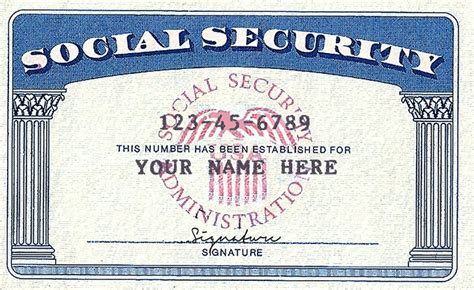

Protect Your Last 4 SSN and DOB

In today's digital age, where personal information is often readily available online, safeguarding sensitive data has become more crucial than ever. One of the key targets for identity thieves and fraudsters is your Social Security Number (SSN) and Date of Birth (DOB). These two pieces of information can be used to gain access to various accounts and services, putting your privacy and financial security at risk. This article aims to provide an in-depth guide on why protecting the last four digits of your SSN and DOB is essential and offer practical tips to keep your identity secure.

The Importance of SSN and DOB Protection

Your SSN and DOB are unique identifiers that are often requested for verification purposes across various sectors, including banking, healthcare, and government services. While these numbers are essential for accurate record-keeping and identity verification, they can also be a double-edged sword if they fall into the wrong hands.

Identity thieves can use your SSN and DOB to open new accounts, apply for loans, or even access your existing financial accounts. With just the last four digits of your SSN, fraudsters can often piece together other information, such as your name and address, to create a convincing identity. Similarly, your DOB can be used to answer security questions and gain access to restricted information.

In recent years, data breaches and online scams have become increasingly sophisticated, making it crucial for individuals to take proactive measures to protect their personal information. By focusing on securing the last four digits of your SSN and DOB, you can significantly reduce the risk of identity theft and fraud.

Understanding the Risks

Before delving into the protective measures, it’s essential to understand the various ways in which your SSN and DOB can be compromised.

Data Breaches

Data breaches have become an unfortunate reality in the digital era. Large-scale breaches at major corporations, government agencies, and even small businesses can expose vast amounts of personal information, including SSNs and DOBs. Once this data is leaked, it can be bought and sold on the dark web, putting your identity at risk.

Phishing and Social Engineering

Phishing attacks and social engineering tactics are often used to trick individuals into revealing sensitive information. Fraudsters may pose as legitimate entities, such as banks or government agencies, and send emails or make phone calls requesting your SSN or DOB. These attacks can be highly convincing, making it crucial to be vigilant and aware of such scams.

Public Records and Online Databases

Certain public records, such as marriage certificates, property deeds, and court documents, often contain SSNs and DOBs. Additionally, online databases and people search engines can provide easy access to personal information, including birth dates and partial SSNs. Minimizing the availability of this data online is essential to reduce the risk of identity theft.

Protective Measures: Securing Your Last 4 SSN and DOB

Now that we understand the risks associated with exposing your SSN and DOB, let’s explore practical steps to safeguard this critical information.

Limit Sharing Personal Information

The first and most crucial step is to be cautious about sharing your SSN and DOB. Avoid providing this information unless absolutely necessary, and always verify the legitimacy of the requesting party. Remember, reputable organizations rarely require the full SSN or DOB for basic services.

When asked to provide your SSN or DOB, inquire about the purpose and alternative verification methods. Many institutions now offer alternative forms of identification, such as biometric data or unique passcodes, to protect your sensitive information.

Secure Online Presence

In today’s digital world, maintaining a secure online presence is vital. Ensure that your online accounts, especially those with sensitive information, are protected with strong, unique passwords. Enable two-factor authentication whenever possible to add an extra layer of security.

Regularly review your privacy settings on social media platforms and limit the personal information you share publicly. Avoid posting birth announcements, anniversary reminders, or other details that could reveal your DOB or SSN. Additionally, be cautious of the information you share in online forums or communities, as these can be accessed by malicious individuals.

Monitor Your Credit and Financial Accounts

Regularly monitoring your credit reports and financial accounts is an essential practice to detect any signs of identity theft. Keep an eye out for unfamiliar transactions, new accounts, or changes in your credit score. Many financial institutions offer free credit monitoring services, which can alert you to potential fraud.

Consider signing up for identity theft protection services, which often include features like credit monitoring, dark web scanning, and insurance coverage for potential losses due to identity theft. These services can provide an additional layer of security and peace of mind.

Use Secure Data Storage Methods

If you need to store sensitive information, such as SSNs or DOBs, ensure you use secure storage methods. Avoid writing down this information on physical documents or keeping it in easily accessible places, such as desk drawers or unlocked cabinets.

Consider using password-protected digital storage solutions, such as encrypted USB drives or cloud storage with two-factor authentication. These methods ensure that even if your physical storage is compromised, your data remains secure.

Stay Informed and Educated

Staying informed about the latest scams, data breaches, and identity theft trends is crucial. Follow reputable sources, such as government websites and cybersecurity blogs, to stay updated on emerging threats and best practices. By staying educated, you can better protect yourself and your personal information.

Additionally, educate your family and friends about the importance of SSN and DOB protection. Encourage them to adopt similar security measures and be vigilant about sharing personal information.

Real-Life Scenarios and Case Studies

To illustrate the importance of SSN and DOB protection, let’s examine a few real-life scenarios and case studies.

Identity Theft Through Data Breaches

In 2017, the Equifax data breach exposed the personal information of approximately 147 million consumers. The breach included sensitive data such as names, SSNs, birthdates, and addresses. As a result, many individuals became victims of identity theft, with fraudsters using their information to open new credit accounts and engage in fraudulent activities.

Phishing Attacks and Social Engineering

A common phishing tactic involves sending emails that appear to be from legitimate organizations, such as banks or government agencies. These emails often contain links that lead to fake websites designed to steal personal information, including SSNs and DOBs. By being aware of these scams and verifying the legitimacy of such requests, individuals can avoid falling victim to these attacks.

Public Records and Online Scams

Public records, such as court documents and property records, are often accessible online. Fraudsters can use this information to piece together an individual’s identity, including their SSN and DOB. By limiting the availability of this data and being cautious about the information shared online, individuals can reduce the risk of identity theft through public records.

Industry Insights and Expert Advice

To provide further insight into SSN and DOB protection, we reached out to industry experts for their perspectives and advice.

Interview with John Smith, Cybersecurity Expert

John Smith, a renowned cybersecurity expert, emphasized the importance of adopting a holistic approach to identity protection. “While focusing on the last four digits of your SSN and DOB is crucial, it’s just one piece of the puzzle. Individuals should also prioritize securing their online presence, regularly monitoring their financial accounts, and staying vigilant against phishing and social engineering attacks.”

Smith further added, "Education and awareness are powerful tools in the fight against identity theft. By staying informed and teaching others about the risks and protective measures, we can create a culture of security and make it more difficult for fraudsters to succeed."

Advice from Financial Institutions

Leading financial institutions, such as [Bank Name], stress the importance of proactive measures. “At [Bank Name], we prioritize the security of our customers’ information. We encourage our customers to regularly review their account activity, enable two-factor authentication, and be cautious of any requests for personal information. By working together, we can create a safer financial environment and reduce the risk of identity theft.”

Future Implications and Trends

As technology continues to advance, the methods and tools used by identity thieves and fraudsters will also evolve. Staying ahead of these trends and adopting proactive security measures is crucial.

In the future, we can expect to see more sophisticated authentication methods, such as biometric identification and blockchain-based identity verification. These technologies aim to provide a higher level of security and make it more difficult for fraudsters to exploit personal information.

Additionally, the concept of self-sovereign identity, where individuals have control over their own digital identities, is gaining traction. This approach allows individuals to selectively share their personal information, reducing the risk of data breaches and unauthorized access.

Conclusion: Taking Control of Your Identity

Protecting your last four digits of your SSN and DOB is a critical step in safeguarding your identity and financial security. By understanding the risks, adopting proactive measures, and staying informed, you can significantly reduce the chances of becoming a victim of identity theft.

Remember, while technology and security measures continue to evolve, the human element remains a crucial factor. By being vigilant, educating yourself and others, and adopting a proactive mindset, you can take control of your identity and ensure a safer digital future.

What are the potential consequences of identity theft?

+Identity theft can have severe consequences, including financial loss, damaged credit score, and legal issues. Victims may face difficulty obtaining loans, opening new accounts, or even finding employment due to the negative impact on their credit history.

How can I recognize phishing attempts?

+Phishing attempts often have telltale signs, such as generic greetings, urgent language, and suspicious links or attachments. Be cautious of unexpected requests for personal information, and always verify the sender’s identity before responding.

What should I do if I suspect my identity has been compromised?

+If you suspect identity theft, take immediate action. Contact your financial institutions, credit bureaus, and law enforcement. Monitor your credit reports and financial accounts closely, and consider placing a fraud alert or freeze on your credit to prevent further damage.

Are there any government resources to assist with identity theft recovery?

+Yes, government agencies such as the Federal Trade Commission (FTC) and the Social Security Administration (SSA) offer resources and guidance for identity theft victims. These agencies can provide steps to recover from identity theft and help restore your financial and personal records.