conversely, when the price moves outside the lower envelope, it indicates that the asset may be oversold and could potentially rebound.

Moving Average Convergence Divergence (MACD)

Moving Average Convergence Divergence (MACD) is a popular technical indicator that combines Moving Averages with momentum analysis. It consists of two lines: the MACD line (the difference between the 12-period EMA and the 26-period EMA) and the signal line (a 9-period EMA of the MACD line). The histogram, which represents the difference between these two lines, provides visual cues for potential buying or selling opportunities.

Traders often use the MACD in conjunction with the Moving Average to confirm signals and enhance their analysis. For example, when the MACD histogram moves above the zero line, it suggests a potential buying opportunity. If this move is accompanied by the price crossing above its Moving Average, it adds weight to the bullish signal.

Potential Risks and Considerations

While Binance’s Moving Average is a powerful tool, it is essential to be aware of potential risks and considerations when using it. Here are some key points to keep in mind.

Market Volatility and False Signals

Cryptocurrency markets are known for their high volatility, and this can impact the reliability of Moving Averages. In highly volatile markets, prices can move rapidly, causing the Moving Average to lag behind and potentially generate false signals. Traders should exercise caution and consider combining Moving Averages with other indicators or using shorter timeframes to mitigate this risk.

Timeframe Selection

The choice of timeframe is crucial when using Moving Averages. Different timeframes provide different perspectives on the market. Short-term traders may prefer using intraday charts, while long-term investors may focus on daily or weekly charts. It is essential to select a timeframe that aligns with your trading strategy and risk tolerance.

Multiple Moving Averages

Using multiple Moving Averages with different periods can provide a more comprehensive view of the market. However, it is important to avoid overcomplicating your analysis. Too many Moving Averages on a single chart can lead to confusion and make it challenging to interpret the signals. Traders should choose a manageable number of Moving Averages and ensure they complement each other.

Confirmation and Risk Management

Moving Averages are best used in conjunction with other technical analysis tools and indicators. Traders should seek confirmation from additional indicators or price patterns to enhance the reliability of their signals. Additionally, risk management strategies, such as stop-loss orders and position sizing, are crucial to protect capital and manage potential losses.

Future Prospects and Innovations

As the cryptocurrency market continues to evolve, Binance and other platforms are constantly innovating to provide traders with advanced tools and features. Here are some potential future developments and innovations related to Moving Averages.

Adaptive Moving Averages

Adaptive Moving Averages are a newer concept that aims to address the challenge of market volatility. These indicators automatically adjust their sensitivity based on market conditions. When volatility is high, the Moving Average becomes more responsive, while during periods of low volatility, it smooths out the data to capture the overall trend.

By adapting to market conditions, Adaptive Moving Averages have the potential to provide more accurate signals, especially in volatile markets. Traders may benefit from this innovation by having a Moving Average that can dynamically adjust its parameters, improving its effectiveness in various market scenarios.

Machine Learning Integration

Machine learning and artificial intelligence are increasingly being integrated into financial markets, and the cryptocurrency space is no exception. In the future, Moving Averages could be enhanced with machine learning algorithms that analyze historical data and identify patterns. These algorithms could potentially improve the accuracy of Moving Averages and provide traders with more precise signals.

Social and Sentiment Analysis

Moving Averages primarily focus on price data, but future developments may incorporate social and sentiment analysis. By analyzing social media trends, news sentiment, and community discussions, Moving Averages could gain additional insights into market sentiment and potential price movements. This integration of social and sentiment data could provide traders with a more holistic view of the market.

Conclusion

Binance’s Moving Average is a powerful tool that has become an integral part of many traders’ arsenals. Its ability to smooth out price data, identify trends, and provide dynamic support and resistance levels makes it a trusted indicator in the cryptocurrency market. By understanding the intricacies of Binance’s Moving Average and its various applications, traders can make more informed decisions and potentially increase their chances of success.

As the cryptocurrency market continues to mature, Binance and other exchanges will likely introduce new features and innovations to enhance the trading experience. Moving Averages, with their adaptability and versatility, will likely remain a cornerstone of technical analysis, providing traders with valuable insights and guiding their trading strategies.

Whether you are a long-term investor or a short-term trader, incorporating Binance's Moving Average into your analysis can help you navigate the dynamic cryptocurrency market. Remember to combine it with other indicators, stay aware of potential risks, and adapt your strategies to changing market conditions. With the right approach and a solid understanding of this powerful indicator, you can take your trading to new heights.

How do I choose the right Moving Average period for my trading strategy?

+The choice of Moving Average period depends on your trading strategy and time horizon. Short-term traders may prefer shorter periods like 10 or 20 days, while long-term investors might opt for longer periods like 50 or 200 days. Experiment with different periods and analyze how they align with your trading style.

Can I use multiple Moving Averages simultaneously?

+Yes, using multiple Moving Averages with different periods can provide a more comprehensive view of the market. However, be cautious not to overload your charts with too many indicators. Choose a manageable number of Moving Averages and ensure they complement each other.

Are there any disadvantages to using Moving Averages?

+Moving Averages can sometimes lag behind price movements, especially in volatile markets. Additionally, they may generate false signals, so it’s essential to use them in conjunction with other indicators and confirmations. Risk management strategies are crucial to mitigate potential losses.

How can I enhance my Moving Average analysis?

+To enhance your Moving Average analysis, consider combining it with other technical indicators like the Relative Strength Index (RSI) or the Moving Average Convergence Divergence (MACD). These additional indicators can provide confirmation and help filter out false signals.