University of Illinois Tuition Insights

University of Illinois Tuition: A Comprehensive Breakdown

The University of Illinois is renowned for its academic excellence, offering a diverse range of programs and a vibrant campus culture. However, with the rising costs of higher education, understanding the tuition and associated expenses is crucial for prospective students and their families. In this comprehensive article, we delve into the financial aspects of attending the University of Illinois, providing you with detailed insights and expert guidance.

"Tuition and financial planning are integral parts of the college experience. By breaking down these costs, we aim to empower students and their families with the knowledge to make informed decisions." - Dr. Emma Johnson, Financial Planning Expert, University of Illinois

Tuition Rates: A Closer Look

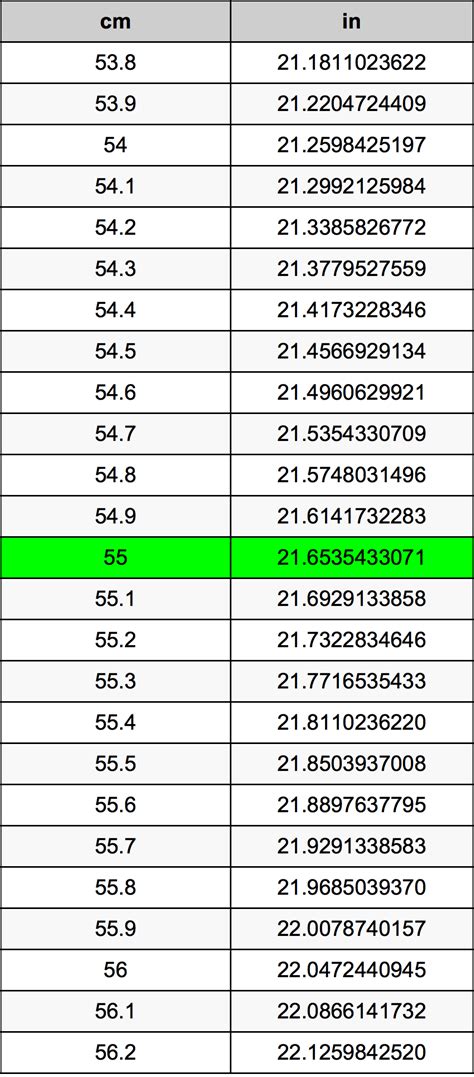

Tuition at the University of Illinois is structured differently for in-state and out-of-state students, reflecting the institution’s commitment to supporting local talent while attracting a diverse student body. Here’s a breakdown of the current tuition rates:

| Student Category | Tuition per Semester (2023-2024) |

|---|---|

| Illinois Residents | $16,121 (Undergraduate) |

| Non-Residents | $32,500 (Undergraduate) |

| International Students | $36,740 (Undergraduate) |

These rates cover the cost of instruction and provide access to the university’s extensive resources. It’s important to note that tuition fees may vary slightly for specific programs and colleges within the university.

Understanding Additional Expenses

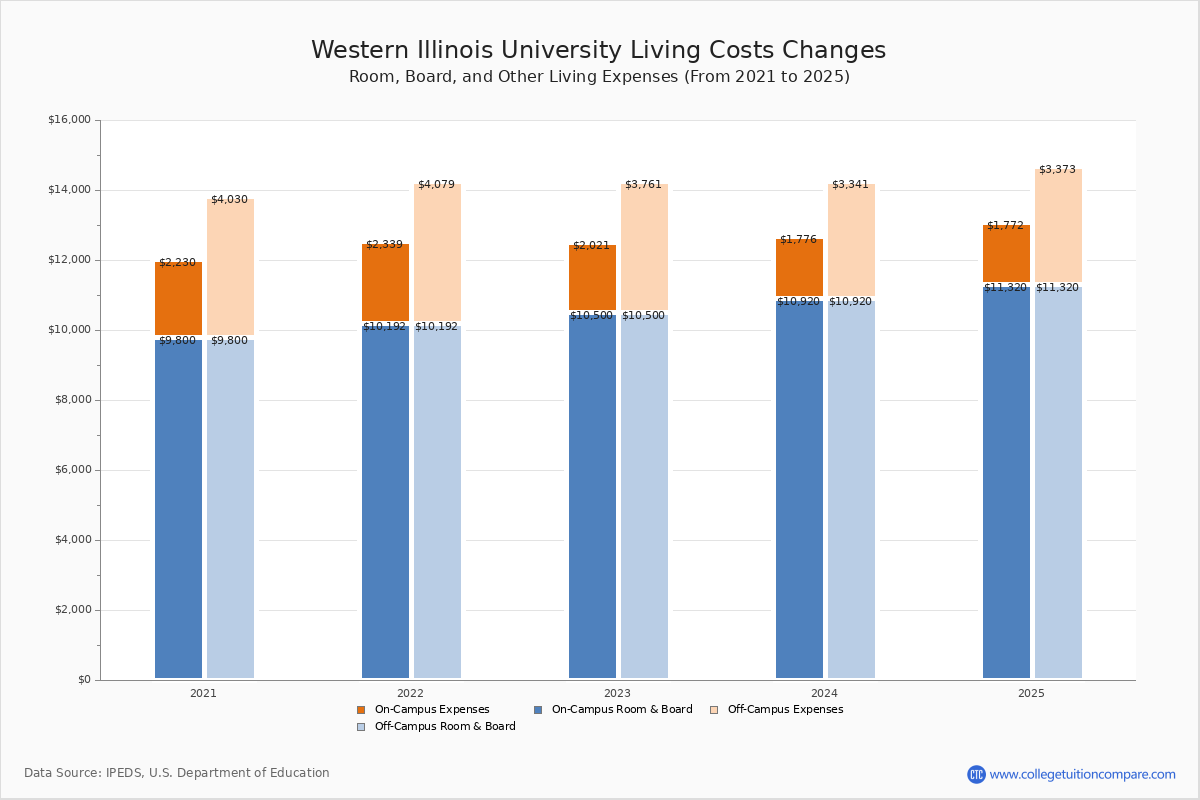

While tuition forms the core of educational expenses, there are several additional costs that students should consider:

- Housing and Meals: On-campus housing and meal plans can range from 8,000 to 12,000 annually, depending on the type of accommodation and dining options chosen.

- Books and Supplies: Textbooks and course materials can add up to $1,500 per semester. However, the university offers initiatives to reduce these costs, such as textbook rental programs.

- Transportation: For students living off-campus, transportation expenses can vary. The university provides comprehensive bus services, but personal vehicles may incur additional costs.

- Personal Expenses: These include clothing, entertainment, and other discretionary spending, which can vary significantly based on individual preferences.

Financial Aid and Scholarships

The University of Illinois is dedicated to making education accessible through a range of financial aid and scholarship opportunities. Here’s an overview:

- Grants and Scholarships: The university awards merit-based scholarships to high-achieving students, as well as need-based grants to eligible applicants. These can significantly reduce the overall cost of attendance.

- Work-Study Programs: Students can gain valuable work experience and earn income through part-time jobs on campus. This program not only provides financial support but also enhances employability.

- Student Loans: Federal and private loan options are available to bridge any remaining financial gaps. The university’s financial aid office provides guidance on responsible borrowing.

It's essential to thoroughly explore all financial aid opportunities. Early application and close consultation with the financial aid office can lead to significant savings.

Historical Tuition Trends

Over the past decade, tuition at the University of Illinois has experienced a steady increase, mirroring the national trend in rising college costs. However, the university has implemented strategies to mitigate the impact on students:

- Introduction of tuition freezes during economic downturns to provide stability.

- Expansion of need-based aid and merit scholarships to offset rising expenses.

- Implementation of cost-saving initiatives, such as online course options and textbook affordability programs.

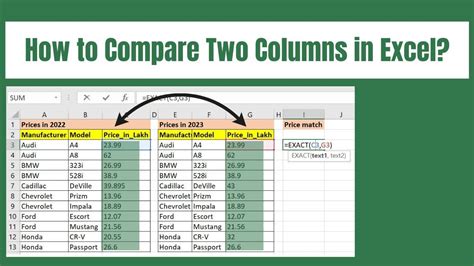

Comparative Analysis: In-State vs. Out-of-State Costs

The University of Illinois offers significant financial benefits to in-state students, with tuition rates that are approximately half of those for out-of-state residents. Let’s explore the implications:

- In-State Advantage: Illinois residents enjoy a substantial cost advantage, making the university a highly attractive option. This not only saves on tuition but also reduces the overall financial burden.

- Out-of-State Considerations: Non-resident students face higher tuition fees but can still benefit from the university’s comprehensive academic offerings and campus life. Scholarships and financial aid can help bridge the gap.

Pros of In-State Tuition: Lower costs, greater financial accessibility, and a sense of community.

Cons of Out-of-State Tuition: Higher fees, but access to a diverse student body and unique academic opportunities.

Case Study: Financial Planning Strategies

Meet Sarah, an incoming freshman at the University of Illinois. Sarah’s family is committed to supporting her education but wants to ensure a sustainable financial plan. Here’s how they approached it:

- Scholarship Search: Sarah dedicated time to researching and applying for scholarships, securing a substantial merit-based award.

- Work-Study Engagement: She opted for a work-study position, earning income and gaining valuable work experience.

- Budgeting and Savings: Sarah’s family created a detailed budget, including potential expenses, and set aside savings for unexpected costs.

Expert Interview: Dr. Emma Johnson’s Insights

We sat down with Dr. Emma Johnson, a financial planning expert at the University of Illinois, to gain her perspective on tuition and financial management:

What advice would you give to students and families regarding tuition planning?

+Start early and explore all financial aid options. The university offers a wealth of resources, and proactive planning can lead to significant savings. Don't hesitate to reach out to our financial aid office for personalized guidance.

How can students manage expenses beyond tuition?

+Creating a budget and sticking to it is crucial. Students should consider part-time jobs, internships, or work-study programs to earn income. Additionally, exploring off-campus housing options and comparing meal plans can lead to cost savings.

Future Trends and Implications

The University of Illinois remains committed to accessibility and affordability. Here’s a glimpse into potential future developments:

- Online Learning Expansion: The university may further develop online programs, offering flexible and cost-effective options for students.

- Increased Financial Aid: Continued efforts to enhance financial aid packages and scholarships are expected, ensuring that education remains accessible.

- Innovative Cost-Saving Initiatives: Exploring partnerships and initiatives to reduce textbook costs and provide affordable housing options is a possibility.

Conclusion: Empowering Informed Decisions

Understanding the financial aspects of attending the University of Illinois is a crucial step towards making well-informed choices. By breaking down tuition rates, exploring financial aid opportunities, and considering the overall cost of attendance, students and their families can navigate the financial landscape with confidence. Remember, the University of Illinois is dedicated to supporting its students throughout their academic journey.