Understanding the Deadweight Loss Equation.

The Concept of Deadweight Loss

Have you ever wondered about the hidden costs associated with inefficient markets and price distortions? Deadweight loss is an economic term that sheds light on these unseen expenses, offering a powerful tool to analyze and optimize market outcomes.

Imagine a scenario where a seemingly small change in policy or a market disruption leads to a ripple effect of inefficiencies, impacting producers, consumers, and the overall economy. This is where understanding the deadweight loss equation becomes crucial.

The equation itself is a mathematical representation of the difference between the total potential surplus (the sum of consumer and producer surplus) and the actual surplus achieved in a market due to distortions. In simpler terms, it quantifies the loss of economic welfare caused by these disruptions.

Let’s dive deeper into the components of this equation and explore its implications.

The Deadweight Loss Equation Unpacked

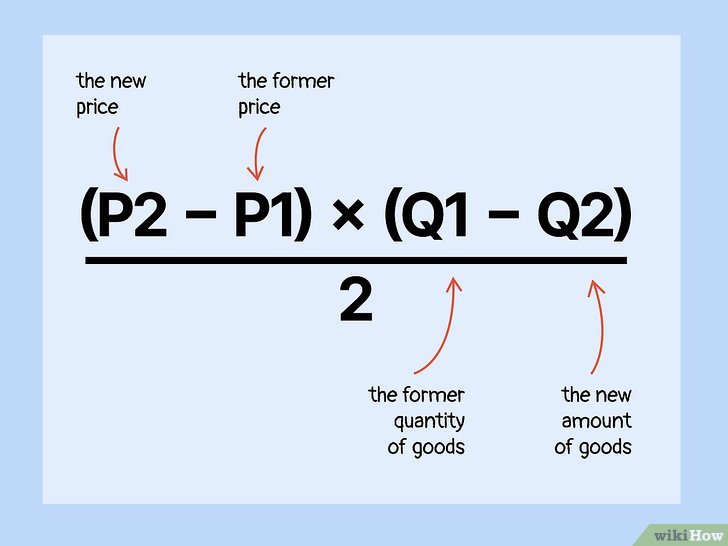

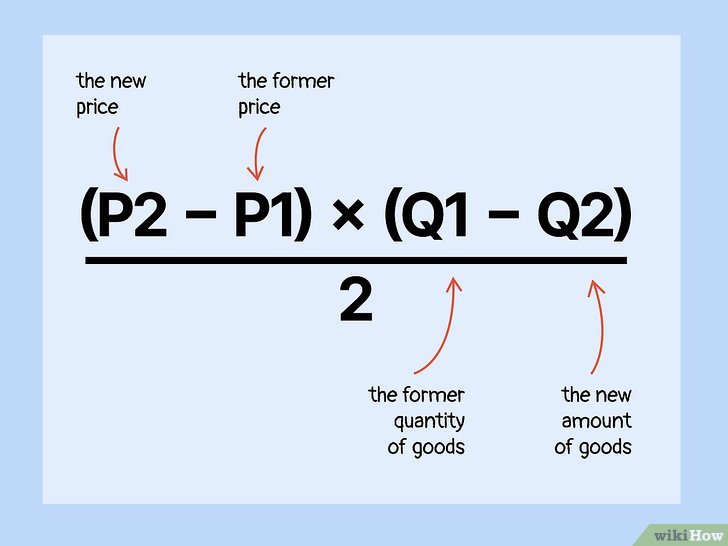

The deadweight loss equation, often denoted as DWL, can be expressed as:

\[ \begin{equation*} DWL = \frac{1}{2} \cdot Q_0 \cdot P_0 - \frac{1}{2} \cdot Q_1 \cdot P_1 \, . \end{equation*} \]

Here’s a breakdown of the key terms:

- Q_0 represents the quantity demanded before the market distortion or policy change.

- P_0 is the corresponding price at which this quantity is demanded.

- Q_1 is the new quantity demanded after the distortion or change.

- P_1 is the new price at which the market equilibrates post-distortion.

The equation essentially calculates the area between the demand curve and the price axis for the two quantities (Q_0 and Q_1) and averages them. This area represents the lost economic surplus due to the market inefficiency.

Visualizing Deadweight Loss

Let’s illustrate this concept with a simple diagram. Consider a market for widgets, represented by the following demand and supply curves:

Figure 1: Market for Widgets before and after a Policy Change

In this market, before any policy change, the equilibrium quantity (Q_0) is at point A, where the demand and supply curves intersect. The corresponding equilibrium price (P_0) is also at point A.

Now, imagine a new policy is implemented, shifting the demand curve to the left, as shown by the dotted line. The new equilibrium quantity (Q_1) is now at point B, and the new equilibrium price (P_1) is at point C.

The deadweight loss, as illustrated in the diagram, is the triangular area between the original demand curve, the new demand curve, and the price axis. This area represents the potential economic surplus that was not realized due to the policy change.

Implications and Real-World Examples

Understanding deadweight loss is crucial for policymakers, economists, and businesses alike. It provides a quantitative measure of the impact of market distortions and helps in evaluating the efficiency of policies and interventions.

For instance, consider the imposition of a tax on a particular good. This tax shifts the supply curve upward, reducing the quantity demanded and creating a deadweight loss. Similarly, government subsidies can also lead to inefficiencies, as they may encourage overproduction and distort market signals.

In the context of international trade, tariffs and quotas can significantly impact global markets, leading to deadweight losses across nations.

Strategies to Minimize Deadweight Loss

Minimizing deadweight loss is a complex task that requires careful consideration of market dynamics and policy objectives. Here are some strategies that can help reduce deadweight loss:

- Precision in Policy Design: Policymakers should strive for precision in their interventions, ensuring that any market distortions are minimal and targeted.

- Market Flexibility: Encouraging market flexibility and adaptability can help mitigate the impact of disruptions.

- Information Dissemination: Transparent and accurate information about market conditions can aid in efficient decision-making by producers and consumers.

- Regulatory Review: Regularly reviewing and updating regulations can ensure that they remain aligned with market realities and minimize inefficiencies.

Key Takeaway

The deadweight loss equation provides a powerful tool to quantify and understand the impact of market inefficiencies. By grasping this concept, economists, policymakers, and business leaders can make more informed decisions to optimize market outcomes and promote economic welfare.

FAQ

What is the significance of the 1⁄2 factor in the deadweight loss equation?

+The 1⁄2 factor in the equation represents the average of the areas under the demand curve for the two quantities (Q_0 and Q_1). This averaging accounts for the fact that the loss of surplus is spread across the range of prices between P_0 and P_1.

Can deadweight loss be positive or negative?

+Deadweight loss is typically considered a positive value, indicating a loss of economic surplus. However, in certain theoretical scenarios, it can be negative, suggesting a potential gain in surplus due to market distortions. This is a rare occurrence and often involves complex market interactions.

How does deadweight loss differ from consumer surplus or producer surplus?

+Deadweight loss is a measure of the overall loss of economic welfare due to market inefficiencies. It is distinct from consumer surplus, which represents the benefit gained by consumers when they pay less than the maximum they are willing to pay, and producer surplus, which is the benefit gained by producers when they receive more than the minimum they are willing to accept.

Are there any real-world examples of deadweight loss that have had significant economic impacts?

+Yes, the imposition of tariffs and trade barriers during historical periods, such as the Smoot-Hawley Tariff Act in the 1930s, is often cited as a classic example of deadweight loss on a global scale. These policies reduced trade volumes, disrupted supply chains, and contributed to economic downturns.

Can deadweight loss be mitigated through market intervention?

+While market intervention can sometimes reduce deadweight loss, it is a delicate balance. Poorly designed or overly intrusive interventions can create new distortions and potentially increase deadweight loss. A careful analysis of market dynamics and a nuanced approach are essential to minimize the negative impacts.