5 Tips for NY Payroll Management Online

1. Understand the Complexities of NY Payroll Regulations

Navigating payroll management in New York can be daunting due to the intricate web of regulations. It’s crucial to familiarize yourself with the state’s unique requirements, which may differ significantly from other jurisdictions. This includes grasping the nuances of minimum wage laws, overtime rules, and tax obligations specific to the Empire State.

For instance, New York has some of the highest minimum wage rates in the country, with varying rates for different industries and regions. Additionally, the state’s overtime rules are more stringent than federal regulations, mandating overtime pay after 40 hours in a week for most workers. These variations can have a substantial impact on your payroll calculations and compliance.

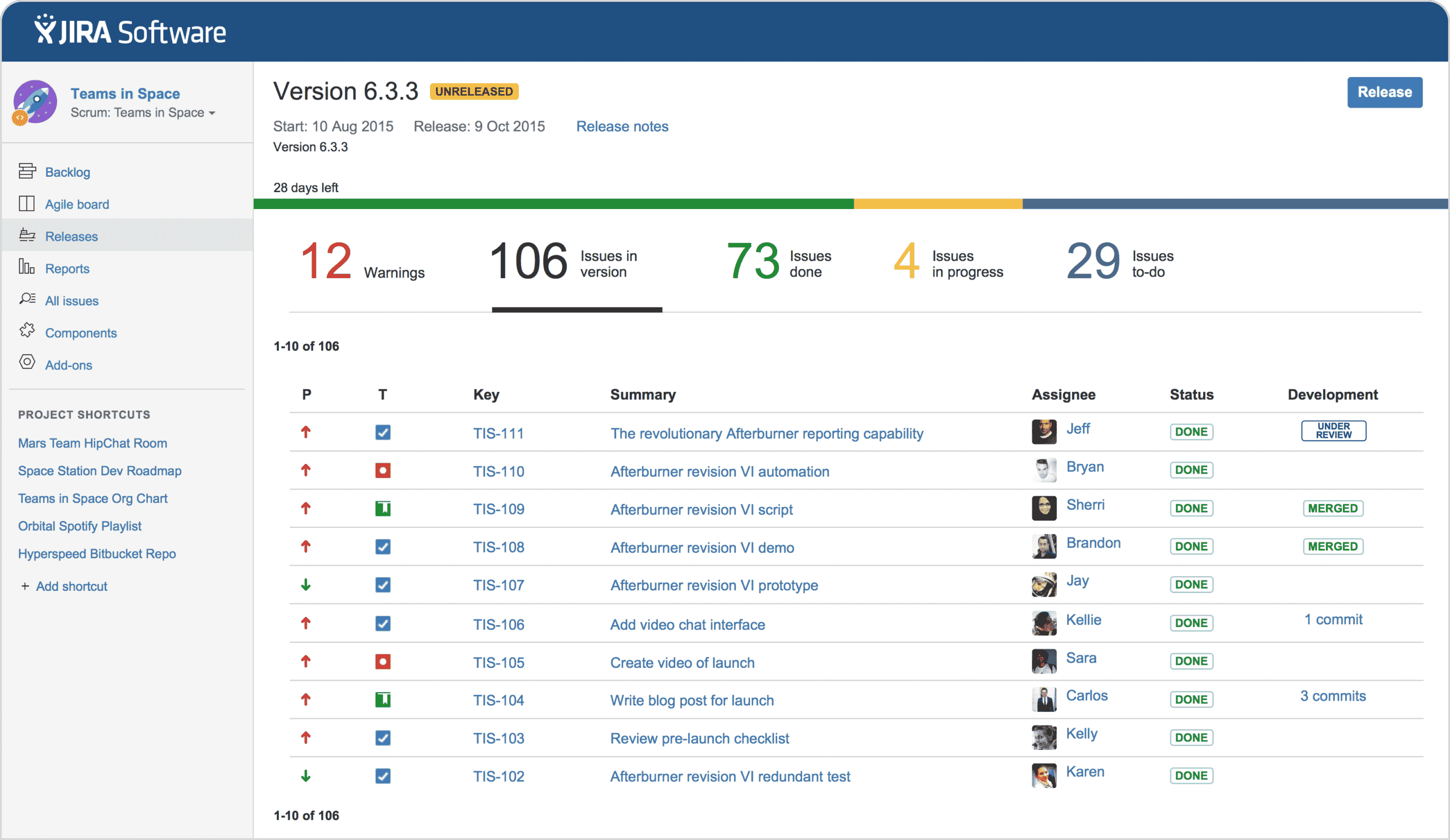

2. Utilize Specialized NY Payroll Software

Given the complexity of New York’s payroll regulations, investing in specialized software can be a game-changer. These tools are designed to automate the payroll process, ensuring compliance with the state’s intricate rules and regulations. They can handle everything from calculating wages and deductions to filing the necessary tax forms and reports.

Some of the top NY-specific payroll software solutions include Gusto, ADP, and Paychex. These platforms offer features tailored to the state’s unique requirements, such as automated tax filings, worker’s compensation management, and compliance with New York’s wage payment laws.

3. Stay Updated with Frequent Regulatory Changes

New York is known for its frequent updates and amendments to payroll regulations. Staying abreast of these changes is essential to avoid costly mistakes and penalties. This includes keeping track of shifts in minimum wage rates, changes in overtime rules, and updates to tax laws and reporting requirements.

One effective strategy is to subscribe to newsletters and alerts from reputable sources like the New York State Department of Labor and the Internal Revenue Service. These organizations often provide timely updates on regulatory changes, ensuring you’re informed of any modifications that could impact your payroll processes.

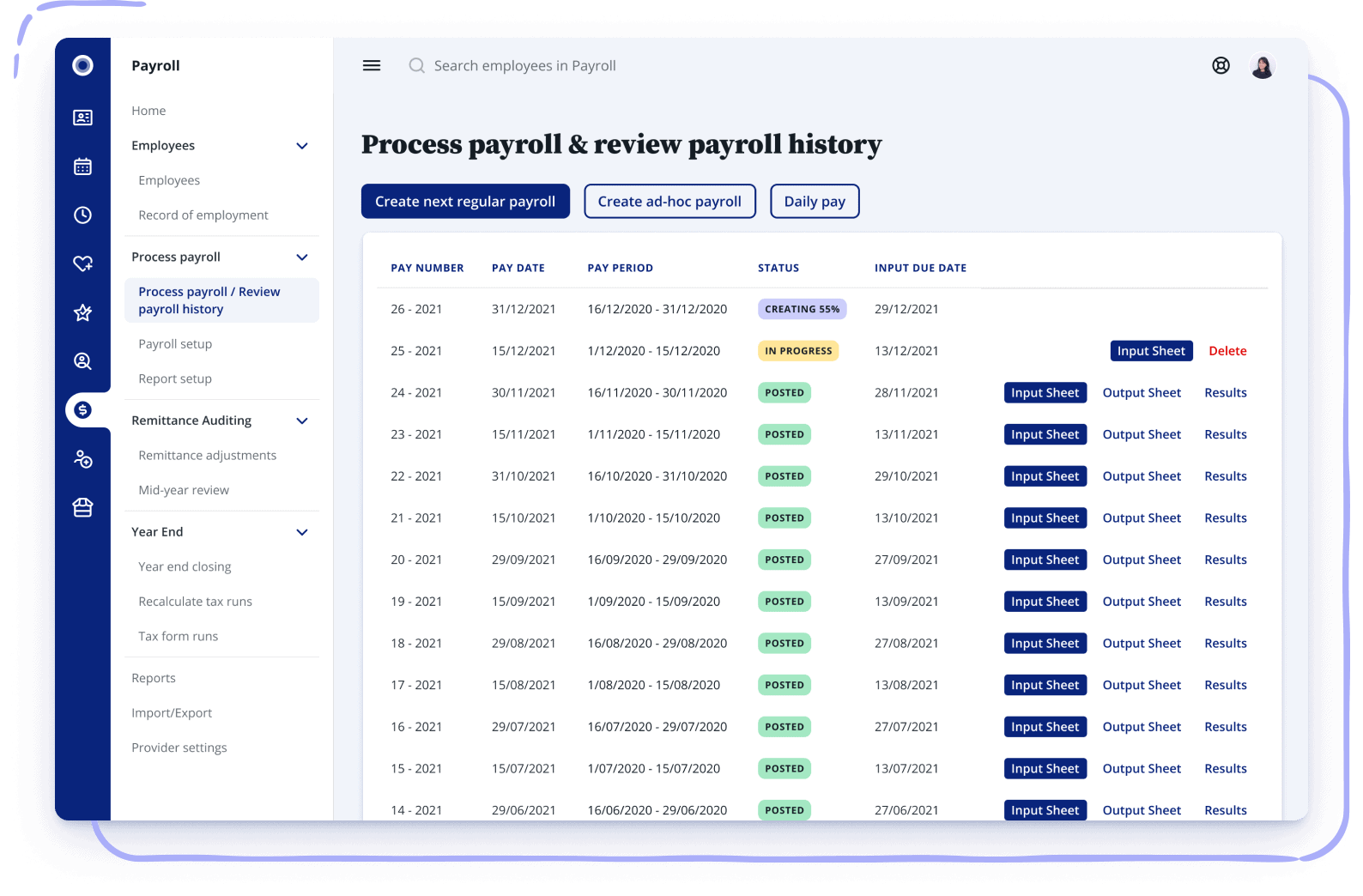

4. Ensure Accurate Time Tracking and Attendance Management

Accurate time tracking and attendance management are critical components of effective payroll management. In New York, where overtime rules are stringent, precise record-keeping is essential to ensure compliance and avoid potential lawsuits.

Implementing a robust time tracking system can help automate this process, ensuring that overtime is accurately recorded and compensated. This not only streamlines payroll processing but also fosters a culture of transparency and trust with your employees.

5. Regularly Review and Audit Your Payroll Processes

Conducting regular reviews and audits of your payroll processes is a best practice to identify and rectify any errors or inefficiencies. This proactive approach can help you stay on top of changing regulations, catch potential compliance issues early on, and optimize your payroll management systems.

During these reviews, pay close attention to areas like wage calculations, tax withholdings, and benefit deductions. Ensure that your payroll records are accurate, complete, and easily accessible for audits and inspections. This will not only help you maintain compliance but also enhance the overall efficiency and effectiveness of your payroll management.

Pros and Cons of Online Payroll Management in NY

-

Pros:

- Automated compliance with NY's intricate regulations.

- Streamlined payroll processes, reducing administrative burden.

- Enhanced accuracy and efficiency in wage calculations.

-

Cons:

- Cost of specialized software and ongoing maintenance.

- Learning curve associated with new software implementation.

- Potential for errors if not properly configured or monitored.

How often should I update my payroll software to stay compliant with NY regulations?

+It's recommended to update your payroll software at least quarterly to ensure compliance with the latest regulatory changes. However, some providers offer automatic updates, ensuring you're always working with the most current version.

<div class="faq-item">

<div class="faq-question">

<h3>Can I use a general payroll software for NY payroll management, or do I need a specialized solution?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>While general payroll software can be used, specialized NY-specific solutions offer distinct advantages. They're designed to handle the state's unique regulations, automating compliance and reducing the risk of errors.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What are some common mistakes to avoid when managing NY payroll online?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Common pitfalls include failing to stay updated with regulatory changes, not having a robust time tracking system, and neglecting to conduct regular payroll audits. By being proactive and diligent, you can avoid these pitfalls and maintain compliance.</p>

</div>

</div>

</div>