A Beginner's Guide to NMLS Consumer Access

Diving into the world of mortgage loans and financial services, one encounters a myriad of regulations and systems designed to ensure transparency and consumer protection. Among these, the NMLS Consumer Access portal stands as a crucial tool, offering a wealth of information and resources for those seeking to navigate the complex landscape of lending. Let’s embark on a journey to demystify this platform and uncover its potential for beginners.

Understanding the NMLS Consumer Access Portal

The Nationwide Multistate Licensing System and Registry, often abbreviated as NMLS, is an expansive system that manages the licensing, registration, and monitoring of non-depository mortgage lenders, brokers, and loan originators across the United States. It is a collaborative effort between state mortgage regulators and the Conference of State Bank Supervisors (CSBS), designed to streamline the licensing process and enhance consumer protection.

The NMLS Consumer Access portal is the public-facing component of this system, providing individuals with access to a vast database of information related to the mortgage industry. It serves as a one-stop shop for consumers to research and verify the legitimacy and licensing status of mortgage professionals and companies, empowering them to make informed decisions about their financial future.

Key Features and Benefits for Beginners

1. Company and Individual Search

One of the most fundamental features of the NMLS Consumer Access portal is its comprehensive search functionality. Beginners can easily look up mortgage companies, branches, and individual loan originators to verify their licensing status and other relevant details. This search tool is especially valuable for those who want to ensure they are dealing with legitimate and licensed professionals, thereby mitigating potential risks associated with unlicensed or fraudulent lenders.

2. Detailed Licensing Information

When conducting a search, users are provided with a wealth of information about the entity or individual in question. This includes details such as the type of license, the date it was issued, any disciplinary actions taken against the licensee, and even the physical address of the business. This level of transparency is crucial for consumers to assess the credibility and reliability of the mortgage professionals they are considering engaging with.

3. Consumer Alerts and Educational Resources

The NMLS Consumer Access portal also serves as a platform for disseminating important consumer alerts and educational resources. These resources are designed to help individuals better understand the mortgage process, their rights as consumers, and potential pitfalls to avoid. By providing accessible information, the portal empowers beginners to make more informed decisions and navigate the mortgage landscape with greater confidence.

4. Disciplinary Action Records

A unique and powerful feature of the NMLS Consumer Access portal is its ability to provide access to disciplinary action records. This transparency allows consumers to research the history of a mortgage company or individual loan originator and make decisions based on their past conduct. By revealing any prior violations or complaints, the portal ensures that consumers can assess the integrity and reliability of the professionals they are considering.

Navigating the Portal: A Step-by-Step Guide

For beginners, navigating the NMLS Consumer Access portal may seem daunting at first. However, with a few simple steps, it becomes a straightforward process:

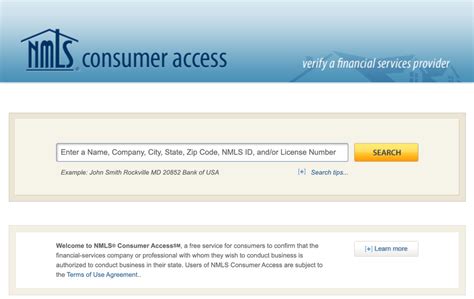

Step 1: Access the Portal

Start by visiting the NMLS Consumer Access website (https://www.nmlsconsumeraccess.org/). The homepage provides an intuitive interface with clear navigation options, making it easy to begin your search.

Step 2: Conduct a Search

In the search bar, enter the name of the mortgage company, branch, or loan originator you wish to research. You can also search by license number or physical address if you have that information. The portal will then provide a list of results, allowing you to select the entity you are interested in.

Step 3: Review the Results

Once you have selected the entity, the portal will display a wealth of information, including licensing details, contact information, and any relevant disciplinary actions. Take the time to review this information carefully, paying close attention to any red flags or concerns that may arise.

Step 4: Utilize Additional Resources

Beyond the basic search function, the NMLS Consumer Access portal offers a range of additional resources. These include educational materials, consumer alerts, and detailed explanations of mortgage-related terms and processes. Take advantage of these resources to enhance your understanding of the mortgage landscape and make more informed choices.

The Importance of Consumer Empowerment

The NMLS Consumer Access portal is more than just a regulatory tool; it is a powerful instrument for consumer empowerment. By providing accessible and transparent information, it enables individuals to take control of their financial decisions and protect themselves from potential harm. In an industry as complex and nuanced as mortgage lending, this level of transparency is invaluable, ensuring that consumers can make choices with confidence and peace of mind.

Conclusion: Unlocking the Potential of NMLS Consumer Access

For beginners navigating the world of mortgage loans, the NMLS Consumer Access portal is an essential resource. It offers a wealth of information, from basic licensing verification to detailed disciplinary records, all presented in a user-friendly format. By utilizing this portal, individuals can empower themselves to make informed decisions, protect their financial interests, and navigate the mortgage landscape with greater ease and confidence.

As you embark on your mortgage journey, remember that knowledge is power. The NMLS Consumer Access portal is your gateway to that knowledge, unlocking a world of transparency and consumer protection. So, dive in, explore its features, and unlock the potential of this invaluable resource.

How often is the information on the NMLS Consumer Access portal updated?

+The NMLS Consumer Access portal is updated on a regular basis, with information being refreshed every week. However, it’s important to note that the frequency of updates may vary depending on the state’s reporting requirements and the activity of the mortgage industry. To ensure you have the most up-to-date information, it’s recommended to conduct searches periodically, especially when making important financial decisions.

Can I use the NMLS Consumer Access portal to find mortgage rates and loan offers?

+While the NMLS Consumer Access portal provides a wealth of information about mortgage companies and loan originators, it does not directly offer mortgage rates or loan offers. However, by using the portal to research and verify the legitimacy of mortgage professionals, you can make more informed choices when comparing loan options from different lenders. Remember to always compare multiple offers and consider factors beyond just the interest rate.

What should I do if I find a disciplinary action against a mortgage company or loan originator on the NMLS Consumer Access portal?

+Disciplinary actions on the NMLS Consumer Access portal indicate that a mortgage company or loan originator has violated certain regulations or faced complaints from consumers. If you discover such actions, it’s crucial to carefully evaluate the nature and severity of the violation. While a single disciplinary action may not necessarily disqualify a professional, it’s essential to thoroughly research their track record and consider alternative options. Always prioritize your financial well-being and trust your instincts when making decisions.

Is the NMLS Consumer Access portal available in multiple languages?

+At present, the NMLS Consumer Access portal is primarily available in English. However, the NMLS system, which includes the Consumer Access portal, is designed to be accessible and user-friendly for all individuals, regardless of their primary language. If you require assistance in navigating the portal or understanding the information provided, it’s recommended to seek help from a trusted source, such as a mortgage professional or financial advisor who can provide guidance in your preferred language.