3 Ways to Calculate Annual Loss Expectancy

Annual Loss Expectancy (ALE) is a critical metric used in risk management and insurance to quantify the potential financial impact of a particular risk event occurring within a year. Accurately calculating ALE is essential for organizations to make informed decisions, allocate resources effectively, and ensure they have adequate insurance coverage. In this article, we will explore three distinct methods to calculate Annual Loss Expectancy, each with its own advantages and considerations.

Method 1: Single Loss Expectancy (SLE) Multiplied by Annualized Rate of Occurrence (ARO)

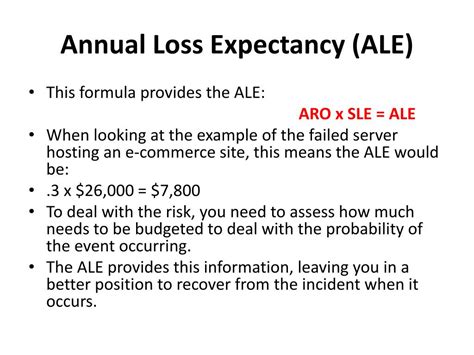

The first method involves multiplying the Single Loss Expectancy (SLE) by the Annualized Rate of Occurrence (ARO). SLE represents the expected monetary loss resulting from a single occurrence of a specific risk event, while ARO signifies the anticipated number of such events in a year. By combining these two factors, we can estimate the ALE.

Let's break down this method with a practical example. Suppose we are evaluating the risk of a data breach in an organization's network infrastructure. The organization has calculated an SLE of $50,000, which is the estimated cost of recovering from a single data breach incident. Additionally, based on historical data and industry trends, the ARO is determined to be 0.05, indicating that a data breach is expected to occur once every 20 years.

To calculate the Annual Loss Expectancy using this method, we multiply the SLE by the ARO:

ALE = SLE x ARO

ALE = $50,000 x 0.05

ALE = $2,500

Therefore, the organization's Annual Loss Expectancy for a data breach is $2,500, indicating that on average, they can expect to incur this amount of financial loss due to data breaches annually.

Advantages and Considerations

- Simplicity: This method is straightforward and easy to understand, making it accessible for organizations with limited risk management expertise.

- Historical Data: It relies on historical data and industry trends to estimate ARO, ensuring that the calculation is grounded in real-world observations.

- Single Risk Event: It is suitable for assessing risks with relatively low frequencies, such as natural disasters or specific types of cyberattacks.

- Limited Variability: ALE calculated this way assumes a constant rate of occurrence, which may not capture the dynamic nature of some risks.

Method 2: Monte Carlo Simulation

Monte Carlo Simulation is a powerful statistical technique that can be employed to calculate Annual Loss Expectancy. This method involves running multiple simulations, each representing a possible scenario, and aggregating the results to obtain a range of potential ALE values.

To illustrate this method, let's consider a manufacturing company assessing the risk of equipment failure in its production line. The company has identified several types of equipment failures with varying frequencies and potential costs.

| Equipment Type | Annualized Rate of Occurrence (ARO) | Single Loss Expectancy (SLE) |

|---|---|---|

| Conveyor Belts | 0.08 | $10,000 |

| Robotic Arms | 0.02 | $25,000 |

| Assembly Machines | 0.01 | $50,000 |

Using Monte Carlo Simulation, the company runs multiple simulations, each considering different combinations of equipment failures and their associated costs. By aggregating the results, they obtain a distribution of potential ALE values.

For example, in one simulation, the company might experience a failure of the conveyor belts and robotic arms, resulting in a total loss of $35,000. In another simulation, they might encounter failures in all three equipment types, leading to a higher loss of $85,000.

By running numerous simulations and analyzing the distribution of ALE values, the company can gain insights into the range of potential losses they may face annually due to equipment failures.

Advantages and Considerations

- Complexity: Monte Carlo Simulation provides a comprehensive assessment of ALE, accounting for the variability and uncertainty inherent in risk events.

- Dynamic Risks: It is particularly useful for assessing risks with dynamic and unpredictable characteristics, such as market fluctuations or natural disasters.

- Risk Management: By exploring a wide range of scenarios, organizations can identify critical risks and develop robust risk management strategies.

- Resource Intensive: Monte Carlo Simulation requires significant computational resources and expertise to implement effectively.

Method 3: Scenario Analysis

Scenario Analysis is a qualitative approach to calculating Annual Loss Expectancy, where experts and stakeholders collaborate to develop and assess different risk scenarios. This method involves identifying key risk factors, assigning probabilities to their occurrence, and estimating the potential financial impact of each scenario.

For instance, a financial institution may use Scenario Analysis to assess the potential impact of a credit crisis on its loan portfolio. By considering various economic conditions, default rates, and market scenarios, the institution can estimate the ALE associated with each scenario.

Scenario Analysis often involves a combination of quantitative and qualitative methods. While it may not provide precise ALE values, it offers valuable insights into the potential range of losses and helps organizations understand the impact of different risk scenarios.

Advantages and Considerations

- Expertise: Scenario Analysis leverages the knowledge and expertise of industry professionals and stakeholders, ensuring a comprehensive assessment of risks.

- Qualitative Insights: It provides a holistic understanding of the potential impact of risks, considering both financial and non-financial aspects.

- Risk Mitigation: By identifying and analyzing specific scenarios, organizations can develop targeted risk mitigation strategies.

- Subjectivity: Scenario Analysis relies on subjective judgments and expert opinions, which may introduce biases or variations in estimates.

Conclusion

Calculating Annual Loss Expectancy is a crucial step in effective risk management and insurance planning. The three methods presented in this article - multiplying SLE and ARO, Monte Carlo Simulation, and Scenario Analysis - each offer unique advantages and considerations. Organizations should carefully evaluate their risk profiles, available data, and resource constraints to select the most appropriate method for their specific needs.

By accurately estimating ALE, organizations can make informed decisions, optimize their risk management strategies, and ensure they have the necessary insurance coverage to protect their financial well-being.

What is the significance of calculating Annual Loss Expectancy (ALE) in risk management and insurance planning?

+

Calculating ALE helps organizations understand the potential financial impact of specific risks and enables them to make informed decisions regarding resource allocation, risk mitigation strategies, and insurance coverage.

How do the three methods for calculating ALE differ in their approach and suitability?

+

The first method is straightforward and suitable for low-frequency risks. Monte Carlo Simulation provides a comprehensive assessment but requires computational resources. Scenario Analysis is qualitative and leverages expert insights, offering a holistic understanding of risks.

Are there any limitations or challenges associated with each method for calculating ALE?

+

The first method assumes a constant rate of occurrence, which may not capture dynamic risks. Monte Carlo Simulation is resource-intensive, and Scenario Analysis relies on subjective judgments, introducing potential biases.