The Ultimate Guide to Quick Claim Deeds in Georgia

Understanding the intricacies of real estate transactions, particularly within the context of Georgia's legal framework, is paramount for both property owners and prospective buyers. Quick claim deeds, a legal instrument facilitating property transfer, offer a unique and often expedited approach to ownership changes. This comprehensive guide will delve into the specifics of quick claim deeds in Georgia, exploring their advantages, potential pitfalls, and the essential steps to ensure a smooth and legally sound process.

What is a Quick Claim Deed in Georgia?

A quick claim deed is a legal document used to transfer ownership rights in real property. Unlike a traditional warranty deed, which guarantees clear title, a quick claim deed does not provide such assurances. Instead, it serves as a means to convey whatever interest the grantor (the current owner) may have in the property to the grantee (the new owner), without any warranties or representations.

In Georgia, quick claim deeds are commonly employed when there's a need for a swift transfer of property ownership. This might include situations like family transfers, gifts, or even resolutions to disputes where a quick and amicable solution is sought.

The Benefits of Using a Quick Claim Deed

Quick claim deeds offer several advantages, particularly in scenarios where time is of the essence or when the transfer involves little to no monetary consideration.

- Speed and Efficiency: One of the primary benefits is the expedited nature of the process. Unlike traditional deeds that require extensive title searches and legal assurances, quick claim deeds can be executed quickly, often within a matter of days.

- Cost-Effectiveness: Given the absence of warranty guarantees, the legal and administrative costs associated with quick claim deeds are generally lower. This makes them an attractive option for transfers where financial considerations are minimal.

- Flexibility: Quick claim deeds offer a high degree of flexibility in terms of who can be involved in the transfer. This can be especially beneficial for family transfers or when resolving complex ownership disputes.

Potential Pitfalls and Limitations

While quick claim deeds offer undeniable benefits, they also come with certain limitations and potential risks that must be carefully considered.

Advantages

- Ideal for family transfers and gifts.

- Suitable for resolving ownership disputes.

- Can be executed quickly, saving time.

Disadvantages

- No guarantee of clear title or ownership.

- May not be accepted by all lenders or financial institutions.

- Potential for future legal complications if title issues arise.

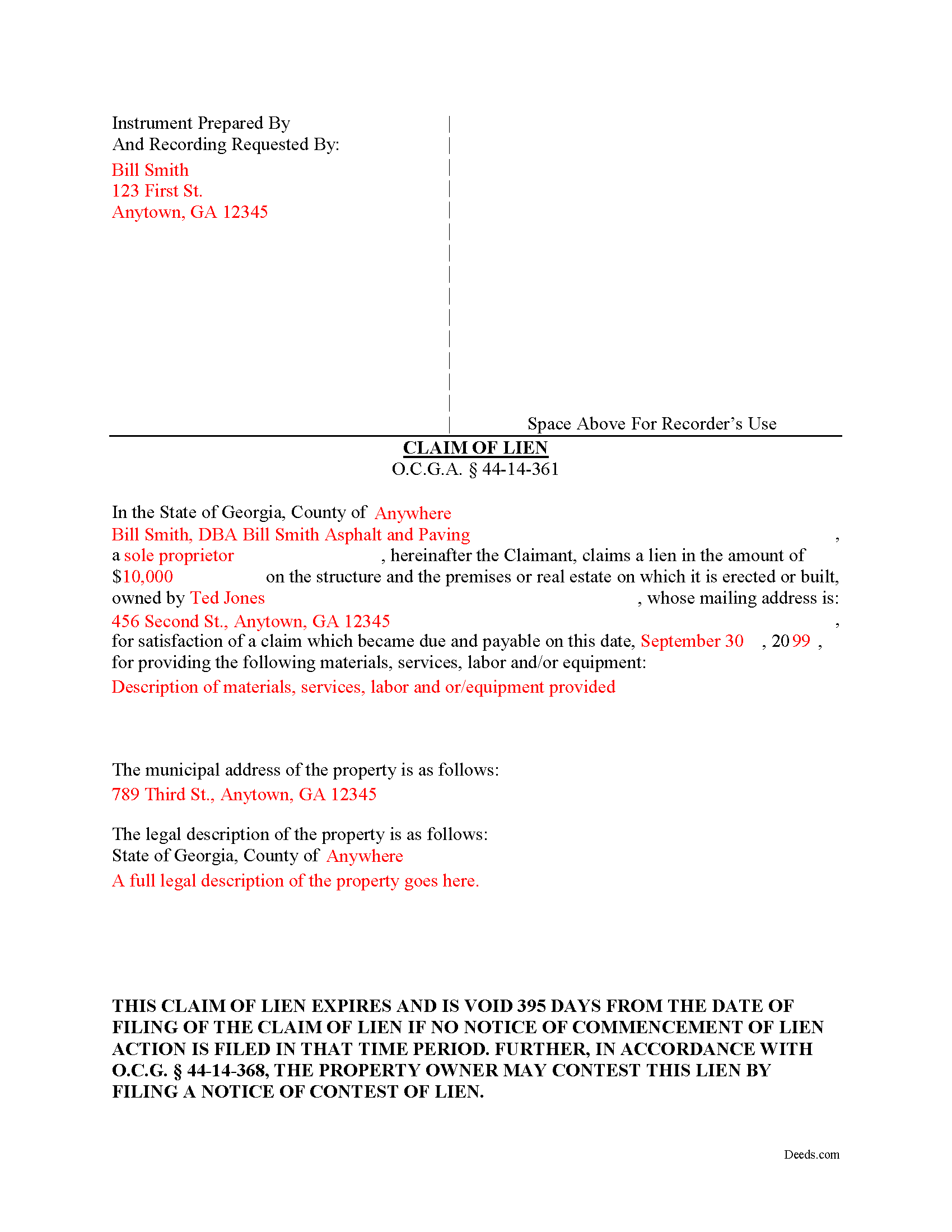

One of the key limitations is the lack of warranty. A quick claim deed does not guarantee that the grantor has valid title to the property or that the property is free from liens or encumbrances. This means that if there are any hidden title defects, the grantee may not have a legal recourse to rectify the situation.

Additionally, while quick claim deeds can expedite the transfer process, they may not be universally accepted. Some lenders and financial institutions may require a warranty deed for certain transactions, particularly those involving mortgages or loans. This can create complications when the grantee wishes to secure financing for the property.

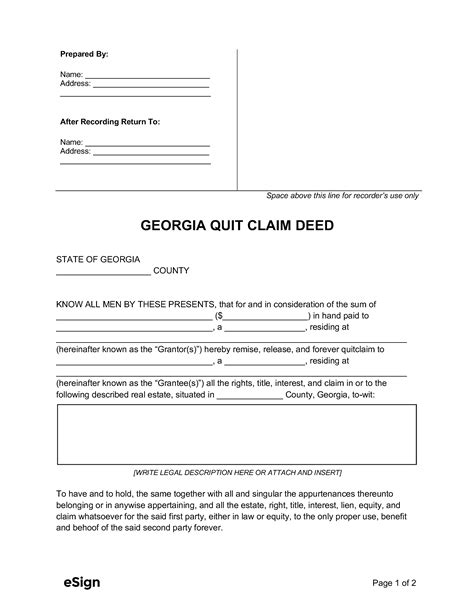

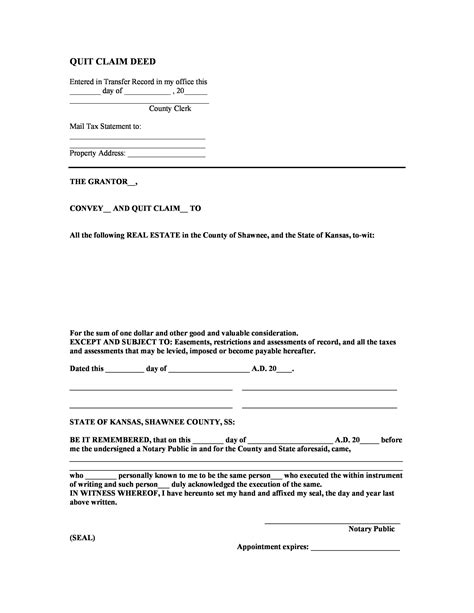

Steps to Execute a Quick Claim Deed in Georgia

- Determine Eligibility: Not all property transfers can be executed using a quick claim deed. Ensure that the transfer falls within the permissible categories, such as family transfers or gift transactions.

- Prepare the Deed: Obtain a quick claim deed form specific to Georgia. These forms are available online or can be prepared by a legal professional. Ensure all relevant details, including the names of the grantor and grantee, the property address, and any additional terms, are accurately filled out.

- Sign and Witness: Both the grantor and grantee must sign the deed in the presence of a notary public. The notary will witness the signatures and certify the document.

- Record the Deed: Once signed and notarized, the quick claim deed must be recorded with the appropriate county clerk’s office. This process ensures that the transfer is officially documented and becomes a matter of public record.

- Obtain Title Insurance: Given the absence of warranty guarantees, it is highly recommended to obtain title insurance. This provides protection against potential title defects or ownership disputes that may arise in the future.

Expert Perspective: A Conversation with Real Estate Attorney, Jane Smith

“Quick claim deeds can be a valuable tool in the right circumstances, but they should be used with caution. While they offer a quick and cost-effective solution, they are not without risks. It’s crucial to fully understand the implications of a quick claim deed, especially in terms of potential title issues and their impact on future transactions.”

~ Jane Smith, Real Estate Attorney, Atlanta, GA

Case Study: A Successful Quick Claim Deed Transaction

To illustrate the practical application of quick claim deeds, consider the following scenario:

John, a resident of Atlanta, wished to transfer a vacation home he owned in the mountains of Georgia to his daughter, Sarah. The property had been in the family for generations, and John wanted to ensure Sarah inherited it without any legal complications. Given the family nature of the transfer and the absence of any outstanding debts or liens on the property, a quick claim deed was an ideal solution.

John and Sarah executed the quick claim deed, which was then recorded with the county clerk. To ensure future protection, they also obtained a title insurance policy. This process allowed for a swift and seamless transfer of ownership, preserving the family's legacy while avoiding the more complex and costly processes associated with traditional deeds.

Future Trends and Considerations

The use of quick claim deeds in Georgia, while beneficial in certain contexts, is not without its challenges. As real estate transactions become increasingly complex, there is a growing need for innovative solutions that balance speed and legal certainty.

Looking ahead, there are several emerging trends that may impact the use and perception of quick claim deeds:

- Technological Advancements: The integration of blockchain technology and digital signatures may streamline the process, making quick claim deeds more secure and efficient.

- Legal Reforms: There is a possibility of legislative changes that could impact the acceptability and usage of quick claim deeds, particularly in light of increasing concerns over title fraud and real estate scams.

- Industry Practices: As more real estate professionals and legal experts become familiar with quick claim deeds, there may be a shift in their perception and usage, especially in specialized circumstances.

Conclusion

Quick claim deeds offer a unique and often advantageous approach to property transfers in Georgia. They provide a swift and cost-effective solution, particularly in family transfers or situations where there are no monetary considerations. However, their use should be approached with caution, given the absence of warranty guarantees and potential limitations in certain transactions.

By understanding the benefits, limitations, and essential steps involved, individuals can make informed decisions about whether a quick claim deed is the right choice for their specific circumstances. As always, seeking legal advice and due diligence are paramount to ensuring a smooth and legally sound process.

Remember, while quick claim deeds offer flexibility and speed, they are not a one-size-fits-all solution. Always assess your specific situation and consult with legal professionals to ensure the best approach for your unique needs.

Can a quick claim deed be used for any type of property transfer in Georgia?

+No, quick claim deeds are generally used for specific types of transfers, such as family transfers, gifts, or resolutions to disputes. They are not commonly used for traditional property sales or transfers involving financial institutions.

What happens if there are hidden title defects after a quick claim deed transfer?

+As quick claim deeds do not provide warranty guarantees, the grantee may have limited legal recourse if hidden title defects are discovered. It’s crucial to obtain title insurance to mitigate these risks.

Are quick claim deeds accepted by all lenders and financial institutions in Georgia?

+No, some lenders and financial institutions may require a warranty deed for certain transactions, particularly those involving mortgages or loans. It’s essential to check with the specific lender or institution to ensure acceptance.

Is it mandatory to obtain title insurance after a quick claim deed transfer?

+While not mandatory, obtaining title insurance is highly recommended. It provides protection against potential title defects or ownership disputes that may arise after the transfer.

Can a quick claim deed be used to transfer property between family members in Georgia?

+Yes, quick claim deeds are commonly used for family transfers, including between parents and children, siblings, or other close relatives. They offer a simple and efficient way to convey ownership without the complexities of a traditional sale.