The Importance of Policy Issuer Names

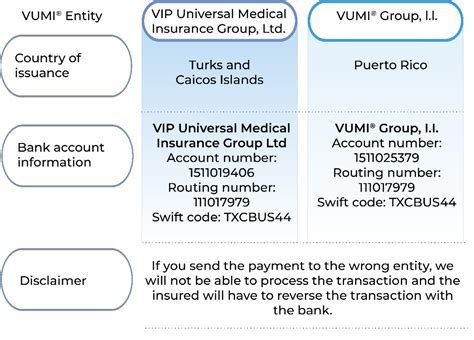

The name of a policy issuer is an often overlooked yet crucial aspect of the insurance landscape. It forms the foundation of trust and confidence that policyholders place in their insurance providers. This seemingly simple detail carries significant weight, influencing various facets of the insurance experience, from initial perception to long-term satisfaction and loyalty. Understanding its importance is key to navigating the complex world of insurance with clarity and confidence.

At its core, the name of a policy issuer serves as a brand identifier, much like a logo or a slogan. It is the first point of recognition for policyholders, the initial touchpoint that sets the tone for the entire insurance journey. A well-chosen name can evoke a sense of security, professionalism, and reliability, fostering a positive impression from the outset.

Moreover, the issuer’s name plays a pivotal role in establishing trust and credibility. In an industry where financial transactions and personal data are involved, consumers seek assurance that their interests are protected. A recognizable and reputable name can instill confidence, providing a sense of stability and reassurance that the issuer is a trustworthy partner.

In practical terms, the issuer’s name is integral to the policyholder’s experience. It appears on all official documents, from policy contracts to billing statements and correspondence. Consistency in the use of the issuer’s name across these materials is vital to maintaining a professional image and ensuring a seamless customer experience.

However, the importance of the policy issuer’s name extends beyond mere recognition and trust. It is also a critical factor in brand differentiation and market positioning. In a crowded and competitive insurance market, a unique and memorable name can set an issuer apart, helping it stand out from the crowd and attract attention.

Furthermore, the name can influence an issuer’s ability to expand its product offerings and services. A well-regarded name can open doors to new partnerships, collaborations, and opportunities, enabling the issuer to diversify its portfolio and meet the evolving needs of its customers.

Despite its significance, the policy issuer’s name is often taken for granted. Many policyholders may not give it a second thought, assuming that all issuers are created equal. However, a closer examination reveals that the name is a powerful tool, capable of shaping perceptions, influencing decisions, and driving the success of an insurance provider.

In conclusion, the name of a policy issuer is much more than a simple label. It is a cornerstone of the insurance experience, influencing everything from initial perception to long-term satisfaction. As such, it deserves careful consideration and strategic planning, ensuring that it accurately reflects the values, reputation, and aspirations of the issuer.

As we navigate the intricate web of the insurance industry, let us not underestimate the power of a name, for it is the first step towards building trust, confidence, and a lasting relationship with policyholders.