5 Ways to Understand Horizontal Integration

Introduction

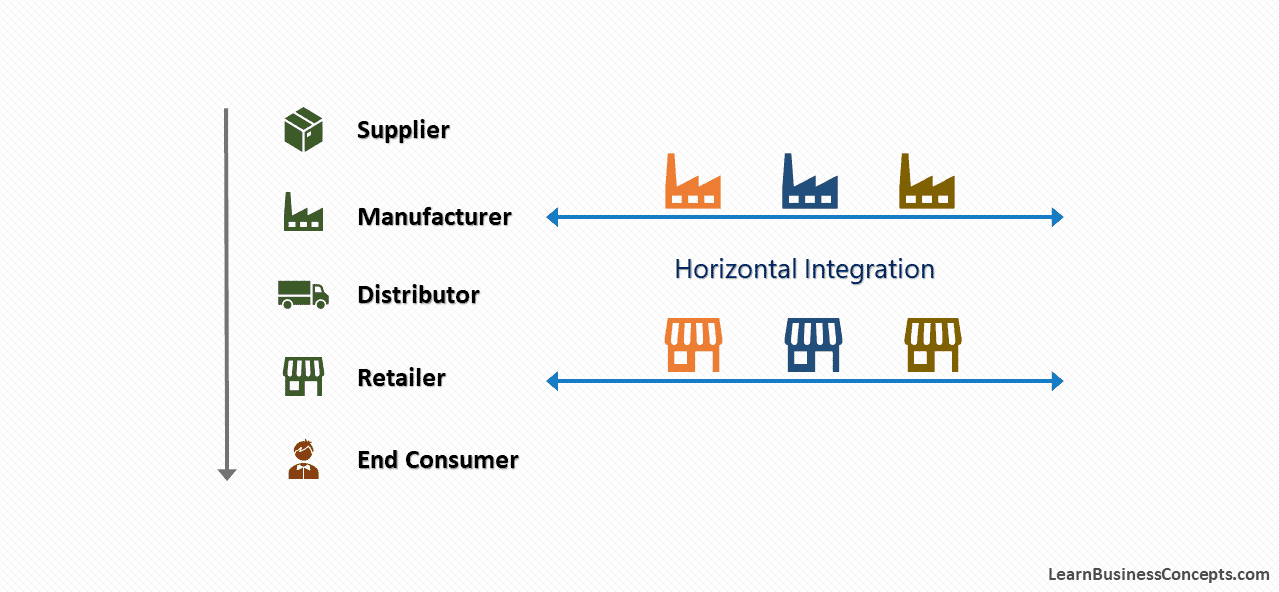

Horizontal integration is a strategic move that reshapes industries and paves the way for significant market transformations. It involves merging or consolidating businesses operating at the same level of the supply chain, creating a powerful dynamic that demands both understanding and careful navigation. This article will explore five key dimensions that offer a comprehensive grasp of horizontal integration’s complexities and implications.

1. The Economics of Horizontal Integration

Horizontal integration is driven by economic incentives that aim to maximize efficiency and market power. By merging with competitors or acquiring similar businesses, firms can achieve economies of scale, reduce costs, and enhance their bargaining power. This economic strategy is particularly effective in industries with high fixed costs or where market dominance is advantageous.

For example, consider the case of a large retailer that acquires several smaller retail stores in its niche market. By consolidating their operations, the retailer can negotiate better deals with suppliers, streamline distribution networks, and achieve cost savings through centralized marketing and administrative functions. This integration allows the retailer to establish a stronger presence in the market and improve its overall profitability.

2. Competitive Dynamics and Market Power

Horizontal integration can significantly alter the competitive landscape of an industry. When firms merge horizontally, they reduce competition, potentially leading to market concentration and increased market power. This consolidation can result in higher prices, reduced innovation, and limited consumer choices. Understanding the competitive dynamics post-integration is crucial for both industry participants and regulatory bodies.

Pros of Market Power

- Enhanced bargaining power with suppliers and distributors.

- Ability to invest in long-term strategic initiatives.

- Potential for improved product quality and service.

Cons of Market Power

- Risk of reduced competition and innovation.

- Potential for higher prices and limited consumer choices.

- Increased scrutiny from regulatory authorities.

3. Regulatory and Legal Considerations

Horizontal integration often falls under the scrutiny of antitrust laws and regulatory bodies. These authorities ensure that such mergers do not lead to unfair market practices or harm consumers. Regulatory processes can be complex and time-consuming, requiring companies to navigate legal hurdles and demonstrate the benefits of the integration to society.

Regulatory Process for Horizontal Integration

- Filing: Companies submit a detailed merger notification to the relevant regulatory authority.

- Review: Regulators assess the potential impact on competition, market power, and consumer welfare.

- Consultation: The process involves public consultation, where interested parties can provide input.

- Decision: Regulators make a final determination, approving or blocking the merger with potential conditions.

4. Operational and Strategic Synergies

Beyond economic and competitive considerations, horizontal integration offers operational and strategic advantages. By combining resources, firms can achieve synergies in areas like research and development, shared infrastructure, and streamlined processes. This integration allows for a more efficient allocation of resources and can lead to innovative product development and improved customer service.

How do companies identify potential synergies in horizontal integration?

+Companies conduct thorough due diligence and strategic analysis to identify areas where integration can bring mutual benefits. This involves assessing overlapping operations, supply chains, and market positions. By understanding these synergies, companies can create a compelling business case for integration and maximize its potential.

5. Impact on Innovation and Consumer Welfare

The implications of horizontal integration extend beyond the merged entities. It can influence the pace of innovation and the overall consumer experience. When competition is reduced, there may be a decrease in incentives for innovation, potentially leading to stagnant product development. On the other hand, integrated firms may invest in research and development, driving technological advancements and benefiting consumers.

A Real-World Example: The Tech Giants

In the tech industry, horizontal integration has been a significant strategy for market leaders. For instance, a tech company acquiring several smaller startups with innovative technologies can drive significant advancements. By integrating these technologies into its existing products or services, the company can enhance its offerings and stay ahead of the competition. This horizontal integration not only benefits the company but also provides consumers with access to cutting-edge solutions.

Conclusion

Horizontal integration is a complex strategic maneuver with far-reaching implications. Understanding its economic, competitive, regulatory, operational, and innovation-related aspects is crucial for stakeholders to navigate its challenges and opportunities effectively. As industries continue to evolve, a comprehensive grasp of horizontal integration will be essential for businesses and policymakers alike.