The Ultimate Guide to Power of Attorney Forms in Georgia

Navigating the Legal Landscape: Understanding Power of Attorney in Georgia

In the state of Georgia, the concept of Power of Attorney (POA) holds immense significance, especially when it comes to making critical decisions on behalf of another individual. This legal instrument empowers a designated person, known as the ‘agent’ or ‘attorney-in-fact’, to handle various affairs for someone who might be unable to do so themselves due to illness, injury, or other incapacitating circumstances. The scope of this authority can range from financial matters to healthcare choices, underscoring the importance of a comprehensive understanding of Power of Attorney forms and their implications.

The Evolution of Power of Attorney in Georgia

The history of Power of Attorney in Georgia is deeply rooted in the state’s legal framework, evolving over time to meet the changing needs of its citizens. Initially, POA forms were more limited in scope, often focusing solely on financial matters. However, as medical science advanced and life expectancies increased, the need for more comprehensive POA forms became evident. Today, Georgia’s POA forms are designed to provide a robust framework that allows individuals to maintain control over their lives and affairs, even in times of incapacity.

Types of Power of Attorney Forms in Georgia

Georgia recognizes several types of Power of Attorney forms, each tailored to meet specific needs and circumstances. These include:

General Power of Attorney: This form grants broad authority to the agent, allowing them to make decisions and take actions on behalf of the principal in various areas of their life, such as financial, legal, and personal affairs. The general POA is typically used when the principal is healthy and wishes to delegate specific tasks or responsibilities to their agent.

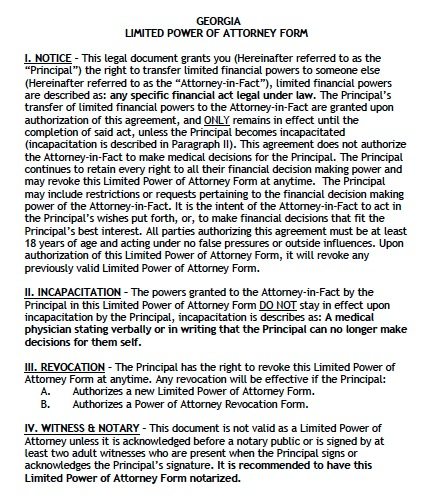

Limited Power of Attorney: As the name suggests, this form restricts the agent’s authority to a specific type of transaction or a defined period. It is commonly used in situations where the principal needs help with a particular task, such as selling a property or managing a business, but does not want to grant unlimited power.

Durable Power of Attorney: This form is particularly crucial as it remains effective even if the principal becomes incapacitated. It covers a wide range of matters, including healthcare decisions, financial transactions, and legal affairs. The durable POA ensures that the principal’s wishes are respected and carried out, even if they are unable to communicate their preferences directly.

Springing Power of Attorney: A unique form, the springing POA only comes into effect under certain specified circumstances, often related to the principal’s incapacity. It provides a way for individuals to plan for potential future incapacity while still maintaining control over their affairs until that time.

Healthcare Power of Attorney: Focused specifically on medical decisions, this form empowers the agent to make choices regarding the principal’s healthcare, including consenting to or refusing medical treatments, surgeries, or end-of-life care. It ensures that the principal’s healthcare wishes are respected and followed, even if they are unable to communicate them.

The Importance of Proper Form Execution

Executing a Power of Attorney form correctly is of utmost importance to ensure its validity and enforceability. In Georgia, specific formalities must be followed, including proper signing, witnessing, and sometimes even notarization. Failure to adhere to these requirements can render the form invalid, leaving the principal without the necessary legal protections.

It's crucial to consult with an experienced attorney who can guide you through the process, ensuring that all legal requirements are met and that the form accurately reflects your wishes and intentions.

Key Considerations When Granting Power of Attorney

When deciding to grant Power of Attorney, several critical factors should be carefully considered:

Trust and Reliability: The individual you choose as your agent should be someone you trust implicitly. They will have significant control over your affairs, so it’s essential they are reliable, honest, and committed to acting in your best interests.

Clear Communication: Ensure that both you and your agent fully understand the scope and limitations of the Power of Attorney. Open and detailed communication about your wishes and expectations is vital to avoid any misunderstandings or disputes in the future.

Regular Review and Updates: Life is dynamic, and your circumstances and preferences may change over time. Regularly review your Power of Attorney forms and update them as needed to ensure they continue to reflect your current wishes and accurately address any changes in your life.

Legal and Tax Implications: Granting Power of Attorney can have legal and tax consequences. Consult with a qualified attorney and tax professional to understand these implications and ensure compliance with relevant laws and regulations.

Case Study: Real-World Application of Power of Attorney in Georgia

To illustrate the practical application of Power of Attorney in Georgia, let’s consider the story of Mr. Johnson, a successful businessman in his late 60s. Mr. Johnson, aware of the importance of planning for the future, decided to grant a Durable Power of Attorney to his trusted son, David. This decision ensured that David could make crucial financial and legal decisions on his father’s behalf if he became incapacitated due to a sudden illness.

Unfortunately, Mr. Johnson’s health took a turn for the worse, and he was hospitalized with a severe stroke. As he was unable to communicate, David, armed with the Durable Power of Attorney, stepped in to make critical decisions regarding his father’s medical care and financial affairs. David’s actions, guided by the POA, ensured that Mr. Johnson’s wishes were respected and that his financial obligations were met during his period of incapacity.

Frequently Asked Questions (FAQs)

Can I revoke a Power of Attorney once it's been granted?

+Absolutely! You have the right to revoke a Power of Attorney at any time, as long as you are of sound mind and have the legal capacity to do so. The revocation process typically involves notifying your agent in writing and ensuring that all relevant parties, such as financial institutions, are aware of the change.

Are there any restrictions on who can be appointed as an agent in a Power of Attorney?

+Generally, anyone who is legally competent and of sound mind can be appointed as an agent. However, it's important to choose someone you trust implicitly and who is willing and able to take on the responsibilities associated with the Power of Attorney. Avoid appointing someone who might have conflicting interests or who may not act in your best interests.

What happens if I don't have a Power of Attorney and become incapacitated?

+If you don't have a Power of Attorney and become incapacitated, a court may need to appoint a guardian or conservator to make decisions on your behalf. This process can be lengthy and costly, and the court-appointed individual might not always align with your wishes or best interests. Having a Power of Attorney in place allows you to maintain control over your affairs and ensure that your wishes are respected.

Can a Power of Attorney be used to make end-of-life decisions?

+Yes, a Healthcare Power of Attorney can be used to make end-of-life decisions on your behalf. This includes decisions about life-sustaining treatments, organ donation, and funeral arrangements. It's crucial to have detailed conversations with your agent about your end-of-life wishes to ensure they can make decisions that align with your values and beliefs.

How long does a Power of Attorney remain valid in Georgia?

+The duration of a Power of Attorney depends on the type of POA and the terms specified in the document. A general or limited POA typically remains valid until it is revoked or until a specific event occurs, such as the completion of a particular task. A durable POA, on the other hand, remains valid even if the principal becomes incapacitated, unless it is revoked or a specific event occurs, such as the principal's death.

Conclusion

Understanding and utilizing Power of Attorney forms is a crucial aspect of legal and financial planning in Georgia. These forms provide a means for individuals to maintain control over their affairs, even in times of incapacity, and ensure that their wishes are respected and carried out. By carefully considering the different types of POA, executing the forms correctly, and regularly reviewing and updating them, Georgians can effectively plan for their future and the well-being of their loved ones.