Everything You Need to Know About Resale Permits

When it comes to buying and selling items, especially in the world of second-hand goods, understanding the concept of resale permits is crucial. These permits play a vital role in ensuring legal compliance and providing a smooth transaction process for both buyers and sellers. In this comprehensive guide, we will delve into the intricacies of resale permits, exploring their purpose, how they work, and their significance in various industries.

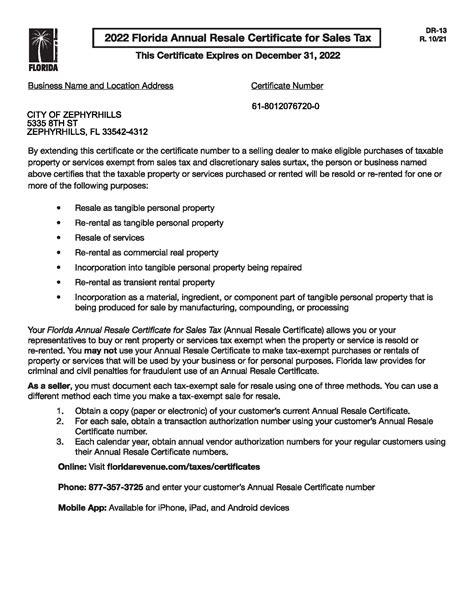

The resale permit, often referred to as a resale certificate or resale license, is a document that authorizes individuals or businesses to purchase goods for resale purposes without incurring sales tax. It serves as a crucial tool for businesses engaged in the resale of products, ensuring they can operate efficiently within the complex web of tax regulations.

One of the primary benefits of a resale permit is its ability to streamline the purchasing process for resellers. By presenting this permit to suppliers or manufacturers, resellers can avoid paying sales tax on their purchases. This not only reduces their financial burden but also simplifies their record-keeping and accounting processes.

Imagine a scenario where a small boutique owner, let's call her Sarah, wants to purchase a batch of trendy clothing items from a wholesale supplier. Without a resale permit, Sarah would be required to pay sales tax on her purchase, which could significantly impact her profit margins. However, with a valid resale permit, she can bypass this tax, making her business more competitive and sustainable.

How Resale Permits Work:

Obtaining a resale permit typically involves a straightforward application process. Businesses or individuals interested in obtaining a permit must complete an application, providing relevant information such as their business details, tax identification number, and the nature of their resale activities. This application is then reviewed by the appropriate tax authority, which may vary depending on the jurisdiction.

Once approved, the permit holder receives a unique identification number or certificate, which they must display prominently during transactions. This number or certificate serves as proof of their resale status, allowing them to purchase goods without sales tax. It’s important to note that the permit is not a one-time pass; it requires regular renewal to maintain its validity.

The Significance of Resale Permits:

Resale permits hold significant importance in various industries, particularly those involved in the buying and selling of goods. Let’s explore some key sectors where these permits play a vital role:

Retail and E-commerce:

In the fast-paced world of retail and e-commerce, where businesses rely on efficient supply chains, resale permits are a game-changer. They enable retailers to procure products from manufacturers or wholesalers without the added cost of sales tax, ensuring competitive pricing and better profit margins.Wholesale and Distribution:

Wholesale businesses, which act as intermediaries between manufacturers and retailers, heavily rely on resale permits. These permits allow wholesalers to purchase goods in bulk without incurring sales tax, which they can then pass on to their retail clients, making their offerings more attractive.Second-Hand and Vintage Markets:

The second-hand and vintage markets, known for their unique and pre-loved items, also benefit from resale permits. Resellers in these markets can purchase items from various sources, such as estate sales or auctions, without paying sales tax, making their operations more cost-effective.Online Resellers and Marketplace Sellers:

With the rise of online marketplaces, individuals and small businesses have found new avenues for reselling. Resale permits enable these online resellers to purchase goods at competitive prices, ensuring they can offer attractive deals to their customers.

Navigating the Challenges:

While resale permits offer numerous advantages, they also come with certain challenges and considerations:

Compliance and Regulations:

Resale permits are subject to strict regulations and compliance requirements. Businesses must ensure they adhere to the guidelines set by the tax authorities, which may include maintaining accurate records, filing regular reports, and renewing their permits timely.Fraud and Misuse:

Unfortunately, resale permits can be vulnerable to fraud and misuse. Unscrupulous individuals may attempt to use them for personal purchases, which can lead to legal consequences. Businesses must take precautions to safeguard their permits and ensure their proper usage.Limited Applicability:

It’s important to note that resale permits are not applicable to all types of transactions. Certain goods, such as groceries or prescription medications, may be exempt from sales tax regardless of the resale permit. Understanding the specific regulations in your jurisdiction is crucial.

Real-World Case Study:

To illustrate the practical application of resale permits, let’s consider the story of John, an aspiring entrepreneur in the world of antique furniture restoration. John’s passion lies in acquiring vintage pieces, restoring them to their former glory, and then reselling them to collectors and enthusiasts.

Without a resale permit, John would face significant challenges. He would be required to pay sales tax on his purchases of antique furniture, which could eat into his profits and make his business less competitive. However, with a valid resale permit, John can bypass this tax, allowing him to focus on his restoration work and offer affordable prices to his customers.

In John's case, the resale permit serves as a catalyst for his business's success. It not only reduces his financial burden but also enables him to build relationships with antique dealers and suppliers, who are more likely to work with a legitimate reseller.

Future Trends and Implications:

As the business landscape continues to evolve, resale permits are likely to adapt and play an even more significant role. Here are some potential future trends and implications:

Digitalization of Resale Permits:

With the increasing digitization of business processes, it’s likely that resale permits will follow suit. Tax authorities may explore the development of digital platforms or apps that streamline the application and renewal process, making it more convenient for businesses.Enhanced Fraud Detection:

To combat the issue of fraud and misuse, tax authorities may invest in advanced technologies for better fraud detection. This could include the implementation of artificial intelligence or blockchain-based solutions to ensure the integrity of resale permits.Expanding Resale Permit Networks:

As more businesses recognize the benefits of resale permits, there may be a push for expanding the network of participating suppliers and manufacturers. This could lead to increased collaboration and easier access to tax-exempt purchases for resellers.

Conclusion:

In a complex world of tax regulations, resale permits offer a valuable solution for businesses engaged in the resale of goods. By understanding the purpose, process, and significance of these permits, entrepreneurs and business owners can navigate the tax landscape with confidence. Whether you’re a small boutique owner, an online reseller, or a wholesale distributor, resale permits can be a powerful tool to streamline your operations and enhance your competitiveness.

Remember, staying informed about the latest developments and regulations surrounding resale permits is essential. By doing so, you can ensure your business remains compliant and takes full advantage of the opportunities these permits present.

Frequently Asked Questions (FAQs):

How often do I need to renew my resale permit?

+The renewal frequency for resale permits can vary depending on the jurisdiction. Some states may require annual renewals, while others may have a biennial or even triennial renewal cycle. It’s crucial to stay updated with the specific regulations in your area to ensure timely renewal.

Can I use my resale permit for personal purchases?

+Absolutely not! Resale permits are specifically designed for business-to-business transactions. Using a resale permit for personal purchases is illegal and can lead to severe penalties. It’s important to maintain the integrity of the permit and use it solely for its intended purpose.

Are there any exemptions or special cases for resale permits?

+Yes, certain jurisdictions may have specific exemptions or special cases for resale permits. For instance, some states may exempt certain types of goods, such as food or medications, from sales tax even without a resale permit. It’s essential to research and understand the specific regulations in your area.

What happens if I lose my resale permit or it expires?

+If your resale permit is lost or expires, it’s crucial to contact the relevant tax authority promptly. They will guide you through the process of obtaining a replacement or renewing your permit. In the meantime, you may need to pay sales tax on your purchases until the new permit is issued.

Can I transfer my resale permit to another business or individual?

+Transferring a resale permit is generally not permitted. Resale permits are typically issued to specific businesses or individuals and are not transferable. If you wish to sell or transfer your business, you would need to apply for a new permit in the name of the new owner or entity.