The Ultimate Moving Company Invoice Guide

Moving can be a complex and stressful process, and one of the crucial aspects that often requires attention to detail is the creation of a comprehensive and accurate invoice. Whether you are a seasoned moving company or just starting out, having a well-structured invoice is essential for smooth operations and maintaining positive relationships with your clients. This guide aims to provide an in-depth understanding of the key components, best practices, and industry standards for creating an ultimate moving company invoice.

Understanding the Moving Company Invoice

A moving company invoice is a legal document that outlines the services provided, costs incurred, and any additional charges or discounts applicable to a specific move. It serves as a formal record of the transaction between the moving company and the client, ensuring transparency and clarity in the billing process. A well-crafted invoice not only protects the interests of both parties but also enhances the overall customer experience.

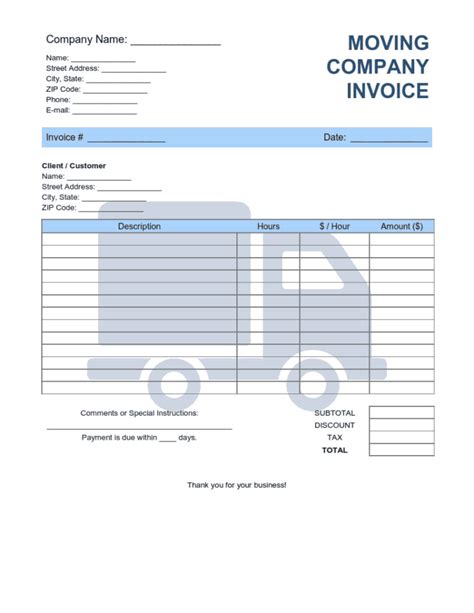

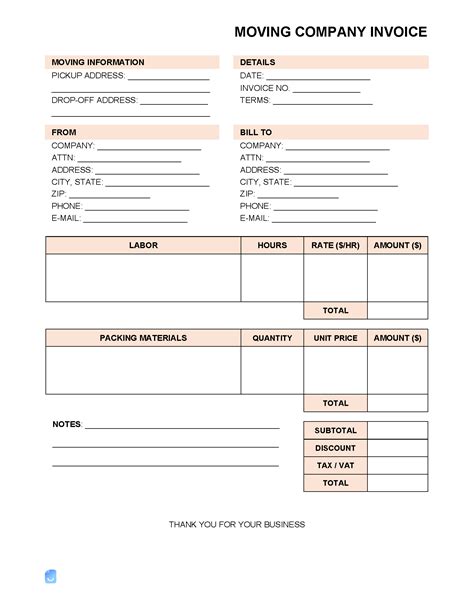

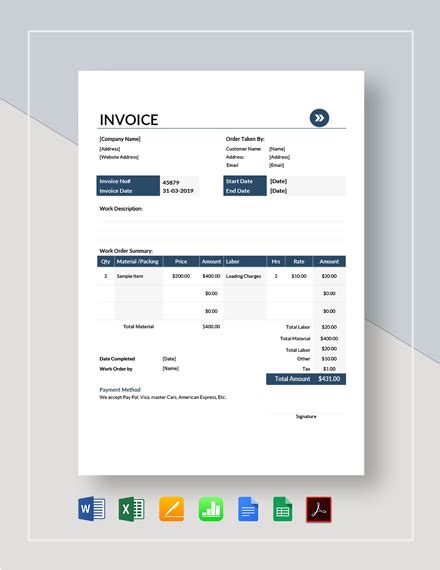

Key Components of a Moving Company Invoice

Let’s delve into the essential elements that should be included in every moving company invoice:

- Company Information: Begin by clearly displaying your company’s name, logo, contact details (phone number, email, and physical address), and any relevant licensing or registration information.

- Client Details: Include the client’s full name, contact information, and billing address. If the move involves multiple locations, ensure you specify the pickup and delivery addresses.

- Invoice Number and Date: Assign a unique invoice number to each invoice, and display the date of issuance. This helps in organizing and tracking invoices for both the company and the client.

- Move Details: Provide a detailed description of the move, including the date, type of move (local or long-distance), and any special services requested (such as packing, storage, or disassembly/assembly of furniture).

- Itemized Services and Costs: Break down the services provided into distinct categories. For example, list the cost of labor, packing materials, fuel, tolls, and any other expenses incurred during the move. Provide a clear and transparent breakdown of these charges.

- Additional Charges and Discounts: Clearly specify any additional fees, such as charges for heavy or bulky items, stairs or elevator usage, or late payment penalties. Also, highlight any discounts applied, such as early payment incentives or volume-based discounts.

- Payment Terms and Methods: Outline the accepted payment methods (cash, check, credit card, or online transfers) and the due date for payment. Include any late payment policies or interest charges that may apply.

- Terms and Conditions: Attach or include a link to your company’s terms and conditions, which should cover aspects like liability, cancellation policies, and dispute resolution procedures.

- Signature and Authorization: Provide a space for the client’s signature, indicating their acceptance of the services and charges. Include a signature line for your company’s representative as well.

Best Practices for Creating Moving Company Invoices

To ensure your invoices are professional, accurate, and efficient, consider the following best practices:

Use Invoice Software

Utilize specialized invoice software or accounting platforms that are tailored for the moving industry. These tools can automate invoice creation, tracking, and payment processing, saving you time and reducing the risk of errors.

Personalize Invoices

While maintaining a standardized format, personalize each invoice to reflect the specific details of the move. This shows attention to detail and enhances the client’s experience.

Include Visuals

Consider adding visual elements such as photos or diagrams to illustrate the move. This can help clients better understand the services provided and reduce the likelihood of disputes.

Offer Multiple Payment Options

Provide a range of payment options to accommodate different client preferences. Online payment gateways and mobile payment apps can streamline the process and improve customer satisfaction.

Implement Payment Reminders

Set up automated payment reminders to prompt clients about upcoming due dates. This not only reduces the chances of late payments but also demonstrates your commitment to clear communication.

Stay Updated with Industry Standards

Keep abreast of industry trends and best practices related to invoicing. Attend industry conferences, join relevant associations, and regularly review industry publications to stay informed about evolving standards and regulations.

Performance Analysis and Insights

Analyzing your moving company’s invoicing performance is crucial for identifying areas of improvement and optimizing your processes. Consider the following key metrics and insights:

Average Invoice Amount

Track the average invoice amount over a specified period. This metric can help you identify trends in the types of moves your company handles and the associated costs.

| Month | Average Invoice Amount |

|---|---|

| January | $2,500 |

| February | $2,800 |

| March | $3,000 |

Payment Timeliness

Monitor the percentage of invoices paid on time versus those that are overdue. This metric provides insights into your clients’ payment habits and can help you adjust your payment terms or collection strategies accordingly.

| Payment Status | Percentage |

|---|---|

| Paid on Time | 85% |

| Overdue | 15% |

Disputed Invoices

Keep track of the number and reasons for disputed invoices. This information can help you identify areas where your invoicing practices may need improvement or where additional communication with clients is required.

Client Satisfaction

Survey your clients to gauge their satisfaction with your invoicing process. Feedback can highlight areas where your invoices excel and areas that may require refinement to enhance the overall customer experience.

Future Implications and Industry Trends

As the moving industry continues to evolve, staying ahead of emerging trends and technologies is essential for maintaining a competitive edge. Consider the following implications and potential future developments:

Digital Transformation

The shift towards digital invoicing and payment processing is likely to accelerate. Embracing digital solutions can streamline your invoicing processes, reduce paperwork, and enhance efficiency.

Blockchain and Smart Contracts

Blockchain technology and smart contracts have the potential to revolutionize the way invoices are created, tracked, and executed. These technologies can enhance security, reduce disputes, and provide a more transparent billing process.

Artificial Intelligence and Automation

AI-powered invoice generation and analysis tools can further optimize your invoicing processes. These technologies can automate data entry, identify potential errors, and provide valuable insights for better decision-making.

Sustainable Invoicing

As environmental concerns gain prominence, consider adopting sustainable invoicing practices. This may involve using eco-friendly materials, digitalizing invoices, and implementing energy-efficient payment processing solutions.

Customer-Centric Approach

In a competitive market, prioritizing the customer experience is crucial. Continue to refine your invoicing processes to ensure they are user-friendly, transparent, and tailored to meet the evolving needs and preferences of your clients.

Frequently Asked Questions

How can I ensure my invoices are legally compliant?

+To ensure legal compliance, familiarize yourself with local and regional regulations governing invoices. This may include requirements for specific information, such as tax identification numbers or sales tax calculations. Consult with legal professionals or industry associations to stay updated on any legal changes.

What is the best way to handle disputed invoices?

+When handling disputed invoices, maintain open communication with your clients. Listen to their concerns, review the details of the move and the invoice, and aim for a mutually agreeable resolution. Consider offering alternatives or adjustments to satisfy the client while protecting your business interests.

How often should I review and update my invoicing practices?

+Regularly reviewing your invoicing practices is essential for staying competitive and responsive to industry changes. Aim to conduct a comprehensive review at least annually, and make updates as necessary. Stay informed about new technologies, industry standards, and client preferences to ensure your invoicing processes remain efficient and effective.