Breaking Down Johns Hopkins University's Cost

Many aspiring students dream of attending Johns Hopkins University, renowned for its academic excellence and prestigious reputation. However, the financial aspect of pursuing an education at this institution can be a significant concern. In this comprehensive breakdown, we delve into the various costs associated with attending Johns Hopkins University, exploring the tuition, fees, living expenses, and financial aid options available to prospective students. By the end of this article, you’ll have a clear understanding of the financial landscape of this esteemed institution and the steps you can take to make your educational dreams a reality.

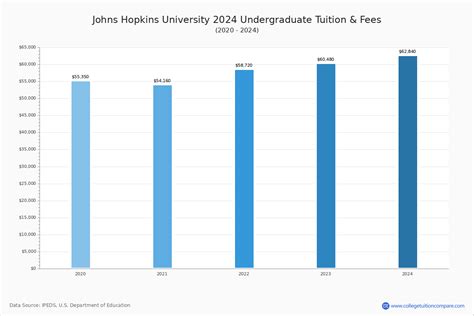

Tuition and Fees: Understanding the Basics

The cost of attending Johns Hopkins University begins with the tuition and fees, which can vary depending on your program of study and whether you are an undergraduate or graduate student. For the 2023-2024 academic year, the estimated tuition and fees for undergraduate students range from 55,000 to 60,000 per year. This figure includes the cost of instruction, academic support services, and other institutional fees.

Graduate programs at Johns Hopkins University offer a diverse range of options, and the tuition costs can vary significantly. For instance, the School of Medicine charges approximately 60,000 per year for medical students, while the Whiting School of Engineering charges around 55,000 per year for graduate students in its various engineering programs. It’s essential to research the specific program you’re interested in to get an accurate estimate of the tuition costs.

Living Expenses: Accommodating Your Lifestyle

In addition to tuition and fees, prospective students must consider the cost of living in and around Baltimore, where Johns Hopkins University is located. The university provides on-campus housing options, which can be a convenient and cost-effective choice for many students. The estimated cost of on-campus housing ranges from 12,000 to 15,000 per year, depending on the type of accommodation and the duration of your stay.

Off-campus housing is also an option, and the costs can vary based on your preferences and location. Renting an apartment or sharing a house with roommates can be more affordable, but it’s essential to factor in utility costs, transportation expenses, and other living expenses. The estimated monthly budget for off-campus living in Baltimore can range from 800 to 1,500, depending on the neighborhood and the amenities you choose.

Financial Aid: Easing the Financial Burden

Johns Hopkins University understands the financial challenges that students face and offers a comprehensive financial aid program to support its diverse student body. The university provides a range of scholarships, grants, work-study opportunities, and loans to assist students in funding their education.

The financial aid process begins with completing the Free Application for Federal Student Aid (FAFSA), which determines your eligibility for federal aid. Additionally, Johns Hopkins University requires prospective students to complete the College Scholarship Service (CSS) Profile to assess their financial need.

Once your financial aid application is processed, you may be offered a financial aid package that includes a combination of grants, scholarships, and loans. Grants and scholarships are forms of financial aid that do not need to be repaid, making them highly desirable. Work-study programs allow students to earn money while gaining valuable work experience on campus or in the community. Loans, while needing to be repaid, can provide a valuable financial resource for students who qualify.

Scholarships and Grants: Unlocking Opportunities

Johns Hopkins University is committed to providing scholarships and grants to deserving students, ensuring that financial constraints do not hinder their academic pursuits. The university offers a range of merit-based and need-based scholarships, as well as scholarships specific to certain programs or departments.

For instance, the Johns Hopkins University Excellence in Education Scholarship Program provides full-tuition scholarships to exceptional undergraduate students. Other scholarships, such as the President’s Scholarship and the Dean’s Scholarship, offer substantial financial support based on academic merit and financial need.

Additionally, external scholarships and grants are available to students who meet specific criteria. These opportunities can be found through various organizations, foundations, and community groups, providing additional financial assistance to ease the burden of education costs.

Work-Study Programs: Gaining Experience and Income

Work-study programs at Johns Hopkins University offer students the opportunity to gain valuable work experience while earning an income to support their education. These programs provide part-time employment opportunities on campus, allowing students to develop professional skills and network with faculty and staff.

Work-study positions are typically available in various departments, including the library, student services, research labs, and administrative offices. Students can expect to earn an hourly wage, and the number of hours worked per week depends on the specific position and the student’s academic schedule.

Loans: A Last Resort, but a Valuable Resource

While loans are a form of financial aid that needs to be repaid, they can be a valuable resource for students who require additional funding to cover their education costs. Johns Hopkins University offers various loan options, including federal student loans, private loans, and institutional loans.

Federal student loans, such as the Direct Subsidized Loan and the Direct Unsubsidized Loan, are available to eligible students and offer favorable interest rates and flexible repayment options. Private loans, offered by external lenders, can provide additional funding but may have higher interest rates and less favorable terms. Institutional loans, provided by Johns Hopkins University, offer competitive interest rates and are designed to support students who have exhausted other financial aid options.

Cost-Saving Strategies: Making the Most of Your Resources

Attending Johns Hopkins University can be a significant financial commitment, but there are strategies you can employ to make the most of your resources and reduce the overall cost of your education. Here are some cost-saving tips to consider:

- Explore financial aid options thoroughly and submit all required documentation promptly to maximize your chances of receiving aid.

- Consider living on campus during your first year to take advantage of the convenience and cost-effectiveness of on-campus housing.

- Research and apply for external scholarships and grants, as these opportunities can provide additional financial support without the need for repayment.

- Participate in work-study programs to gain valuable work experience and earn an income to offset some of your living expenses.

- Look into part-time employment opportunities off-campus, but ensure that your work schedule does not interfere with your academic commitments.

- Explore housing options with roommates to share the cost of rent and utilities, making off-campus living more affordable.

- Take advantage of student discounts and deals offered by local businesses and organizations to save on everyday expenses.

Conclusion: Making an Informed Decision

Attending Johns Hopkins University is an investment in your future, and understanding the financial landscape is crucial to making an informed decision. While the costs associated with attending this prestigious institution can be significant, the university offers a comprehensive financial aid program and various cost-saving strategies to support its students.

By exploring the tuition, fees, living expenses, and financial aid options available, you can gain a comprehensive understanding of the financial commitment required to pursue your educational goals at Johns Hopkins University. Remember, financial aid offices and student support services are available to guide you through the process and help you navigate the financial aspects of your academic journey.