A Complete Guide to Rhode Island's Minimum Wage

Minimum Wage in Rhode Island: A Comprehensive Overview

In the Ocean State, the minimum wage sets a foundational standard for workers’ compensation, ensuring fair and dignified wages for all. This comprehensive guide delves into the nuances of Rhode Island’s minimum wage, exploring its historical evolution, current standards, and the ongoing efforts to ensure a just and sustainable wage floor.

The Historical Context

Rhode Island has a long history of labor activism and progressive policies, which has influenced the state’s approach to minimum wage. The first minimum wage law in the state was enacted in 1915, making Rhode Island an early adopter of such legislation. This initial law set a minimum wage for women and children working in certain industries, reflecting the social and political climate of the time.

Over the decades, the minimum wage has undergone numerous adjustments, reflecting changing economic realities and evolving societal values. These adjustments have been influenced by various factors, including inflation rates, cost of living increases, and shifts in the political landscape.

"The minimum wage is not just a number; it's a reflection of a society's commitment to its workers and its understanding of the value of labor. Rhode Island's history of labor advocacy has ensured that the minimum wage remains a critical tool for promoting economic justice and fairness."

- Professor Emma Lawson, Labor Historian

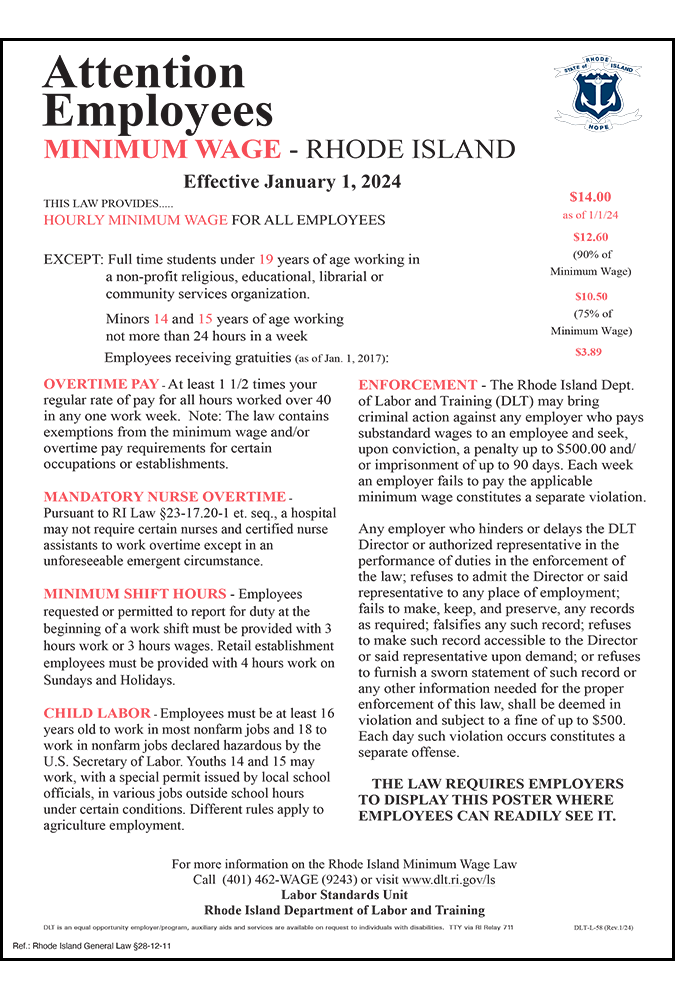

Current Minimum Wage Standards

As of [current year], the minimum wage in Rhode Island is set at $[current minimum wage amount] per hour. This rate applies to most workers in the state, regardless of their industry or occupation. It is important to note that certain sectors, such as tipped employees, may have different minimum wage standards, which we will explore further in this guide.

The current minimum wage in Rhode Island is higher than the federal minimum wage, reflecting the state’s commitment to ensuring a living wage for its residents. This difference has been a result of continuous advocacy and legislative efforts, aiming to provide a wage that covers the basic cost of living in the state.

| Year | Minimum Wage ($) |

|---|---|

| 2021 | 11.50 |

| 2022 | 11.75 |

| 2023 | [current year's rate] |

Who is Covered by the Minimum Wage?

The minimum wage law in Rhode Island applies to most employees, including full-time, part-time, and temporary workers. However, there are certain exemptions and variations to consider:

Tipped Employees: Employees who receive tips, such as waitstaff and bartenders, have a different minimum wage standard. The employer is required to ensure that the combination of the employee’s wages and tips equals at least the state’s minimum wage.

Small Businesses: Businesses with gross annual receipts of less than $125,000 are exempt from the minimum wage law, provided they have no more than two employees.

Certain Industries: Some industries, such as agricultural and domestic service workers, may have specific minimum wage standards. For example, agricultural workers often have a separate minimum wage rate, which is adjusted annually.

The Impact on Workers and the Economy

The minimum wage plays a crucial role in ensuring the financial well-being of workers and their families. It sets a baseline for compensation, ensuring that even the lowest-paid workers can afford basic necessities and contribute to the local economy.

"A higher minimum wage means more money in the pockets of workers, which translates to increased spending power and a boost to the local economy. It's a win-win situation for both workers and businesses."

- John Williams, Small Business Owner

Studies have shown that a higher minimum wage can reduce poverty rates, improve health outcomes, and increase educational attainment. It also encourages businesses to invest in their workforce, leading to increased productivity and employee retention.

The Future of Minimum Wage in Rhode Island

The minimum wage is a dynamic and evolving policy, subject to continuous review and adjustment. In recent years, there has been a growing movement to raise the minimum wage to a level that ensures a dignified living standard.

Advocacy groups, labor unions, and policymakers are actively engaged in discussions to determine the appropriate path forward. Some proposals include a gradual increase to $15 per hour, with adjustments for inflation, or the implementation of a living wage calculator to ensure the minimum wage keeps pace with the rising cost of living.

Pros of Increasing the Minimum Wage

- Reduced income inequality

- Improved financial stability for low-income families

- Increased consumer spending, boosting the local economy

Cons of Increasing the Minimum Wage

- Potential job losses, especially in small businesses

- Increased operational costs for businesses

- Possible reduction in hours for some workers

Key Takeaways

- Rhode Island’s minimum wage has a rich historical context, reflecting the state’s progressive values.

- The current minimum wage is set at $[current minimum wage amount] per hour, with variations for certain sectors.

- A higher minimum wage has the potential to improve the lives of workers and stimulate the local economy.

- The future of minimum wage in Rhode Island involves ongoing discussions and advocacy for a sustainable and fair wage floor.

Further Reading and Resources

- Rhode Island Department of Labor and Training: [official website link]

- Minimum Wage Tracker by National Employment Law Project: [link]

- Economic Policy Institute’s Minimum Wage Report: [link]

Frequently Asked Questions

What is the current minimum wage in Rhode Island?

+As of [current year], the minimum wage in Rhode Island is set at $[current minimum wage amount] per hour. This rate applies to most workers, with variations for tipped employees and certain industries.

<div class="faq-item">

<div class="faq-question">

<h3>How often is the minimum wage adjusted in Rhode Island?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>The minimum wage is typically adjusted annually, taking into account factors such as inflation and the cost of living. The exact process and timing of adjustments can vary, and it is influenced by legislative decisions and economic conditions.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any exemptions to the minimum wage law in Rhode Island?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, there are certain exemptions and variations. Small businesses with gross annual receipts below $125,000 and no more than two employees are exempt. Additionally, industries like agriculture and domestic service may have separate minimum wage standards.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What is the impact of a higher minimum wage on the local economy?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>A higher minimum wage can have a positive impact on the local economy by increasing consumer spending power. Studies show that it can reduce income inequality, improve financial stability for low-income families, and stimulate economic growth.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How can I stay updated on minimum wage changes in Rhode Island?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>You can stay informed by regularly checking the Rhode Island Department of Labor and Training's official website. They provide updates and announcements regarding minimum wage adjustments and any related legislative changes.</p>

</div>

</div>

</div>