Understanding Accounts Receivable: 5 Key Insights

In the intricate world of financial management, accounts receivable (AR) is a vital component that bridges the gap between sales and revenue realization. This area of accounting is pivotal for businesses, large and small, as it represents the lifeblood of cash flow and financial stability. Mismanagement of accounts receivable can lead to liquidity issues, while efficient handling can provide a significant competitive advantage. This article aims to delve into the intricacies of AR, offering a comprehensive understanding and highlighting five key insights that can empower businesses to optimize their financial operations.

1. The Fundamentals of Accounts Receivable

Accounts receivable represent the money owed to a business by its clients for goods or services delivered on credit. It is a critical aspect of business operations, especially in industries where extended payment terms are common, such as B2B (Business-to-Business) transactions. AR is a short-term debt obligation, typically due within a year, and forms part of a company’s current assets on the balance sheet. The efficient management of AR is crucial for maintaining positive cash flow and ensuring the business’s financial health.

Key AR Metrics

Several metrics are used to assess the health of a company’s accounts receivable:

- Days Sales Outstanding (DSO): This metric measures the average number of days it takes for a company to collect payment after a sale is made. A low DSO indicates efficient collection, while a high DSO may suggest potential collection issues or overly lenient credit terms.

- Accounts Receivable Turnover Ratio: This ratio measures how quickly a company collects its AR and is calculated by dividing net credit sales by average accounts receivable for a given period. A higher ratio indicates more efficient collection.

- Accounts Receivable Aging Schedule: This schedule categorizes AR into buckets based on the age of the debt, such as current (0-30 days), 31-60 days, 61-90 days, and so on. It helps businesses identify potentially bad debts and take proactive measures.

Best Practices for AR Management

Efficient AR management involves a combination of strategies, including:

- Establishing clear and concise credit policies and terms of sale.

- Conducting thorough credit checks on new customers to assess their creditworthiness.

- Implementing robust invoicing practices, ensuring accuracy and timeliness.

- Regularly following up on overdue payments to minimize the risk of bad debts.

- Utilizing AR automation tools to streamline processes and reduce human error.

2. Impact of Accounts Receivable on Cash Flow

Accounts receivable have a direct and significant impact on a company’s cash flow. When a business extends credit to its customers, it essentially provides an interest-free loan until the payment is received. This delay in payment can strain a company’s liquidity, especially if a large portion of its sales are on credit. Effective AR management strategies can help minimize this strain by ensuring timely collections and reducing the risk of bad debts.

Strategies to Optimize Cash Flow

To optimize cash flow, businesses can consider the following strategies:

- Negotiating shorter payment terms with customers, especially for larger orders.

- Offering incentives for early payments, such as discounts or loyalty points.

- Implementing a robust credit control process, including regular reviews of customer payment histories.

- Exploring financing options, such as factoring or invoice discounting, to unlock cash tied up in AR.

- Using cash flow forecasting tools to anticipate and manage potential shortfalls.

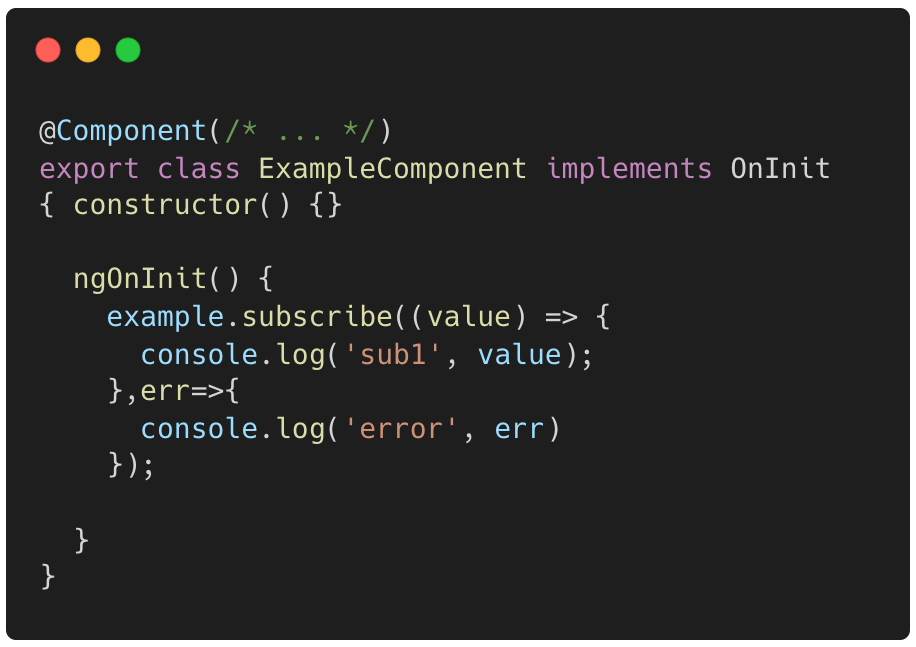

3. Leveraging Technology for Efficient AR Management

In today’s digital landscape, technology plays a pivotal role in optimizing accounts receivable management. AR automation tools can significantly streamline processes, reduce manual errors, and enhance overall efficiency. These tools can automate tasks such as invoicing, payment reminders, and collection follow-ups, freeing up valuable time for finance teams to focus on strategic tasks.

Benefits of AR Automation

- Improved Efficiency: Automation tools can process large volumes of data quickly and accurately, reducing the time and resources required for manual tasks.

- Enhanced Customer Experience: By streamlining processes, businesses can provide timely and accurate invoices, improving customer satisfaction and relationships.

- Real-time Visibility: These tools offer real-time insights into AR, allowing businesses to make informed decisions and take proactive measures.

- Reduced Errors: Automation minimizes the risk of human errors, ensuring accurate records and reducing the likelihood of disputes.

4. The Role of Credit Risk Assessment in AR Management

Credit risk assessment is a critical aspect of accounts receivable management. It involves evaluating the likelihood of a customer defaulting on their payment obligations. By assessing credit risk, businesses can make informed decisions about extending credit, setting appropriate credit limits, and taking necessary precautions to mitigate potential losses.

Credit Risk Assessment Techniques

Businesses can employ various techniques to assess credit risk, including:

- Financial Statement Analysis: Examining a customer’s financial statements, such as balance sheets and income statements, can provide insights into their financial health and ability to meet payment obligations.

- Credit Scoring Models: These models use statistical algorithms to assess credit risk based on various factors, such as payment history, credit utilization, and length of credit history.

- Trade References: Obtaining references from other businesses that have extended credit to the customer can provide valuable insights into their payment behavior.

- Public Records: Checking public records, such as court filings and business registries, can reveal any legal or financial issues that may impact a customer’s ability to pay.

5. Future Trends in Accounts Receivable Management

The field of accounts receivable management is continually evolving, driven by technological advancements and changing business needs. Here are some key trends that are shaping the future of AR:

Artificial Intelligence and Machine Learning

AI and ML technologies are revolutionizing AR management by automating complex tasks and providing predictive insights. These technologies can analyze vast amounts of data to identify patterns, detect anomalies, and predict potential payment issues. For example, AI-powered systems can analyze customer behavior, such as purchase patterns and payment history, to forecast the likelihood of default and suggest appropriate actions.

Blockchain Technology

Blockchain, the technology behind cryptocurrencies like Bitcoin, offers a secure and transparent way to manage accounts receivable. By using blockchain, businesses can create a decentralized ledger that records all transactions, ensuring data integrity and reducing the risk of fraud. Additionally, smart contracts on the blockchain can automate certain AR processes, such as triggering payments upon the delivery of goods or services.

Data Analytics and Predictive Modeling

Advanced data analytics and predictive modeling techniques are enabling businesses to make more informed decisions about credit risk and AR management. By analyzing historical data and identifying trends, businesses can forecast potential payment issues, optimize credit terms, and allocate resources more efficiently. These tools also help in identifying high-risk customers and developing tailored strategies for each customer segment.

Conclusion

Accounts receivable management is a critical function that underpins the financial health of any business. By understanding the fundamentals, leveraging technology, assessing credit risk, and staying abreast of emerging trends, businesses can optimize their AR processes and enhance their overall financial performance. This comprehensive guide provides a roadmap for businesses to navigate the complex world of accounts receivable, empowering them to make informed decisions and drive sustainable growth.

How can businesses improve their accounts receivable turnover ratio?

+Improving the accounts receivable turnover ratio involves a combination of strategies, including negotiating shorter payment terms, offering incentives for early payments, and implementing a robust credit control process. Additionally, businesses can utilize AR automation tools to streamline processes and reduce the time taken for collections.

What are the key benefits of credit risk assessment in AR management?

+Credit risk assessment helps businesses make informed decisions about extending credit, setting appropriate credit limits, and mitigating potential losses. By evaluating the likelihood of a customer defaulting on their payment obligations, businesses can tailor their AR strategies to each customer’s risk profile, ensuring efficient collections and minimizing bad debts.

How can technology enhance accounts receivable management?

+Technology, especially AR automation tools, can significantly enhance accounts receivable management by streamlining processes, reducing manual errors, and providing real-time visibility into AR. These tools automate tasks such as invoicing, payment reminders, and collection follow-ups, freeing up resources for more strategic tasks.