The spending multiplier's secrets revealed.

Understanding the Basics

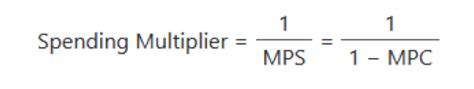

The spending multiplier, or simply the multiplier, is an economic principle that amplifies the initial impact of any injection or withdrawal of money from an economy. This could be through government spending, investment, or consumer spending. It’s a powerful force that can significantly influence economic growth and stability.

Pros of the Multiplier Effect

- It encourages economic growth by boosting demand and encouraging investment.

- Can help to stimulate economies during recessions or periods of slow growth.

- Has the potential to create a positive feedback loop, further enhancing growth.

Cons and Limitations

- Over-reliance can lead to inflationary pressures and economic instability.

- The multiplier effect may not always be as strong as predicted, due to 'leakages' such as imports and savings.

- It can be difficult to control and manage, requiring precise economic policy.

How Does it Work?

At its core, the multiplier operates through the circular flow of income. When money is injected into the economy, it doesn’t just stop with the initial recipient. They spend that money, which then becomes income for someone else, who spends it again, and so on. This continuous cycle of spending and income generation amplifies the initial injection, hence the term ‘multiplier’.

A Simple Example

Imagine a government invests 1 million into the economy through infrastructure projects. This money is paid to contractors and workers, who then go on to spend this money at local businesses. Those businesses then use this income to pay their employees, who spend it again, and so on. The initial 1 million has now multiplied, potentially creating a much larger economic impact.The spending multiplier is a powerful tool, but it's not without its complexities and potential pitfalls. Understanding its mechanics and limitations is crucial for effective economic policy and management.

The Impact on Economic Growth

The multiplier effect can have a significant influence on economic growth, especially in times of recession or slow growth. By injecting money into the economy, governments and central banks can stimulate demand, encourage investment, and boost economic activity. This can lead to increased production, more jobs, and a stronger economy.The Keynesian Perspective

The economist John Maynard Keynes was a strong advocate of the multiplier effect. He argued that government spending during recessions could have a significant impact on economic growth, with the multiplier effect amplifying the benefits. This became a cornerstone of Keynesian economics and has influenced economic policy ever since.Limitations and Real-World Considerations

While the spending multiplier is a powerful concept, it’s not without its limitations and real-world complexities. Here are some key considerations:-

Leakages

Not all of the initial injection remains within the economy. Some of it 'leaks' out through imports, savings, and taxes. These leakages reduce the overall multiplier effect.

-

Time Lag

The multiplier effect doesn't happen instantly. There's often a time lag between the initial injection and the full economic impact, which can make it challenging to manage and predict.

-

Inflationary Pressures

Over-reliance on the multiplier effect can lead to inflation. If the economy is already at full capacity, increasing demand without increasing supply can drive up prices.

-

Unintended Consequences

The multiplier effect can have unintended consequences. For example, increased demand for certain products might lead to trade deficits or encourage unproductive investment.

Policy Implications

The spending multiplier has significant implications for economic policy. Governments and central banks must carefully consider the timing, magnitude, and type of economic injections to maximize the multiplier effect while minimizing potential downsides.

A Balanced Approach

An effective economic policy should aim for a balanced approach, considering both the potential benefits and limitations of the multiplier effect. This might involve a combination of fiscal and monetary policy tools, carefully timed and targeted to maximize impact.Conclusion

The spending multiplier is a powerful economic tool with the potential to significantly influence economic growth and stability. While it’s a key principle in economic theory, its real-world application is complex and requires careful management. By understanding its secrets, economists and policymakers can make more informed decisions to drive economic prosperity.How does the spending multiplier differ from the money multiplier?

+The spending multiplier refers to the amplification of an initial injection of money into the economy, through the circular flow of income. In contrast, the money multiplier refers to the expansion of the money supply by the banking system, through the process of fractional reserve banking. While both concepts involve multiplication, they operate through different mechanisms and have different implications for the economy.

Can the spending multiplier be negative?

+In theory, yes. If the initial injection of money leads to a significant increase in savings or imports, it can reduce the overall income within the economy. This could potentially lead to a negative multiplier effect. However, in practice, negative multipliers are rare and often only occur in specific circumstances, such as during severe economic downturns or in economies with significant trade deficits.

What’s the ideal magnitude for the spending multiplier?

+The ideal magnitude of the spending multiplier depends on various factors, including the state of the economy, the type of injection, and the specific circumstances. In general, a multiplier of around 2 to 3 is often considered ideal, as it indicates a strong amplification of the initial injection without causing excessive inflationary pressures. However, in certain situations, a lower or higher multiplier might be more appropriate.

How can policymakers ensure the spending multiplier works effectively?

+Effective use of the spending multiplier requires careful consideration of several factors. Policymakers should aim for a balanced approach, considering the timing, magnitude, and type of economic injections. They should also monitor economic conditions, such as inflation and unemployment rates, to ensure the multiplier effect is not causing unintended consequences. Additionally, a comprehensive understanding of the economy, including its specific sectors and their interactions, is crucial for effective policy formulation.