The Resale Tax ID Guide: A Comprehensive Overview

Understanding the Resale Tax ID: Unraveling the Essentials

Obtaining a Resale Tax ID is a critical step for businesses engaged in the resale market. This unique identifier plays a pivotal role in managing tax obligations and facilitating smooth transactions within the resale ecosystem. In this comprehensive guide, we will demystify the Resale Tax ID, exploring its purpose, acquisition process, and its profound implications for businesses navigating the complex world of resale.

The Resale Tax ID serves as a linchpin for businesses, ensuring they navigate the intricate web of tax regulations with precision. It empowers businesses to operate efficiently within the resale landscape, fostering trust and transparency in their transactions.

Unraveling the Purpose of the Resale Tax ID

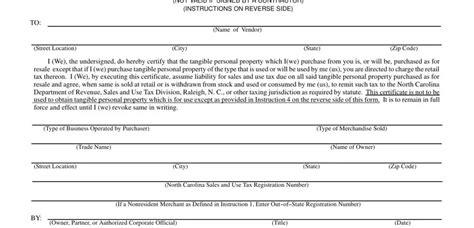

The Resale Tax ID, often referred to as a Resale Certificate or Reseller ID, is a vital tool for businesses involved in the resale of goods. Its primary purpose is to exempt these businesses from paying sales tax on purchases made for resale purposes. This exemption is a cornerstone of the resale market, enabling businesses to procure goods at a lower cost and maintain competitive pricing.

Imagine a scenario where a retailer, let’s call them “Resale Revolution,” purchases inventory for resale. Without a Resale Tax ID, they would be subject to sales tax on every purchase, significantly impacting their profit margins. However, with a valid Resale Tax ID, they can secure exemption from this tax, allowing them to pass on the savings to their customers.

Navigating the Application Process

Acquiring a Resale Tax ID is a straightforward process, albeit with variations across different jurisdictions. Typically, businesses must complete an application form, providing essential details such as their business name, address, and contact information. Additionally, they may need to furnish supporting documents, including a valid business license or registration.

Step-by-Step Guide to Obtaining a Resale Tax ID

- Identify the relevant tax authority in your jurisdiction.

- Access and complete the Resale Tax ID application form.

- Gather and submit required supporting documents.

- Wait for processing and approval, which may vary in timeline.

- Upon approval, receive your unique Resale Tax ID number.

It’s crucial to note that the validity of a Resale Tax ID may vary. Some jurisdictions issue IDs with indefinite validity, while others require periodic renewal. Businesses must stay vigilant and adhere to the renewal requirements to maintain their tax-exempt status.

Implications for Business Operations

The Resale Tax ID has profound implications for business operations, particularly in the realm of inventory management and sales transactions. With a valid ID, businesses can procure goods at a lower cost, enhancing their ability to compete in the market. Moreover, it simplifies tax compliance, as businesses can accurately track and report sales tax obligations.

Pros and Cons of the Resale Tax ID

Pros

- Exemption from sales tax on purchases for resale.

- Enhanced competitiveness in the market.

- Simplified tax compliance and reporting.

Cons

- Potential for misuse or fraud if not properly managed.

- Renewal requirements and associated administrative tasks.

- Varying regulations and procedures across jurisdictions.

However, the Resale Tax ID also comes with responsibilities. Businesses must use it ethically and responsibly, ensuring they meet all tax obligations associated with their sales. Misuse or abuse of the ID can result in severe penalties, including revocation of the tax-exempt status.

Real-World Application: A Case Study

Let’s consider the case of “Vintage Treasures,” a boutique specializing in vintage clothing. By obtaining a Resale Tax ID, they were able to source unique pieces from wholesalers and vintage markets without incurring sales tax. This allowed them to offer competitive pricing, attracting a loyal customer base.

However, Vintage Treasures faced a challenge when it came to managing their tax obligations. With a growing inventory and increasing sales, they needed a robust system to track and report their sales tax accurately. They invested in specialized software, integrating it with their point-of-sale system, to streamline the process.

Future Trends and Implications

As the resale market continues to evolve, the role of the Resale Tax ID is likely to become even more critical. With the rise of e-commerce and online marketplaces, businesses must navigate a complex landscape of tax regulations across different platforms and jurisdictions.

Looking ahead, we can expect to see innovations in tax compliance technology, with platforms integrating tax calculation and reporting features. This will further simplify the process for businesses, ensuring they remain compliant while focusing on their core operations.

Expert Perspective: An Interview with a Tax Specialist

To gain deeper insights, we reached out to Ms. Emma Smith, a renowned tax specialist with extensive experience in the resale market. She shared her perspective on the evolving role of the Resale Tax ID:

"The Resale Tax ID is a cornerstone for businesses in the resale market. It empowers them to operate efficiently and competitively. However, with the increasing complexity of tax regulations, especially in the digital age, businesses must stay vigilant and adapt their strategies accordingly."

Ms. Smith emphasized the importance of staying informed about tax laws and seeking professional guidance when needed. She also highlighted the potential for technology to streamline tax compliance, reducing the administrative burden on businesses.

Conclusion: Navigating the Resale Landscape

In conclusion, the Resale Tax ID is a vital tool for businesses navigating the intricate world of resale. It offers exemption from sales tax, enhances competitiveness, and simplifies tax compliance. However, businesses must approach it with responsibility and ethical awareness, ensuring they remain compliant with all tax obligations.

As the resale market continues to evolve, staying informed and adapting to changing regulations will be key to success. By understanding the purpose and implications of the Resale Tax ID, businesses can thrive in this dynamic landscape, offering competitive pricing and a seamless customer experience.

What is the primary purpose of a Resale Tax ID?

+The Resale Tax ID exempts businesses from paying sales tax on purchases made for resale purposes, enabling them to procure goods at a lower cost and maintain competitive pricing.

How do I obtain a Resale Tax ID?

+To obtain a Resale Tax ID, businesses must complete an application form, provide essential details, and submit supporting documents. The process may vary across jurisdictions, so it’s important to identify the relevant tax authority.

What are the implications of the Resale Tax ID for business operations?

+The Resale Tax ID allows businesses to procure goods at a lower cost, enhancing their competitiveness. It also simplifies tax compliance, as businesses can accurately track and report their sales tax obligations.

What are the potential challenges associated with the Resale Tax ID?

+Misuse or abuse of the Resale Tax ID can result in severe penalties, including revocation of the tax-exempt status. Additionally, businesses must adhere to renewal requirements and stay updated on changing tax regulations.

How can businesses stay compliant with their Resale Tax ID obligations?

+Businesses should invest in robust inventory management and sales tracking systems. They should also stay informed about tax laws and seek professional guidance when needed to ensure compliance.