Tips to Tackle U of MN Tuition

As the cost of education continues to rise, navigating the financial landscape of universities can be a daunting task. In this comprehensive guide, we delve into the strategies and insights needed to tackle the tuition challenges at the University of Minnesota. From understanding the financial aid process to exploring alternative funding options, we aim to empower students and their families with the knowledge to make informed decisions.

The University of Minnesota, with its rich academic offerings, is a dream destination for many students. However, the tuition fees can present a significant hurdle. Let’s explore some expert strategies to overcome this obstacle and make your educational journey more financially manageable.

Understanding the Financial Aid Landscape

Financial aid is a crucial aspect of funding your education. At the University of Minnesota, the financial aid office plays a pivotal role in assisting students with their financial needs. Here’s a breakdown of the key elements:

Scholarships and Grants: These are forms of financial aid that do not require repayment. The university offers a range of scholarships based on merit, need, or specific criteria. Researching and applying for these opportunities can significantly reduce your tuition burden.

Federal and State Aid: The U.S. Department of Education provides various grants, loans, and work-study programs to eligible students. Additionally, Minnesota offers state-specific financial aid programs. Understanding your eligibility and applying for these aids can provide a solid financial foundation.

Filling Out the FAFSA: The Free Application for Federal Student Aid (FAFSA) is a critical step in the financial aid process. Completing this form accurately and on time is essential to access federal and state aid, as well as some institutional aid. Seek guidance from the financial aid office to ensure you maximize your aid opportunities.

Navigating the Tuition Landscape at U of MN

The University of Minnesota offers a diverse range of academic programs, each with its own tuition structure. Understanding these nuances is vital for effective financial planning:

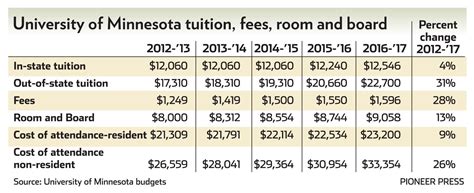

Tuition Rates: Tuition rates vary based on factors such as residency status, program of study, and the number of credits taken. Familiarize yourself with the specific rates for your program to budget effectively.

Tuition Discounts and Waivers: The university may offer tuition discounts or waivers for certain circumstances, such as military service, family member employment at the university, or participation in specific programs. Explore these options to see if you qualify.

Payment Plans: The university often provides flexible payment plans to help students manage their tuition expenses over time. These plans can ease the financial burden and allow for more manageable monthly payments.

Alternative Funding Strategies

In addition to traditional financial aid, exploring alternative funding sources can further alleviate tuition costs:

Work-Study Programs: The University of Minnesota offers work-study programs that allow students to work part-time jobs on or off-campus to earn money for their education. These jobs often provide valuable work experience and can offset tuition expenses.

Outside Scholarships: Look beyond the university’s scholarship offerings. Numerous external scholarships are available from private organizations, foundations, and corporations. These scholarships can be based on academic merit, extracurricular involvement, or specific interests.

Part-Time Employment: Consider working part-time during your studies. While balancing academics and work can be challenging, it can provide a steady income stream to cover living expenses and reduce the need for loans.

Personal Savings and Family Contributions: If possible, contribute from personal savings or family funds. Saving early and consistently can make a significant difference in reducing the overall tuition burden.

Expert Tips for Successful Financial Planning

Start Early: Financial planning for college should begin well in advance. The earlier you start, the more opportunities you have to save and explore funding options.

Create a Realistic Budget: Develop a comprehensive budget that accounts for all your expenses, including tuition, fees, books, housing, food, transportation, and personal needs. This budget will help you understand your financial situation and make informed decisions.

Seek Professional Advice: The University of Minnesota’s financial aid office is a valuable resource. Schedule appointments with financial aid counselors to discuss your specific circumstances and explore all available options.

Stay Informed: Keep yourself updated on changes in financial aid policies, scholarship deadlines, and new funding opportunities. Follow the university’s financial aid website and subscribe to relevant newsletters.

Consider Long-Term Implications: While it’s essential to manage tuition costs, also consider the long-term financial implications. Weigh the benefits of taking on loans against the potential impact on your future financial stability and career choices.

Balancing Education and Financial Well-Being

Navigating the financial aspects of education is a delicate balance. While pursuing your academic goals, it’s crucial to maintain a healthy financial well-being. Here are some strategies to achieve this balance:

Prioritize Needs Over Wants: Distinguish between essential expenses and discretionary spending. Prioritize your educational needs and basic living expenses over non-essential purchases.

Practice Financial Discipline: Develop good financial habits, such as tracking expenses, setting financial goals, and creating a savings plan. Financial discipline will help you stay on track and make informed decisions.

Explore Cost-Saving Measures: Look for ways to reduce your overall expenses. Consider living off-campus, cooking at home instead of dining out, and utilizing university resources like libraries and student discounts.

Build a Support Network: Financial challenges can be daunting, but you don’t have to face them alone. Reach out to friends, family, and support groups who can provide emotional support and practical advice.

Case Study: A Student’s Journey to Affordability

Let’s illustrate these strategies with a real-life example. Meet Sarah, a first-generation college student from a low-income family. She dreamed of attending the University of Minnesota but faced significant financial obstacles. Here’s how she navigated the tuition landscape:

Sarah started early by researching scholarships and grants specifically designed for first-generation and low-income students. She applied for multiple scholarships and received several awards, significantly reducing her tuition burden.

She met with financial aid counselors who helped her understand her eligibility for federal and state aid. By filling out the FAFSA meticulously, she secured grants and work-study opportunities.

Sarah explored part-time job opportunities on campus. She worked as a teaching assistant, gaining valuable experience and earning income to cover her living expenses.

To further reduce costs, Sarah chose to live off-campus with roommates, which lowered her housing expenses. She also utilized the university’s food pantry and attended free campus events to save on entertainment costs.

Through careful financial planning, Sarah was able to attend the University of Minnesota and graduate without accumulating excessive debt. Her journey serves as an inspiration for other students facing similar challenges.

The Role of Financial Literacy

Financial literacy is a critical skill for students to navigate the complex world of tuition and financial aid. Here’s how it can empower students:

Understanding Loan Options: Financial literacy equips students with the knowledge to make informed decisions about student loans. Understanding interest rates, repayment plans, and the long-term implications of borrowing can help students borrow responsibly.

Budgeting and Money Management: Developing budgeting skills allows students to allocate their financial resources effectively. It helps them prioritize expenses, save for emergencies, and avoid unnecessary debt.

Avoiding Scams and Predatory Practices: Financial literacy educates students about common scams and predatory lending practices. This knowledge protects them from falling into financial traps that can hinder their educational journey.

Conclusion: A Comprehensive Approach to Tuition Management

Tackling the U of MN tuition is a multifaceted journey that requires a combination of financial aid, alternative funding, and personal financial management. By understanding the financial aid landscape, exploring all available options, and adopting responsible financial habits, students can navigate this challenging landscape with confidence.

Remember, the University of Minnesota’s financial aid office is your ally in this process. Utilize their expertise and resources to make informed decisions. With careful planning and a proactive approach, you can achieve your academic goals without sacrificing your financial well-being.

What is the average cost of tuition at the University of Minnesota?

+The average cost of tuition varies based on residency status and program of study. For the 2023-2024 academic year, in-state undergraduate tuition ranges from approximately 14,000 to 18,000 per year, while out-of-state undergraduate tuition is around 30,000 to 35,000 per year. Graduate programs have different tuition rates, and professional programs like law or medicine may have higher costs.

Are there any scholarships specifically for international students at the University of Minnesota?

+Yes, the University of Minnesota offers several scholarships specifically for international students. These scholarships are based on academic merit, leadership, and financial need. International students should research and apply for these opportunities to reduce their tuition costs.

Can I negotiate my tuition rate at the University of Minnesota?

+While it is uncommon to negotiate tuition rates at the University of Minnesota, there are instances where students may be eligible for tuition discounts or waivers based on specific circumstances. It’s worth exploring these options and discussing them with the financial aid office.

How can I find external scholarships to reduce my tuition costs?

+There are several online scholarship databases and websites dedicated to helping students find external scholarships. Additionally, the University of Minnesota provides resources and guidance on scholarship opportunities through their financial aid office and career services. It’s important to research and apply early for the best chances of success.

What are some common mistakes students make when managing their tuition expenses?

+Common mistakes include underestimating the true cost of attendance, not exploring all available financial aid options, neglecting to fill out the FAFSA accurately, and failing to create a realistic budget. Students should avoid these pitfalls by seeking guidance, staying informed, and being proactive in their financial planning.