Florida Reseller Certificate Guide: 6 Tips

Navigating the Complexities of Florida’s Reseller Certificate

Obtaining a Florida Reseller Certificate is a crucial step for businesses engaged in selling taxable goods or services within the state. This certificate, officially known as the Florida Sales and Use Tax Certificate of Registration, serves as a vital tool for navigating the state’s tax obligations. While the process may seem daunting, especially for new businesses, understanding the steps and requirements can simplify the journey. In this comprehensive guide, we’ll walk you through the process, offering practical tips and insights to ensure a smooth experience.

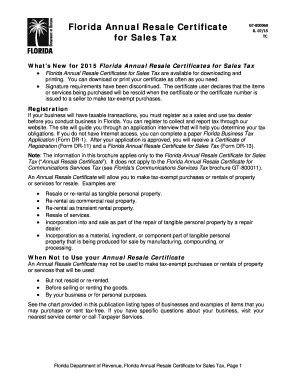

1. Understanding the Purpose

Before diving into the application process, it’s essential to grasp the purpose and benefits of the Florida Reseller Certificate. This certificate serves as your official permission to collect and remit sales tax on behalf of the state. It’s a legal requirement for businesses involved in retail sales, leasing, or renting tangible personal property or providing certain services.

By obtaining this certificate, you gain the authority to purchase goods or services without paying sales tax to your suppliers. This exemption is critical for maintaining your profit margins and ensuring you can compete effectively in the market. Moreover, it streamlines your tax obligations, making it easier to manage your financial responsibilities as a business owner.

2. Eligibility Criteria

Not every business or individual is eligible for a Florida Reseller Certificate. The state has specific criteria that must be met. Here’s a breakdown:

- Business Registration: You must have a valid business registration with the state. This includes entities such as sole proprietorships, partnerships, corporations, or limited liability companies.

- Taxable Activities: Your business must be engaged in activities that are subject to sales tax. This includes selling tangible personal property, leasing, or renting goods, or providing certain services like repairs, installation, or maintenance.

- Location: If you have a physical presence in Florida, such as a store, office, or warehouse, you are typically required to have a Reseller Certificate. Even if your business is primarily online, you may still need one if you have employees or agents working in the state.

- Sales Threshold: In some cases, businesses with low sales volumes may be exempt from obtaining a Reseller Certificate. However, this varies based on the nature of your business and the specific goods or services you provide.

3. The Application Process

Applying for a Florida Reseller Certificate involves a straightforward process, but it requires attention to detail. Here’s a step-by-step guide:

- Online Application: The Florida Department of Revenue provides an online application form, which is the preferred method. Visit their website and navigate to the Sales and Use Tax section. Look for the “Apply for a Certificate of Registration” option.

- Gather Required Documents: Before starting the application, ensure you have all the necessary information. This includes your business registration details, federal tax ID number (EIN), and contact information for your business.

- Complete the Form: Follow the prompts on the online form, providing accurate and up-to-date information. Double-check your entries to avoid errors that could delay your application.

- Submit and Wait: Once you’ve completed the form, submit it electronically. The processing time varies, but typically, you can expect a response within a few business days.

- Check Your Status: After submitting, you can check the status of your application online. This allows you to stay informed and take appropriate action if there are any issues.

4. Maintaining Compliance

Obtaining a Florida Reseller Certificate is just the beginning. To maintain compliance with state tax laws, you must adhere to specific rules and regulations:

- Collect and Remit Sales Tax: As a reseller, you are responsible for collecting sales tax from your customers and remitting it to the state. Ensure you understand the applicable tax rates and collect the correct amount.

- Regular Reporting: Florida requires businesses to file sales tax returns periodically. The frequency depends on your business’s sales volume. Make sure you meet these deadlines to avoid penalties.

- Record Keeping: Maintain accurate records of your sales, purchases, and tax payments. This is crucial for audits and ensuring you remain compliant with tax laws.

- Stay Informed: Tax laws and regulations can change. Stay updated on any modifications to ensure your business remains in compliance. Consider subscribing to tax newsletters or following relevant blogs to stay informed.

5. Common Pitfalls to Avoid

While the process of obtaining a Florida Reseller Certificate is relatively straightforward, there are a few common pitfalls that businesses should be aware of:

- Inaccurate Information: Double-check all the details you provide during the application process. Errors in business registration information or tax ID numbers can lead to delays or even rejection of your application.

- Failure to Understand Tax Obligations: Sales tax laws can be complex. Ensure you understand your tax obligations as a reseller. Misunderstanding or neglecting these responsibilities can result in penalties and legal issues.

- Late or Incomplete Returns: Missing filing deadlines or submitting incomplete sales tax returns can attract penalties and interest charges. Stay organized and set reminders to ensure timely submissions.

6. Seeking Professional Assistance

If you’re unsure about any aspect of the Florida Reseller Certificate process or have concerns about tax compliance, it’s advisable to seek professional assistance. Tax professionals, accountants, or legal experts with experience in sales tax can provide valuable guidance. They can help you navigate the complexities of tax laws, ensure your business remains compliant, and offer strategic advice to optimize your tax obligations.

Key Takeaways

- The Florida Reseller Certificate is essential for businesses engaged in taxable activities, offering an exemption from sales tax on purchases.

- Understanding eligibility criteria and the application process is crucial for a smooth experience.

- Maintaining compliance involves collecting and remitting sales tax, regular reporting, and accurate record keeping.

- Avoid common pitfalls by being meticulous with your application and staying informed about tax laws.

- Seek professional advice if you have doubts or need expert guidance on tax matters.

Wrapping Up

Obtaining a Florida Reseller Certificate is a significant step for businesses operating within the state. By following the steps outlined in this guide and staying vigilant about tax compliance, you can ensure a smooth journey. Remember, the certificate provides not only legal protection but also a competitive advantage in the marketplace. With the right approach, you can navigate the complexities of sales tax and focus on growing your business.