5 Real-Life Price Ceiling Examples

A Tale of Misaligned Incentives and Market Distortions

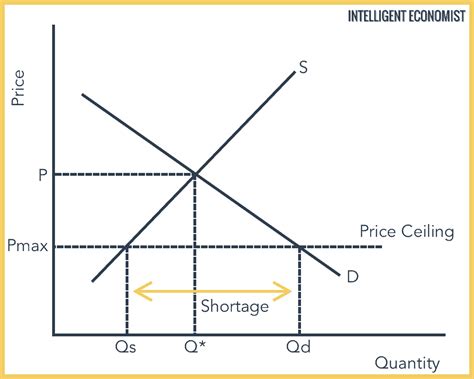

In economics, a price ceiling is a government-imposed regulation that sets the maximum price a seller can charge for a particular good or service. When implemented, it aims to protect consumers from excessive pricing, ensure affordability, and promote access to essential commodities. However, as history and current examples demonstrate, price ceilings often lead to unintended consequences, market distortions, and complex challenges that policymakers and economists must navigate. Here, we explore five real-life instances where price ceilings have been enacted and analyze their impacts.

1. Rent Control in New York City

Rent control policies, designed to make housing more affordable for tenants, have been a controversial topic in cities across the globe. One notable example is New York City’s rent stabilization program, which imposes strict regulations on rental prices. While the intention is to prevent landlords from exploiting tenants, especially in a highly desirable and competitive housing market, the long-term effects are more nuanced.

Under rent control, landlords face disincentives to invest in property maintenance and improvements, as they cannot recoup these costs through higher rents. This can lead to a decline in the quality of rental housing and discourage new construction. As a result, the rental market becomes stagnant, and supply struggles to keep up with demand. Tenants who are lucky enough to secure rent-controlled apartments may enjoy long-term stability, but the limited supply creates a competitive environment where new entrants face significant challenges.

The unintended consequence is a distortion of the housing market, where those without rent-controlled apartments may face higher prices and limited options, especially in a city with a growing population and a limited housing supply.

2. Sugar Price Controls in Brazil

Brazil, a major player in the global sugar market, implemented price controls on sugar to protect its domestic industry and stabilize prices for consumers. The government set a minimum price for sugar, aiming to support farmers and ensure affordable sugar for its population. However, this intervention had ripple effects throughout the industry.

With a guaranteed minimum price, sugar farmers had little incentive to innovate, improve efficiency, or explore alternative crops. This lack of market-driven innovation led to a decline in the competitiveness of Brazil’s sugar industry over time. Additionally, as global sugar prices fluctuated, the fixed domestic price created a disconnection between the Brazilian market and international trade, potentially limiting the country’s export opportunities.

The price ceiling, while intended to protect farmers and consumers, may have hindered Brazil’s ability to adapt to changing market dynamics and maintain its global competitiveness in the sugar industry.

3. Maximum Fare Limits in Ride-Sharing Apps

In response to concerns about fare surges during peak hours or emergencies, some cities have imposed maximum fare limits on ride-sharing platforms like Uber and Lyft. These limits aim to prevent price gouging and ensure fair pricing for passengers. However, they can have unintended consequences on both riders and drivers.

With maximum fare limits, drivers may be discouraged from working during peak hours or in less desirable areas, as the potential earnings are capped. This can lead to reduced supply during times of high demand, causing longer wait times for riders. Additionally, the limited earnings may impact driver retention, as the incentive to work for these platforms decreases.

On the other hand, riders may benefit from lower fares during regular hours but face the challenge of limited availability during peak times. The price ceiling can create a trade-off between affordability and accessibility, impacting the overall efficiency of the ride-sharing system.

4. Price Caps on Prescription Drugs

Price caps on prescription drugs are a global topic of debate, especially in countries with universal healthcare systems. Governments implement these caps to ensure that essential medications are accessible and affordable for their citizens. While the intention is noble, the reality is often more complex.

When drug prices are capped, pharmaceutical companies may face reduced incentives to invest in research and development for new medications. This could potentially slow down innovation in the industry, limiting the availability of cutting-edge treatments. Additionally, the reduced profitability may lead to supply chain disruptions, impacting the consistent availability of essential drugs.

The price ceiling, in this case, may lead to a delicate balance between affordability and access to innovative treatments, a challenge that policymakers must navigate to ensure public health.

5. Rent Control in Berlin

Berlin, known for its vibrant culture and affordable housing, implemented rent control measures to address rising rents and protect tenants. The city introduced a rent cap, limiting increases to a maximum of 10% over the previous three years. While the policy aimed to make housing more accessible, it encountered legal challenges and market distortions.

Landlords, facing restricted rental income, may choose to withdraw properties from the rental market, leading to a reduction in housing supply. This could exacerbate the housing shortage and push rents higher in the long run. Additionally, the rent cap may discourage investments in new housing developments, impacting the city’s ability to accommodate its growing population.

The unintended consequence is a potential slowdown in housing construction and a distortion of the rental market, where tenants may face limited options and increased competition for affordable housing.

Conclusion: Navigating the Complexities

These real-life examples highlight the intricate challenges that arise when governments impose price ceilings. While the intention is often to protect consumers and ensure fairness, the market’s response can be unpredictable. Policymakers must carefully consider the potential consequences, including disincentives to invest, market distortions, and limited access to essential goods and services.

As we analyze these case studies, it becomes evident that finding the right balance between market forces and government intervention is a delicate task. It requires a deep understanding of the specific market dynamics, potential trade-offs, and the long-term impacts on both consumers and producers. The examples provided serve as a reminder that while price ceilings may offer short-term relief, they can also lead to complex challenges that require ongoing evaluation and adjustment.

FAQ Section

How do price ceilings impact the supply of goods and services?

+Price ceilings can lead to reduced supply as producers may face disincentives to produce or invest in their businesses. This is because the capped price may not cover their costs or provide adequate incentives for expansion.

What are the potential consequences of rent control on housing markets?

+Rent control can result in reduced investment in housing maintenance, limited new construction, and a distorted market where supply struggles to meet demand. Tenants may face challenges in finding affordable housing, especially in highly desirable areas.

How do price caps on prescription drugs affect pharmaceutical innovation?

+Price caps may reduce pharmaceutical companies’ incentives to invest in research and development, potentially slowing down the discovery of new treatments. This could impact the availability of innovative medications for patients.

What alternatives exist to price ceilings for protecting consumers?

+Alternatives include promoting competition, providing subsidies to consumers, implementing targeted regulations to address specific market failures, and enhancing consumer education and protection measures.