The Impact of Real GDP Decline on Nominal GDP

In the realm of economic analysis, understanding the intricate relationship between real GDP and nominal GDP is crucial. This exploration delves into the impact of a decline in real GDP on nominal GDP, shedding light on the economic consequences and providing valuable insights for policymakers and analysts alike.

Understanding Real and Nominal GDP

Before we dive into the intricacies of their interplay, let’s establish a clear understanding of what real GDP and nominal GDP represent in economic terms.

Real Gross Domestic Product (GDP) is a measure of a country's economic output, adjusted for inflation. It provides a more accurate representation of economic growth by eliminating the distorting effects of price changes over time. In essence, real GDP reflects the actual value of goods and services produced within a country's borders, independent of fluctuations in prices.

On the other hand, Nominal GDP represents the total market value of all final goods and services produced within a country in a given period, without adjusting for inflation. It captures the current-year prices, making it a useful metric for understanding the absolute size of an economy. However, due to its sensitivity to price changes, nominal GDP may not always accurately reflect the underlying economic performance.

The Interplay: Real GDP Decline and Nominal GDP

When real GDP experiences a decline, it signifies a contraction in the economy’s output. This contraction can arise from various factors, including reduced productivity, decreased investment, or a decline in consumer spending. Consequently, the impact on nominal GDP becomes a critical aspect of economic analysis, offering insights into the overall health and trajectory of an economy.

Direct Impact: Shrinking Economic Output

A decline in real GDP directly translates to a reduction in the overall economic output of a country. This means that fewer goods and services are being produced, which, in turn, leads to a decrease in nominal GDP. As real GDP contracts, the total market value of goods and services produced within the economy diminishes, resulting in a corresponding decline in nominal GDP.

Consider a hypothetical economy with a real GDP of $10 trillion. If the economy experiences a 2% decline in real GDP, the resulting nominal GDP would be $9.8 trillion. This direct relationship between real and nominal GDP underscores the importance of maintaining economic stability and growth.

Inflation and its Role

Inflation plays a crucial role in the relationship between real and nominal GDP. During periods of declining real GDP, inflation can either exacerbate or mitigate the impact on nominal GDP.

In an economy with high inflation, a decline in real GDP may result in a nominal GDP that appears relatively stable or even slightly increased. This is because the higher inflation rates offset the decline in economic output, leading to a nominal GDP that may appear healthier than the underlying real GDP suggests. However, this scenario can be misleading, as it masks the true economic contraction.

Conversely, in an economy with low or stable inflation, a decline in real GDP is more likely to lead to a significant decrease in nominal GDP. In this case, the decline in economic output is not offset by inflation, resulting in a more accurate representation of the economic downturn.

Implications for Policymakers

The impact of real GDP decline on nominal GDP carries significant implications for policymakers. It provides crucial insights into the overall health of the economy and guides decision-making processes. Here’s how policymakers can leverage this understanding:

- Monetary Policy: Central banks can use the relationship between real and nominal GDP to assess the effectiveness of monetary policy. A decline in real GDP, coupled with a significant decrease in nominal GDP, may signal the need for expansionary monetary policies to stimulate economic growth.

- Fiscal Policy: Governments can analyze the impact of real GDP decline on nominal GDP to determine the appropriate fiscal measures. A substantial drop in nominal GDP may warrant government intervention through fiscal stimulus packages or targeted spending initiatives.

- Economic Forecasting: Understanding the interplay between real and nominal GDP allows economists and forecasters to make more accurate predictions about future economic trends. This information is vital for businesses, investors, and policymakers to make informed decisions.

Real-World Examples: Analyzing GDP Declines

Let’s explore some real-world scenarios to illustrate the impact of real GDP decline on nominal GDP. These examples provide a tangible understanding of how economic contractions manifest and their implications.

Case Study: The Great Recession

The global financial crisis of 2007-2009, often referred to as the Great Recession, offers a poignant example of the impact of real GDP decline on nominal GDP. During this period, many economies experienced significant contractions in real GDP.

In the United States, real GDP declined by 3.5% in 2009. This contraction, coupled with the prevailing inflation rate, resulted in a substantial decrease in nominal GDP. The US nominal GDP dropped from $14.4 trillion in 2008 to $14.1 trillion in 2009, reflecting the severity of the economic downturn.

Global Economic Downturns

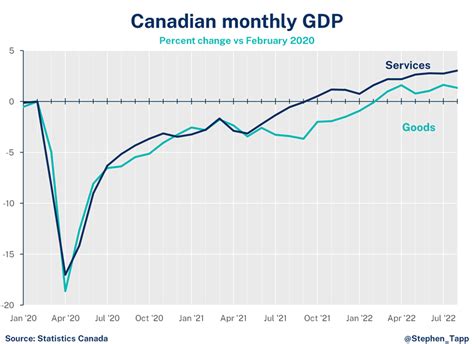

Beyond the Great Recession, various global economic downturns have highlighted the relationship between real and nominal GDP. For instance, during the COVID-19 pandemic, many countries experienced sharp declines in real GDP due to lockdowns and economic disruptions.

In the second quarter of 2020, the United Kingdom's real GDP declined by a staggering 20.4%. This unprecedented contraction led to a corresponding decrease in nominal GDP, with the UK's economy shrinking by 21.7% in the same quarter.

Mitigating Strategies and Future Implications

Understanding the impact of real GDP decline on nominal GDP is not merely an academic exercise. It serves as a foundation for developing effective strategies to mitigate economic downturns and foster sustainable growth.

Stimulus Measures

Policymakers often employ stimulus measures to counteract the negative effects of real GDP decline. These measures can include monetary policies such as lowering interest rates or quantitative easing, as well as fiscal policies like tax cuts or increased government spending.

For instance, during the Great Recession, many central banks worldwide implemented expansionary monetary policies to stimulate economic growth. These policies, combined with fiscal stimulus packages, helped mitigate the impact of real GDP decline on nominal GDP and supported economic recovery.

Long-Term Economic Resilience

Beyond short-term stimulus measures, fostering long-term economic resilience is crucial for mitigating the impact of real GDP declines. This involves investing in education, infrastructure, and innovation to enhance productivity and competitiveness.

By focusing on these long-term strategies, economies can become more resilient to external shocks and reduce the severity of real GDP declines. This, in turn, minimizes the negative impact on nominal GDP and promotes sustainable economic growth.

Conclusion: Navigating Economic Challenges

The intricate relationship between real GDP and nominal GDP underscores the complexity of economic analysis. A decline in real GDP can have significant repercussions on nominal GDP, shaping the trajectory of an economy. By understanding this interplay, policymakers, analysts, and economists can make informed decisions to navigate economic challenges and promote sustainable growth.

As we continue to analyze and interpret economic data, the insights gained from studying the impact of real GDP decline on nominal GDP serve as a compass, guiding us toward a deeper understanding of the economic landscape.

How does a decline in real GDP impact the overall economy in the long term?

+A prolonged decline in real GDP can have severe long-term consequences for an economy. It may lead to reduced living standards, higher unemployment rates, and decreased investment. Over time, this can result in a decline in the country’s competitive position on the global stage.

What are some common causes of real GDP decline?

+Real GDP decline can be attributed to various factors, including economic shocks, such as natural disasters or financial crises, decreased consumer spending, reduced investment, and technological disruptions. Additionally, policy decisions and global economic trends can also impact real GDP.

How do central banks respond to real GDP decline through monetary policy?

+Central banks often respond to real GDP decline by implementing expansionary monetary policies. This may involve lowering interest rates to encourage borrowing and spending, as well as employing quantitative easing measures to inject liquidity into the economy. These actions aim to stimulate economic growth and mitigate the impact of real GDP decline.