Navigating UMich's Financial Aid Process

As a student considering the University of Michigan (UMich), you might be curious about the financial aid process and how to make it work for your unique situation. The financial aid journey can seem daunting, but with the right information and a strategic approach, you can successfully navigate the process and secure the support you need.

UMich is committed to making a quality education accessible to talented students from diverse backgrounds. The financial aid office offers a range of resources and support to help students and their families understand the options available and make informed decisions.

Let’s delve into the key aspects of UMich’s financial aid process and provide you with the insights and guidance to make this journey a little smoother.

Understanding UMich’s Financial Aid Philosophy

UMich believes that financial circumstances should not be a barrier to accessing a world-class education. The university aims to meet the full demonstrated financial need of admitted students through a combination of grants, scholarships, work-study, and loans.

The financial aid office takes a holistic approach, considering each student’s unique financial situation and offering personalized assistance. They strive to provide a comprehensive financial aid package that aligns with the student’s needs and the university’s resources.

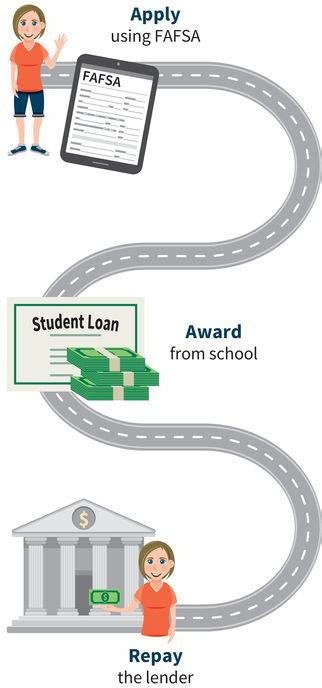

The Application Process: A Step-by-Step Guide

Step 1: Complete the FAFSA (Free Application for Federal Student Aid)

The FAFSA is the starting point for most students seeking financial aid. It’s a comprehensive form that collects information about your family’s financial situation, including income, assets, and household size.

Ensure you complete the FAFSA accurately and on time. The deadline for UMich is typically March 1st, but it's advisable to submit earlier to maximize your chances of receiving aid.

Step 2: Consider Additional Application Forms

Depending on your circumstances, you might need to complete additional forms:

CSS Profile: This form is often required by private colleges and universities, including UMich. It provides a more detailed look at your family’s finances and can influence the aid package you receive.

UMich Financial Aid Application: UMich may require you to complete a supplemental application to gather additional information specific to the university’s financial aid process.

Step 3: Gather Required Documents

To ensure a smooth application process, gather the necessary documents in advance:

- Tax returns for both you and your parents (if applicable)

- W-2 forms and other income statements

- Records of untaxed income, such as child support or veterans benefits

- Bank statements and investment records

- Records of assets, including real estate and business interests

Organize your documents systematically. Consider using a folder or digital storage system to keep track of all the required information. This will save you time and reduce stress during the application process.

Step 4: Submit Your Applications

Once you’ve completed all the required forms and gathered your documents, it’s time to submit your applications:

- Submit the FAFSA online at https://fafsa.ed.gov

- If necessary, complete the CSS Profile on the College Board website

- Upload or mail any required supporting documents to the appropriate financial aid offices

Interpreting Your Financial Aid Award

Once you’ve submitted your applications, the financial aid office will review your information and determine your eligibility for various aid programs. You’ll receive a financial aid award letter outlining the aid package offered to you.

Understanding the Components

Your financial aid award will likely include a combination of the following:

Grants and Scholarships: These are gift aid that you don’t have to repay. They can be based on financial need, academic merit, or a combination of both.

Work-Study: This program allows you to earn money by working part-time on or off campus. The earnings can be used to cover your educational expenses.

Loans: Loans are funds you borrow and must repay with interest. UMich offers a range of loan options, including federal loans and private loans.

Pros of Loans

- Provides immediate financial support for tuition and other expenses.

- Can offer competitive interest rates, especially for federal loans.

Cons of Loans

- Requires repayment, which can be a burden after graduation.

- Interest accumulates over time, increasing the overall cost.

Evaluating Your Award

When you receive your financial aid award, take time to carefully review and understand its components:

Compare the award with your expected costs, including tuition, room and board, books, and other expenses.

Assess your ability to contribute to these costs from personal savings, parental support, or other resources.

Evaluate the long-term impact of accepting loans. Consider your future career prospects and the potential for repayment.

Strategies for Maximizing Your Aid

While UMich aims to meet the full demonstrated need of its students, there are additional strategies you can employ to enhance your financial aid package:

Appeal for More Aid

If you feel your financial circumstances have changed significantly since submitting your applications or if you have extenuating circumstances, you can appeal for more aid.

Gather supporting documentation, such as recent pay stubs, unemployment notices, or medical bills.

Write a detailed letter explaining your situation and how it has impacted your ability to contribute to your education costs.

Submit your appeal to the financial aid office, and be prepared to provide additional information if requested.

Explore External Scholarships

Scholarships are a great way to supplement your financial aid package and reduce your reliance on loans. Consider the following:

Search for scholarships specifically for UMich students or those in your field of study.

Look for local scholarships offered by community organizations, businesses, or foundations.

Apply for national scholarships that align with your interests, talents, or background.

Step-by-Step Guide to Finding Scholarships

- Create a list of keywords related to your interests, hobbies, or academic pursuits.

- Use scholarship search engines like Scholarships.com or Fastweb to find opportunities.

- Set up alerts or subscribe to newsletters to stay informed about new scholarship opportunities.

- Contact UMich's financial aid office or career services for additional resources and guidance.

Consider Part-Time Employment

Working part-time during your studies can provide valuable financial support and reduce the amount you need to borrow.

Explore on-campus employment opportunities, such as working in the library, residence halls, or dining services.

Consider off-campus jobs that align with your interests or provide valuable work experience in your field.

Balance your work hours with your academic commitments to ensure a healthy work-study-life balance.

Conclusion: Your Financial Aid Journey at UMich

Navigating UMich’s financial aid process can be a complex but rewarding journey. By understanding the application process, interpreting your award, and employing strategic approaches, you can maximize your financial aid package and make your educational dreams a reality.

Remember, the financial aid office is here to support you. Don’t hesitate to reach out with any questions or concerns. Your future at UMich is within reach, and with the right financial plan, you can focus on what matters most: your academic success and personal growth.