Bi-Weekly Paychecks: A Yearly Breakdown

For many employees, understanding the financial aspects of their pay structure is crucial. Bi-weekly paychecks are a common arrangement, offering a steady income every two weeks. In this article, we delve into the intricacies of bi-weekly pay, providing a comprehensive breakdown for a year. We'll explore how this payment schedule works, its benefits, and the overall impact on your finances.

Understanding Bi-Weekly Pay

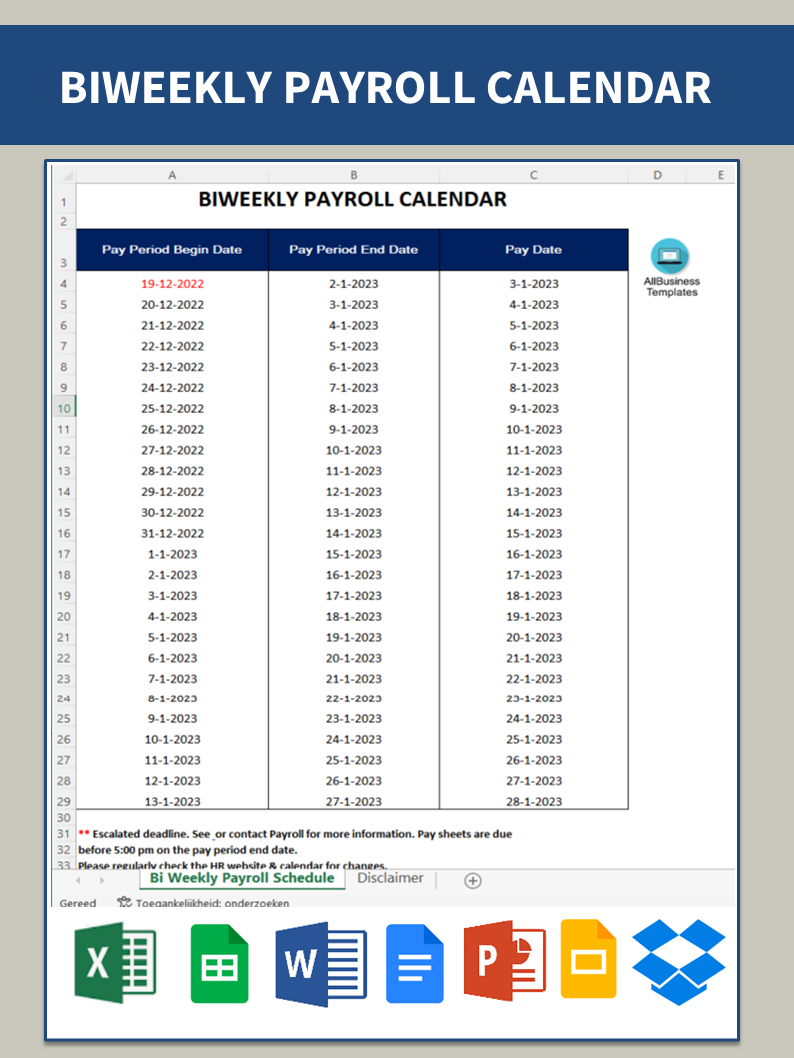

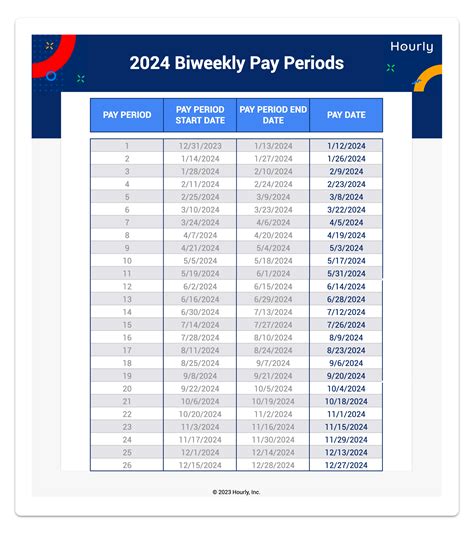

Bi-weekly pay is a payment schedule where employees receive their wages every two weeks, resulting in 26 paychecks per year. This arrangement is popular among employers as it provides a consistent and predictable payroll process. It offers employees a regular income stream, typically with two additional paychecks compared to a monthly payment system.

The bi-weekly schedule ensures employees receive their earnings more frequently, which can be advantageous for budgeting and financial planning. Each paycheck represents a fraction of the annual salary, with the exact amount varying based on factors such as salary, overtime, and deductions.

Calculating Bi-Weekly Paychecks

To calculate the amount of a bi-weekly paycheck, you can use the following formula:

Bi-Weekly Paycheck = (Annual Salary / 52) / 2

This equation divides the annual salary by the number of weeks in a year (52) and then halves the result to find the bi-weekly pay.

For example, let's consider an employee with an annual salary of $50,000. Using the formula:

$50,000 / 52 = $961.54 (weekly amount)

$961.54 / 2 = $480.77 (bi-weekly paycheck)

In this case, the employee would receive approximately $480.77 every two weeks.

Variations in Bi-Weekly Pay

It’s important to note that bi-weekly pay may not always be the same amount. Factors like overtime, bonuses, and tax deductions can affect the paycheck size. Additionally, leap years introduce a slight variation, resulting in one additional paycheck every four years.

To illustrate, consider an employee earning an annual salary of $60,000 with a bi-weekly paycheck. Their regular paycheck would amount to approximately $500, but with occasional overtime, their earnings could vary. For instance, a week with 10 hours of overtime at time-and-a-half pay ($20/hour) would increase their earnings by $300, resulting in a total paycheck of $800.

Advantages of Bi-Weekly Pay

Bi-weekly pay offers several benefits to employees:

- Frequent Income: The more frequent paychecks provide a steady cash flow, aiding in budgeting and financial stability.

- Financial Planning: Employees can plan their expenses and savings more effectively with regular paydays.

- Budget Control: The shorter time frame between paychecks allows for better control over spending and saving habits.

- Emergency Funds: Bi-weekly pay facilitates building an emergency fund more rapidly, providing a financial safety net.

- Financial Flexibility: Employees can better manage unexpected expenses or take advantage of time-limited opportunities.

Comparing Pay Schedules

Bi-weekly pay is often compared to other payment schedules, such as weekly, semi-monthly, and monthly. Each has its pros and cons:

| Pay Schedule | Paychecks per Year | Pros | Cons |

|---|---|---|---|

| Bi-Weekly | 26 | More frequent pay, consistent income | Paycheck amounts may vary |

| Weekly | 52 | Most frequent pay, smaller amounts | High administrative costs for employers |

| Semi-Monthly | 24 | Consistent amounts, slightly less frequent | Can be confusing with varying pay dates |

| Monthly | 12 | Larger paychecks, simpler payroll | Longer wait between paydays, less flexibility |

Financial Planning with Bi-Weekly Pay

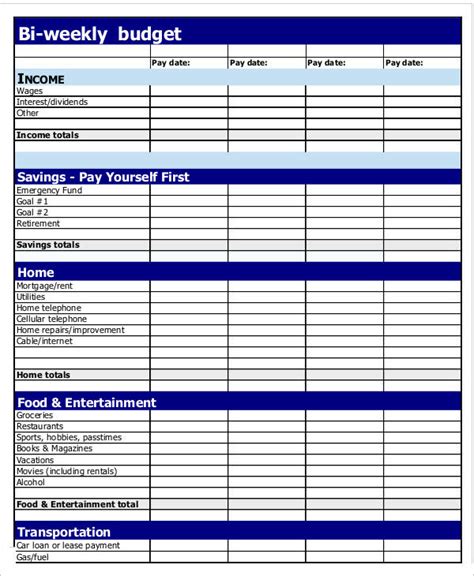

Bi-weekly pay provides an excellent opportunity for employees to enhance their financial planning. Here are some strategies to make the most of this payment schedule:

- Budgeting: Create a detailed budget to allocate your income effectively. Plan your expenses, savings, and investments.

- Saving Goals: Set specific saving goals, such as an emergency fund, a down payment for a house, or a vacation fund. The frequent paychecks make it easier to achieve these goals.

- Retirement Planning: Utilize the extra paychecks to boost your retirement savings. Consider contributing to a retirement account during the years with 27 pay periods (including leap years).

- Debt Repayment: With the additional paychecks, you can accelerate debt repayment, such as student loans or credit card debt.

- Investment Opportunities: Explore investment options like stocks, bonds, or mutual funds. The consistent income stream allows for regular contributions.

Conclusion: Embracing Bi-Weekly Pay

Bi-weekly paychecks provide a reliable and predictable income stream for employees. Understanding how this payment schedule works and its benefits is crucial for effective financial management. With the right strategies, employees can harness the advantages of bi-weekly pay to achieve their financial aspirations.

By utilizing budgeting, saving, and investing techniques, employees can make the most of their bi-weekly paychecks, ensuring a secure financial future. Remember, the key is to plan, save, and invest wisely to maximize the potential of this payment schedule.

Frequently Asked Questions

How do I calculate my bi-weekly paycheck amount?

+To calculate your bi-weekly paycheck, divide your annual salary by 52 (the number of weeks in a year), then divide that amount by 2. This will give you your approximate bi-weekly paycheck amount.

What are the advantages of bi-weekly pay over other schedules?

+Bi-weekly pay offers more frequent income, which can aid in budgeting and financial planning. It provides a balance between having regular paydays and managing expenses effectively.

Can I adjust my budget to align with bi-weekly paychecks?

+Absolutely! Creating a budget that aligns with your bi-weekly paychecks is essential for financial stability. Plan your expenses and savings accordingly to make the most of your income.

How can I take advantage of the extra paychecks in a leap year?

+In a leap year, you’ll receive one additional paycheck. You can use this extra income to boost your savings, invest in retirement funds, or pay off debts faster. It’s a great opportunity to accelerate your financial goals.

Are there any drawbacks to bi-weekly pay?

+One potential drawback is that bi-weekly paychecks may vary in amount due to factors like overtime or deductions. However, with proper financial planning, this can be managed effectively.