Your Comprehensive Guide to Getting a CPA

As you embark on the journey towards becoming a Certified Public Accountant (CPA), you’ll find a world of opportunities opening up. The CPA designation is a hallmark of excellence in the accounting profession, offering a range of career paths and rewarding experiences. This guide aims to provide a roadmap, detailing the steps, insights, and strategies needed to successfully navigate the CPA certification process. From understanding the prerequisites to exploring study strategies and leveraging resources, we’ll cover it all. Let’s get started!

The Significance of the CPA Designation

The CPA credential is a cornerstone in the accounting profession, symbolizing expertise, trustworthiness, and a commitment to ethical standards. It’s a mark of distinction that employers and clients seek, offering a competitive edge in the job market. Beyond career prospects, CPAs play a vital role in society, contributing to financial transparency, accurate reporting, and sound economic decision-making.

"The CPA designation is a powerful credential that not only enhances your career prospects but also contributes to the broader financial health of society." - Dr. Emily Johnson, Accounting Professor

Prerequisites and Eligibility

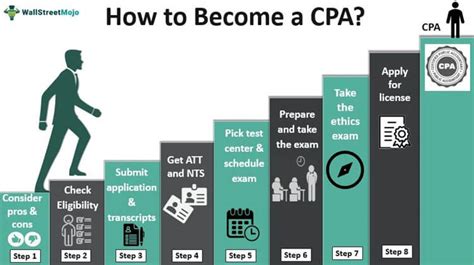

Before diving into the certification process, it’s crucial to understand the prerequisites and eligibility criteria. These vary across jurisdictions, so it’s essential to check the requirements specific to your location. Typically, the basic prerequisites include:

- Education: A bachelor’s degree or higher in accounting or a related field. Some jurisdictions may accept equivalent work experience in lieu of a degree.

- Age: Most jurisdictions require candidates to be at least 18 years old.

- Ethical Standards: Candidates must adhere to a code of professional conduct and ethical standards.

Additionally, some jurisdictions may require candidates to complete a certain number of accounting or business courses as part of their educational background.

Exam Overview and Structure

The CPA exam is a comprehensive assessment designed to evaluate a candidate’s knowledge and skills across various accounting domains. It’s a challenging but rewarding endeavor, consisting of four sections:

- Auditing and Attestation (AUD): This section focuses on auditing principles, procedures, and the role of CPAs in the auditing process.

- Business Environment and Concepts (BEC): BEC covers financial management, operations, and the broader business environment.

- Financial Accounting and Reporting (FAR): FAR delves into financial reporting standards, accounting principles, and the preparation of financial statements.

- Regulation (REG): REG assesses a candidate’s understanding of taxation, ethics, and business law.

Each section is allocated a specific number of testlets, with multiple-choice questions and task-based simulations. The exam is computer-based and is administered year-round at authorized testing centers.

Study Strategies and Resources

Preparing for the CPA exam requires a well-thought-out strategy and access to quality resources. Here are some key strategies and resources to consider:

- Study Materials: Invest in reputable study materials, such as review courses, textbooks, and practice exams. These resources provide structured guidance and help reinforce your understanding of the exam topics.

- Time Management: Create a study schedule that allocates sufficient time for each section. Consider your learning style and preferences, and adjust the schedule accordingly. Consistency is key, so aim for regular study sessions.

- Practice Exams: Utilize practice exams to simulate the actual testing environment. These help you become familiar with the exam format, identify areas of weakness, and improve time management skills.

- Study Groups: Consider joining or forming a study group with fellow CPA candidates. Collaborating with others can provide valuable insights, motivation, and a supportive environment.

- Online Communities: Engage with online forums and communities dedicated to CPA exam preparation. These platforms offer a wealth of information, study tips, and the opportunity to connect with other candidates.

Exam Registration and Scheduling

Once you’ve met the prerequisites and are ready to take the exam, the next step is registration. The process involves the following:

- Account Creation: Create an account with the applicable jurisdiction’s board of accountancy or the National Association of State Boards of Accountancy (NASBA).

- Application: Complete the exam application, providing personal and educational details. This step may involve submitting official transcripts and other supporting documents.

- Payment: Pay the applicable fees, which vary by jurisdiction. These fees typically cover the cost of the exam and associated services.

- Scheduling: Choose a convenient testing date and location. Ensure you have a clear understanding of the testing center’s policies and requirements.

Exam Day Strategies

The day of the exam can be nerve-wracking, but with the right strategies, you can approach it with confidence. Here are some tips for exam day:

- Arrive Early: Give yourself ample time to arrive at the testing center. Familiarize yourself with the location beforehand to avoid last-minute stress.

- Bring the Essentials: Ensure you have all the required documents, such as your admission ticket and valid photo ID. Dress comfortably, and consider bringing snacks and water to stay energized.

- Read Instructions Carefully: Pay close attention to the instructions provided at the testing center. Understand the rules and regulations, and ask questions if needed.

- Pace Yourself: Manage your time effectively during the exam. Allocate sufficient time for each section, and don’t spend too much time on a single question. If you encounter a challenging question, mark it and come back to it later.

- Stay Calm and Focused: Maintain a positive mindset and focus on your preparation. Remember to breathe and take breaks when needed.

Scoring and Passing Requirements

The CPA exam is scored on a scale, with each section receiving a separate score. To pass, candidates must achieve a minimum score in each section. The passing score varies by jurisdiction, but it typically falls within the range of 75-90.

Passing Benefits

Passing the CPA exam opens doors to a wide range of career opportunities. It enhances your marketability and provides a solid foundation for professional growth.

Retaking Exams

If you don't pass a section on your first attempt, you can retake it. However, it's essential to identify areas of improvement and adjust your study strategy accordingly.

Post-Exam Career Prospects

Obtaining your CPA certification is a significant achievement, and it opens up a multitude of career paths. Here are some potential career avenues:

- Public Accounting: CPAs are highly sought after in public accounting firms, where they provide auditing, tax, and consulting services to clients.

- Corporate Finance: Many CPAs find rewarding careers in corporate finance, working as financial analysts, controllers, or chief financial officers.

- Government and Non-Profit: CPAs play a crucial role in government agencies and non-profit organizations, ensuring financial transparency and compliance.

- Entrepreneurship: With their financial expertise, CPAs can venture into entrepreneurship, starting their own accounting or consulting businesses.

Continuous Learning and Professional Development

The accounting profession is dynamic, and CPAs must stay updated with evolving standards and practices. Continuous learning is essential for maintaining your certification and staying ahead in your career. Consider the following:

- CPE Requirements: Check the continuing professional education (CPE) requirements in your jurisdiction. These ensure that CPAs remain current with industry developments.

- Professional Networks: Engage with professional organizations and attend industry events. These platforms provide opportunities for networking, learning, and staying connected with the accounting community.

- Advanced Certifications: Explore advanced certifications, such as the Certified Management Accountant (CMA) or Certified Internal Auditor (CIA). These designations further enhance your skills and marketability.

Conclusion: Your CPA Journey

The path to becoming a CPA is a challenging yet rewarding endeavor. It requires dedication, a strong foundation in accounting principles, and a commitment to continuous learning. By understanding the prerequisites, following effective study strategies, and leveraging the right resources, you can successfully navigate the certification process. Remember, the CPA designation is a testament to your expertise and a key to unlocking a world of career opportunities.

What are the benefits of obtaining a CPA designation?

+The CPA designation offers a range of benefits, including enhanced career prospects, increased earning potential, and a reputation for expertise and trustworthiness. CPAs are highly sought after in various industries and can pursue diverse career paths.

How long does it typically take to become a CPA?

+The time it takes to become a CPA varies depending on individual circumstances. On average, it can take around 2-3 years, including completing the necessary education, meeting the experience requirements, and passing the CPA exam.

Are there alternatives to the CPA designation for accounting professionals?

+Yes, there are alternative certifications, such as the Certified Management Accountant (CMA) and Certified Internal Auditor (CIA). These designations offer specialized expertise in specific areas of accounting and finance.

Can I work in the accounting field without a CPA designation?

+While a CPA designation is not always required, it can significantly enhance your career prospects and earning potential. Many employers prefer or require CPAs for certain roles, especially in public accounting and senior-level positions.

What are some common challenges faced during the CPA exam preparation process?

+Common challenges include managing study time effectively, understanding complex accounting concepts, and staying motivated throughout the lengthy preparation process. Utilizing study resources, joining study groups, and seeking support can help overcome these challenges.