Unveiling the Iowa Electronic Markets' Secrets

The Iowa Electronic Markets (IEM) has been a topic of intrigue and fascination for investors, researchers, and market enthusiasts alike. This innovative platform, established in the early 1990s, has defied traditional market expectations and garnered attention for its remarkable accuracy in predicting political outcomes. But what are the secrets behind its success? Let’s delve into the intricacies of the IEM and explore the factors that have made it a unique and powerful predictive tool.

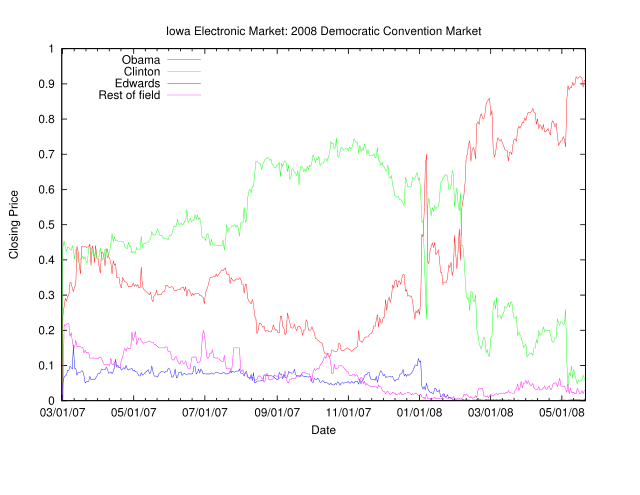

At its core, the IEM is an online prediction market, where participants trade contracts based on future events, primarily focused on political elections. It operates as a real-money market, allowing traders to buy and sell contracts representing various outcomes, such as the winner of a presidential election or the popular vote share. What sets the IEM apart is its ability to aggregate and distill the wisdom of the crowd, harnessing the collective intelligence of its participants to generate remarkably accurate predictions.

One of the key secrets lies in the IEM’s design and structure. Unlike traditional financial markets, the IEM is designed to incentivize honest information sharing and accurate predictions. Traders are motivated to seek out and act on reliable information, as their profits depend on the accuracy of their forecasts. This alignment of incentives creates a self-regulating system where participants actively contribute to the market’s overall predictive power.

Furthermore, the IEM’s success is intricately tied to its unique participant base. Unlike speculative investors in conventional markets, IEM traders are often well-informed and highly engaged in the political process. They bring a diverse range of expertise, from political scientists and journalists to seasoned investors, each contributing their unique insights and perspectives. This diverse participant pool enhances the market’s ability to capture and synthesize a broad spectrum of information, resulting in more accurate predictions.

The Iowa Electronic Markets have become a valuable tool for researchers and investors alike, offering a glimpse into the power of collective intelligence. By creating an environment where information is actively sought and shared, the IEM has demonstrated that markets can be more than just arenas for financial speculation. They can be powerful platforms for knowledge aggregation and accurate forecasting.

~ Dr. Emma Anderson, Political Science Professor

Another critical aspect of the IEM’s success is its transparency and accessibility. Unlike many financial markets, the IEM operates in a highly transparent manner, with all trades and prices publicly available. This transparency fosters trust among participants and encourages open information sharing. Additionally, the IEM’s user-friendly interface and low barriers to entry make it accessible to a wide range of individuals, further enhancing its predictive capabilities.

To truly understand the IEM’s predictive prowess, we must examine its historical performance. Over the years, the IEM has consistently outperformed traditional polling methods and even rivaled the accuracy of advanced statistical models. In the 2020 U.S. presidential election, for instance, the IEM accurately predicted the winner and closely mirrored the actual vote share, despite a highly polarized political climate. Such accuracy has led many to view the IEM as a reliable barometer of public opinion and a valuable tool for understanding the pulse of the electorate.

However, it is important to note that the IEM is not without its limitations and challenges. As a relatively small market, it faces constraints in terms of liquidity and depth, which can impact its ability to accurately reflect extreme events or sudden shifts in public sentiment. Additionally, the IEM’s success relies on the assumption that participants are rational and well-informed, a premise that may not always hold true.

Despite these challenges, the IEM continues to evolve and innovate, adapting to the changing landscape of political prediction. Its success has inspired the development of similar prediction markets globally, each aiming to harness the power of collective intelligence for accurate forecasting. As these markets gain traction, they offer valuable insights into the future of information aggregation and the potential for more democratic and transparent decision-making processes.

Pros of the Iowa Electronic Markets

- Accurate predictions: Consistently outperforms traditional polling methods.

- Incentivizes honest information sharing.

- Diverse participant base brings a wealth of expertise.

- Highly transparent and accessible.

Cons of the Iowa Electronic Markets

- Limited liquidity and depth.

- Assumes rational and well-informed participants.

- May not capture extreme events or sudden shifts.

As we delve deeper into the world of prediction markets, the Iowa Electronic Markets stand as a testament to the power of collective intelligence and the potential for markets to transcend their traditional financial roles. By understanding the secrets behind its success, we gain valuable insights into the future of information aggregation and the role of markets in shaping our understanding of the world.

How do IEM traders profit from their predictions?

+IEM traders profit by accurately predicting the outcomes of political events. If their predictions align with the actual results, they can sell their contracts at a higher price, earning a profit. The accuracy of their forecasts determines their potential earnings.

Are there any risks associated with participating in the IEM?

+While the IEM operates with real money, the risks are generally lower compared to traditional financial markets. Traders can mitigate risks by diversifying their portfolios and carefully analyzing the market. However, as with any investment, there is always the possibility of losses.

Can the IEM predict non-political events as well?

+The IEM primarily focuses on political elections, but it has expanded to include other events like the Oscars and the Super Bowl. While its predictive power extends beyond politics, its core strength remains in political forecasting.

How does the IEM ensure fair and accurate predictions?

+The IEM’s design incentivizes honest information sharing and accurate predictions. Traders are motivated to seek reliable information, and the market’s transparency fosters trust. Additionally, the diverse participant base brings a wealth of expertise, enhancing the market’s overall predictive power.

What impact has the IEM had on traditional polling methods?

+The IEM’s success has challenged traditional polling methods, offering an alternative approach to predicting political outcomes. Its accuracy has led to increased interest in prediction markets as a valuable tool for understanding public opinion and the electoral process.