Understanding Miami-Dade County Sales Tax

Miami-Dade County, nestled in the vibrant state of Florida, boasts a unique sales tax system that influences the way residents and businesses operate within its borders. The sales tax, a critical revenue stream for the county, impacts a wide range of transactions and plays a pivotal role in funding essential services and infrastructure. This article aims to demystify the Miami-Dade County sales tax, offering a comprehensive guide to its structure, rates, exemptions, and implications for consumers and businesses alike.

Historical Context: The Evolution of Sales Tax in Miami-Dade County

The story of sales tax in Miami-Dade County is a fascinating one, reflecting the county’s growth and changing needs over time. In the early days of its establishment, sales tax was a relatively straightforward concept, serving as a simple tool for generating revenue to support basic county functions. However, as the county’s population expanded and its economic activities diversified, the sales tax system evolved to become a more sophisticated mechanism.

Over the years, the county government introduced various amendments and adjustments to the sales tax structure. These changes were often driven by the need to address emerging challenges, such as funding new infrastructure projects, supporting public transportation initiatives, or investing in education and healthcare facilities. The historical evolution of sales tax in Miami-Dade County is a testament to the county’s ability to adapt its fiscal policies to meet the changing demands of its residents and businesses.

Current Sales Tax Rates: A Complex Web of Percentages

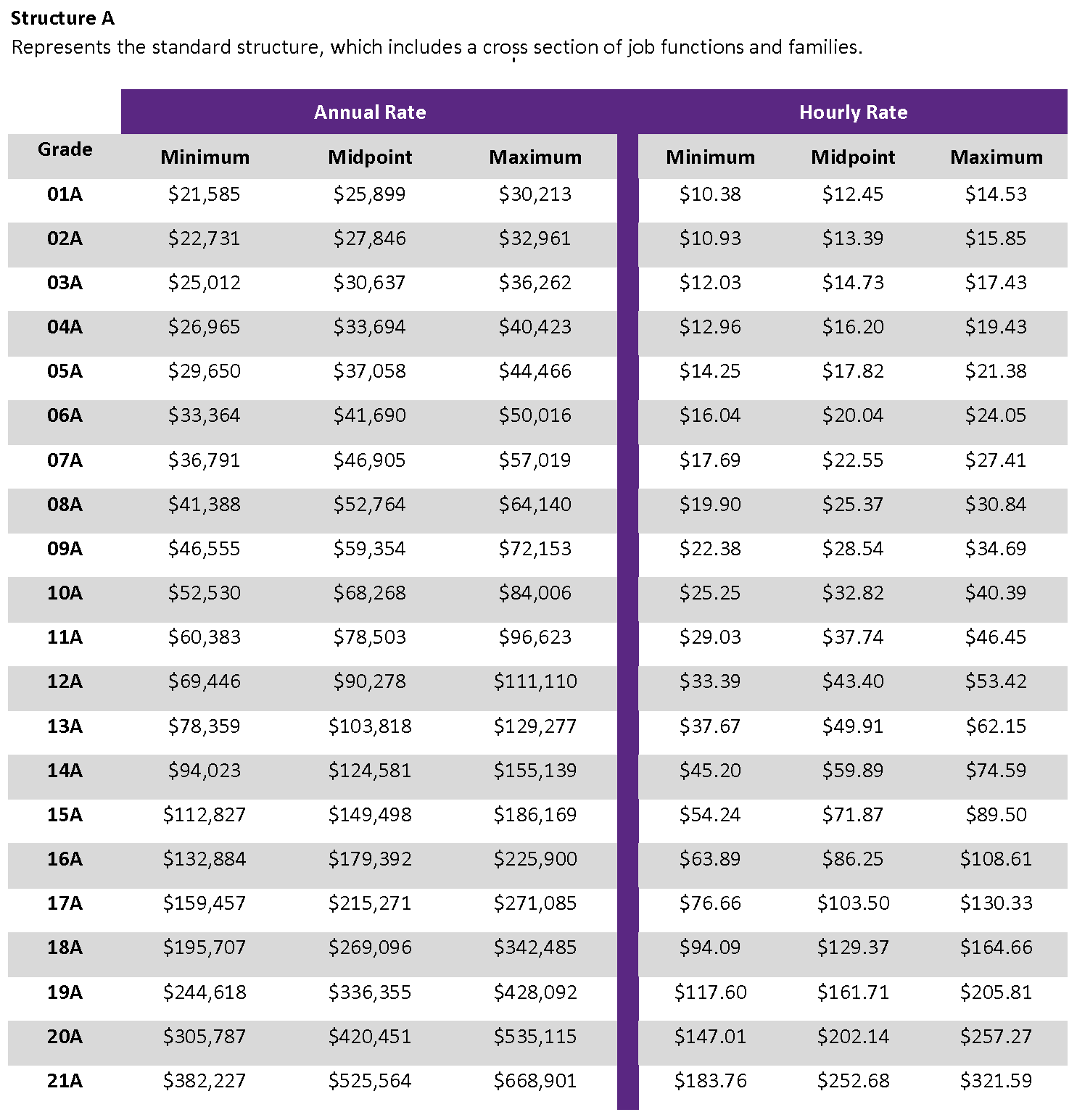

Today, the sales tax landscape in Miami-Dade County is a intricate web of varying rates, each applicable to different types of transactions and goods. At the core of this system is the county’s general sales tax rate, which currently stands at 7%. This rate applies to most retail sales and rentals of tangible personal property within the county’s borders.

However, the story doesn’t end there. Miami-Dade County, like many other jurisdictions, also levies additional taxes on specific categories of goods and services. These specialized sales taxes, often referred to as “surcharges,” are designed to fund dedicated programs or address specific community needs. For instance, the county imposes a 1% surtax on sales of certain categories of goods to support tourism marketing efforts.

Moreover, certain jurisdictions within Miami-Dade County may have their own unique sales tax rates. This localized approach allows individual municipalities to address their specific budgetary requirements, further complicating the sales tax landscape. As a result, the effective sales tax rate for a particular transaction can vary significantly depending on the location of the seller and the nature of the goods or services being purchased.

Exemptions and Special Considerations: Navigating the Exceptions

While the sales tax system in Miami-Dade County is comprehensive, it’s not without its exemptions and special considerations. These exceptions play a crucial role in shaping the economic landscape and can significantly impact the financial obligations of businesses and consumers.

One notable exemption is the sales tax holiday, a designated period when certain categories of goods are exempt from sales tax. These holidays, often timed to coincide with major shopping seasons, provide a significant incentive for consumers to make large purchases, benefiting both retailers and the local economy. For instance, Miami-Dade County typically observes a back-to-school sales tax holiday, allowing families to stock up on school supplies and clothing without the added burden of sales tax.

Additionally, certain types of transactions and goods are permanently exempt from sales tax. These exemptions, outlined in the county’s tax code, are designed to support specific public policy goals. For example, sales tax is generally not levied on prescription medications, providing a critical financial relief to individuals in need of medical treatment. Similarly, sales of certain agricultural products and machinery are often exempt, supporting the county’s agricultural sector and its economic viability.

Impact on Businesses: Compliance, Planning, and Competitive Strategies

For businesses operating in Miami-Dade County, understanding the sales tax system is not just a matter of compliance; it’s a strategic imperative. The county’s complex sales tax structure can significantly influence a business’s financial health, competitive positioning, and growth prospects.

Businesses must carefully navigate the web of sales tax rates, surcharges, and exemptions to ensure they are collecting and remitting the correct amounts. This requires a robust understanding of the tax code and the ability to apply it accurately to a wide range of transactions. Moreover, businesses must stay abreast of any changes to the sales tax landscape, as even minor adjustments can have significant financial implications.

Beyond compliance, businesses must also leverage the sales tax system to gain a competitive edge. For instance, businesses can use their understanding of sales tax rates to structure their pricing strategies, offering competitive advantages in certain markets or during specific promotional periods. Additionally, a thorough grasp of sales tax exemptions can enable businesses to develop innovative products or services that capitalize on tax-free opportunities, enhancing their profitability and market appeal.

Consumer Perspective: Making Informed Choices

For consumers, understanding the sales tax system in Miami-Dade County is essential for making informed purchasing decisions. The county’s varied sales tax rates and exemptions can significantly influence the overall cost of goods and services, impacting everything from routine household purchases to major investments.

Consumers can use their knowledge of sales tax rates to comparison shop, seeking out retailers who offer the most competitive pricing after tax. Additionally, staying informed about sales tax holidays and other promotional periods can enable consumers to make larger purchases with significant savings. For example, planning major home improvement projects during a sales tax holiday on building materials can result in substantial cost savings.

Furthermore, consumers can leverage their understanding of sales tax exemptions to make more strategic purchasing decisions. For instance, being aware of the exemption for prescription medications can encourage consumers to shop around for the best prices, ensuring they receive the most value for their healthcare expenditures.

Conclusion: A Complex, Yet Essential, Component of Miami-Dade County’s Economy

The sales tax system in Miami-Dade County is a multifaceted and dynamic entity, shaping the economic landscape of the region in profound ways. From its historical evolution to its current complex structure, the sales tax plays a pivotal role in funding essential services, supporting community initiatives, and influencing the competitive dynamics of the local business environment.

For residents and businesses alike, understanding the sales tax system is not just a matter of compliance; it’s a strategic necessity. By navigating the intricacies of the sales tax landscape, individuals and organizations can make informed decisions, optimize their financial obligations, and contribute to the vibrant economic ecosystem of Miami-Dade County.

As the county continues to evolve and adapt to meet the changing needs of its residents and businesses, the sales tax system will undoubtedly remain a critical component of its economic foundation, reflecting the dynamic and innovative spirit of the Sunshine State.