5 Steps to Get Your Breast Pump Covered

Navigating the process of securing insurance coverage for a breast pump can seem daunting, especially for new parents. Fortunately, with the right approach and a few key insights, you can ensure that this essential equipment is accessible and affordable. This guide will walk you through the essential steps to make the process smooth and stress-free.

Step 1: Understand Your Insurance Coverage

The first step towards securing coverage for your breast pump is to gain a comprehensive understanding of your insurance policy. This means delving into the fine print to uncover the specific details of your plan’s benefits and limitations.

Breakdown of Essential Coverage Details: - Eligibility: Check if your insurance plan covers breast pumps and the specific criteria you need to meet to be eligible. This may include factors like pregnancy, birth of a child, or a medical necessity. - Benefit Amount: Understand the maximum amount your insurance will cover for a breast pump. This amount may vary based on the type of pump and any additional accessories you require. - Network Providers: Determine if your insurance plan has a network of preferred providers for breast pumps. If so, you’ll need to choose a pump from this network to ensure coverage. - Prescription Requirements: Some insurance plans may require a prescription from a healthcare provider to approve coverage for a breast pump. Find out if this is a prerequisite for your plan.

Step 2: Determine Your Breast Pump Needs

Choosing the right breast pump is crucial, as it will impact your breastfeeding experience and comfort. Take the time to research and understand the different types of pumps available, their features, and how they align with your personal needs.

Factors to Consider: - Pump Type: There are various types of breast pumps, including manual, single electric, double electric, and hospital-grade pumps. Each has its advantages and is suitable for different situations. - Usage Frequency: Consider how often you’ll be pumping. For occasional use, a manual or single electric pump might suffice, but for frequent pumping, a double electric pump could be more efficient. - Portability: If you plan to pump on-the-go, look for a portable pump with a lightweight design and easy-to-use features. - Comfort and Fit: Breast shields come in various sizes, so choose one that fits your nipple comfortably. Ill-fitting shields can cause pain and reduce milk flow.

Step 3: Obtain a Prescription (If Required)

As mentioned earlier, some insurance plans require a prescription from a healthcare provider to approve coverage for a breast pump. This step is crucial, as it ensures that your insurance company recognizes the medical necessity of the pump.

Prescription Process: - Consult Your Healthcare Provider: Schedule an appointment with your healthcare provider to discuss your need for a breast pump. They will assess your situation and provide a prescription if necessary. - Document the Prescription: Ensure that you receive a detailed prescription document that includes your name, the type of pump required, and any additional accessories. - Submit the Prescription: Depending on your insurance plan, you may need to submit the prescription directly to your insurance company or to the breast pump provider.

Step 4: Choose an In-Network Provider

If your insurance plan has a network of preferred providers for breast pumps, it’s essential to choose a provider from this network to ensure coverage. This step can save you time and potential headaches down the line.

Tips for Choosing an In-Network Provider: - Research Online: Most insurance companies provide online directories of their network providers. Search for breast pump suppliers in your area and make a list of potential options. - Check Credentials: Ensure that the providers on your list are reputable and have the necessary credentials and certifications. - Compare Prices: While all in-network providers should offer the same level of coverage, prices may still vary. Compare the prices of different pumps and accessories to find the best deal.

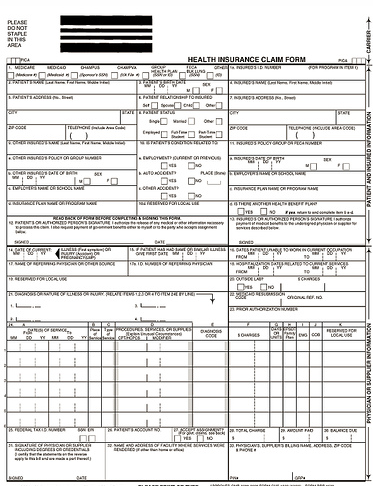

Step 5: Submit Your Claim

Once you’ve chosen your breast pump and obtained any necessary prescriptions, it’s time to submit your claim to your insurance company. This step is crucial to ensure you receive the coverage you’re entitled to.

Claim Submission Process: - Gather Required Documents: Collect all the necessary documents, including your prescription, a copy of your insurance card, and any additional forms or information required by your insurance company. - Fill Out Claim Forms: Complete the claim forms provided by your insurance company accurately and thoroughly. Ensure you include all relevant details, such as the date of service, the provider’s information, and the cost of the pump. - Submit Your Claim: Submit your claim through the method specified by your insurance company, which may include mailing, faxing, or online submission.

Conclusion: Ensuring Accessibility and Comfort for New Parents

Securing coverage for a breast pump is an important step towards ensuring the health and well-being of both mother and child. By following these five steps, you can navigate the process with confidence and ensure that you receive the support and equipment you need during this special time.

Remember, breastfeeding is a journey, and having the right tools can make all the difference. With the right breast pump and insurance coverage, you can focus on what matters most—bonding with your little one and providing them with the best possible start in life.

FAQ

Can I get a breast pump covered by insurance if I’m not currently pregnant or have recently given birth?

+Insurance coverage for breast pumps is typically tied to pregnancy or the birth of a child. However, some insurance plans may cover breast pumps for medical reasons, such as low milk supply or medical conditions that impact breastfeeding. It’s best to check with your insurance provider to understand your specific coverage.

Are all breast pumps covered by insurance, or are there specific brands or models that are excluded?

+Insurance coverage for breast pumps can vary based on your insurance plan. Some plans cover a wide range of pumps, while others may have specific brands or models that are preferred or excluded. It’s important to check with your insurance provider to understand the specific pumps that are covered under your plan.

How long does it typically take to receive approval and coverage for a breast pump from insurance companies?

+The timeline for receiving approval and coverage for a breast pump can vary depending on your insurance provider and the complexity of your claim. In some cases, it may take a few days to a week for a decision to be made. However, if your claim requires additional information or clarification, the process may take longer. It’s best to submit your claim as early as possible to allow for any potential delays.

What happens if my insurance claim for a breast pump is denied? Are there any appeals processes available?

+If your insurance claim for a breast pump is denied, it’s important to understand the reason for the denial. Insurance companies may deny claims for various reasons, such as lacking the necessary documentation or not meeting eligibility criteria. In such cases, you can often file an appeal to have your claim reconsidered. Check with your insurance provider for their specific appeals process and the documentation required for a successful appeal.