Top 5 Spring Break Money Strategies

Spring break is an exciting time for students, a well-deserved break from academic routines to unwind and have some fun. However, it can also be a challenging period financially, as unexpected expenses often arise. Implementing effective money strategies is crucial to ensure a memorable spring break without breaking the bank. This comprehensive guide aims to provide expert advice on managing finances during spring break, offering practical tips and insights to help students make the most of their break while staying financially savvy.

Strategic Financial Planning for an Enjoyable Spring Break

Spring break, a much-anticipated respite for students, presents a unique opportunity to relax and recharge. However, it also poses a significant challenge: managing finances to ensure an enjoyable break without incurring excessive costs. To navigate this challenge effectively, students must adopt a strategic approach to financial planning. This involves not only budgeting but also creative strategies to maximize their spring break experience while minimizing unnecessary expenses.

Setting Realistic Budgets

Creating a realistic budget is the cornerstone of any successful financial strategy. Begin by estimating your expected expenses, including travel costs, accommodation, meals, entertainment, and any additional activities you plan to engage in. It’s crucial to be thorough and consider all potential expenses to ensure your budget is comprehensive.

One effective approach is to categorize your expenses. For instance, allocate a specific amount for transportation, another for accommodation, and set aside funds for daily living expenses like meals and snacks. By breaking down your budget into categories, you can better understand where your money is going and make informed decisions about your spending.

To help you visualize your budget, consider using a simple spreadsheet or a budgeting app. These tools can provide a clear overview of your finances, making it easier to track your spending and identify areas where you might be overspending.

Maximizing Savings with Smart Strategies

Saving money doesn’t have to mean sacrificing your spring break experience. By implementing smart strategies, you can make significant savings without compromising on fun.

- Early Bird Discounts: Booking your travel and accommodations early often comes with substantial discounts. Many airlines, hotels, and resorts offer early bird specials, so plan ahead to take advantage of these savings.

- Group Deals: Consider traveling with friends to split costs. Sharing accommodations and transportation can lead to significant savings, especially if you opt for group discounts or package deals.

- Student Discounts: As a student, you have access to a wealth of discounts. From travel agencies to restaurants, many businesses offer special rates for students. Always ask about student discounts and carry your student ID to take advantage of these savings.

Additionally, consider alternative accommodation options like Airbnb or home-sharing services, which often provide more affordable and unique living experiences. These platforms can offer substantial savings compared to traditional hotels, especially if you're willing to stay slightly further from the main attractions.

Managing Daily Expenses

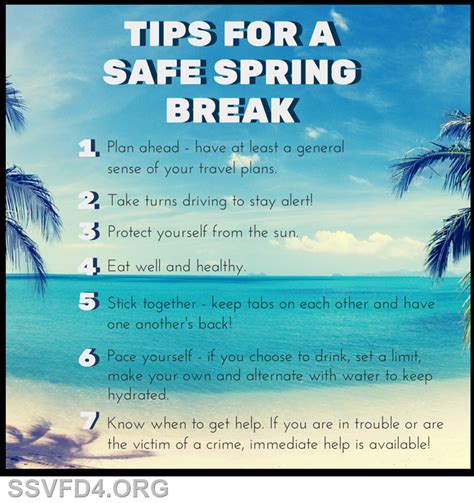

Daily expenses during spring break can quickly add up, so it’s important to be mindful of your spending. Here are some strategies to help you manage these costs effectively:

- Meal Planning: Instead of dining out for every meal, consider cooking some meals in your accommodation. This not only saves money but also provides a more authentic local experience. If cooking isn’t an option, look for affordable street food or local eateries, which often offer delicious meals at a fraction of the cost of tourist hotspots.

- Entertainment on a Budget: Spring break is about having fun, but it doesn’t have to be expensive. Look for free or low-cost activities like visiting local parks, attending cultural events, or exploring the city’s history. Many cities offer free walking tours, which can be a great way to explore while keeping costs down.

- Use Travel Rewards: If you’ve been using a rewards credit card or have accumulated travel miles, now is the time to cash in on those rewards. Redeem your points for flights, hotels, or activities to significantly reduce your out-of-pocket expenses.

Remember, the key to successful financial management during spring break is balance. While it's important to save where you can, don't forget to treat yourself occasionally. After all, spring break is a time to celebrate and make memories.

Building an Emergency Fund

Despite careful planning, unexpected expenses can arise during spring break. From medical emergencies to sudden changes in travel plans, these situations can be both stressful and costly. That’s why building an emergency fund is crucial.

Aim to set aside a small amount each week leading up to spring break. Even a modest sum can provide a safety net for unexpected costs. Consider putting this money into a separate savings account, so it’s readily accessible when needed.

It's also a good idea to familiarize yourself with travel insurance options. While insurance can be an additional expense, it can provide significant peace of mind and financial protection in case of emergencies.

Maximizing Post-Spring Break Savings

The benefits of financial planning during spring break don’t end when the break concludes. By adopting smart money strategies, you can continue saving long after your break is over.

Consider using any leftover funds from your spring break budget to start or contribute to a savings account. This can be a great way to build up your financial cushion for future expenses, such as textbooks or next semester’s tuition.

Additionally, think about ways to continue saving throughout the year. This might include finding a part-time job, freelancing, or participating in paid surveys or focus groups. These opportunities can not only provide additional income but also valuable work experience.

Conclusion

Spring break is a time for relaxation and fun, but it’s also an opportunity to develop essential financial management skills. By implementing the strategies outlined in this guide, you can ensure that your spring break is both enjoyable and financially responsible. Remember, with careful planning and a bit of creativity, you can make the most of your break without overspending.

FAQ

How can I estimate my spring break expenses accurately?

+

To estimate your spring break expenses accurately, start by breaking down your trip into categories: travel, accommodation, meals, entertainment, and any specific activities you plan to do. Research average costs for each category in your chosen destination. Use travel websites, local guides, and budget calculators to get an idea of the expenses. Don’t forget to factor in incidental costs like souvenirs, tips, and transportation within your destination.

What are some effective ways to save money on travel during spring break?

+

There are several strategies to save on travel during spring break. First, consider traveling off-peak to avoid the high costs associated with peak travel seasons. Look for last-minute deals or early bird discounts. Many airlines and travel agencies offer reduced rates for booking in advance. Additionally, consider budget-friendly travel options like buses or trains instead of more expensive flights. Finally, don’t forget to research and utilize student discounts for travel and accommodations.

How can I make sure I stick to my spring break budget?

+

Sticking to a budget can be challenging, but there are a few strategies that can help. First, ensure your budget is realistic and covers all your expected expenses. Track your spending throughout your trip, either manually or using budgeting apps. Set spending limits for different categories like meals, entertainment, and souvenirs. Finally, don’t be afraid to negotiate prices, especially for services like tours or activities. You might be surprised at the savings you can achieve.

What should I do if I encounter unexpected expenses during spring break?

+

Unexpected expenses can be a concern during spring break. The best approach is to have an emergency fund set aside specifically for such situations. If you don’t have an emergency fund, consider reaching out to your parents or guardians for assistance. Alternatively, you can use a credit card with a low interest rate to cover the expense and pay it off quickly once you’re back home. Always remember to stay calm and prioritize your safety and well-being in such situations.

Are there any additional ways to save money on spring break besides budgeting and discounts?

+

Absolutely! Besides budgeting and seeking discounts, there are other creative ways to save money on spring break. Consider traveling with a group, as you can split the costs of accommodations and transportation. Look for free or low-cost activities in your destination, such as visiting parks, museums with free entry days, or exploring local festivals. Additionally, consider cooking some meals in your accommodation instead of dining out for every meal.