Step-by-Step: Marking Invoices Paid in QuickBooks

In today's fast-paced business environment, keeping track of payments and managing invoices is crucial for maintaining financial accuracy and efficiency. QuickBooks, a widely-used accounting software, offers a user-friendly platform to streamline these processes. One essential task in this workflow is marking invoices as paid, a step that ensures accurate record-keeping and provides a clear overview of your financial transactions. In this step-by-step guide, we'll delve into the process of marking invoices paid in QuickBooks, offering a comprehensive yet simple approach to this vital task.

Understanding the Importance of Marking Invoices Paid

Marking invoices as paid in QuickBooks is more than just a tick-box exercise; it’s a fundamental step in maintaining the integrity of your financial records. When you mark an invoice as paid, you’re not only updating your accounts receivable but also ensuring that your records reflect the actual financial status of your business. This simple action provides a clear picture of your cash flow, helps in tracking outstanding payments, and ensures that your books are up-to-date and accurate.

Additionally, marking invoices as paid facilitates better decision-making. It provides a real-time overview of your business's financial health, helping you identify trends, make informed decisions about future investments, and plan your business strategy effectively. By keeping your financial records accurate and up-to-date, you can also streamline your accounting processes, making tax season and financial reporting less daunting tasks.

Step-by-Step Guide: Marking Invoices Paid in QuickBooks

Now, let’s walk through the process of marking invoices as paid in QuickBooks. This process is straightforward and can be completed in a few simple steps, ensuring your financial records are accurate and up-to-date.

Step 1: Access the Invoices

The first step is to access the invoices you wish to mark as paid. To do this, navigate to the “Customers” menu in QuickBooks and select “All Invoices.” This will bring up a list of all the invoices you’ve created, including those that are due, overdue, and those that have been paid.

Step 2: Identify the Invoices to Mark as Paid

Once you’ve accessed the invoices, you need to identify which ones you want to mark as paid. You can do this by sorting the invoices by status or by using the search bar to find specific invoices. For example, you might want to mark all overdue invoices as paid to get a clear overview of your accounts receivable.

Step 3: Select the Invoices

After identifying the invoices, select them by checking the box next to each invoice you wish to mark as paid. You can select multiple invoices at once, making it easy to process a batch of payments.

Step 4: Mark Invoices as Paid

With the invoices selected, the next step is to mark them as paid. In the “Actions” menu, select “Mark Invoices as Paid.” This will bring up a pop-up window where you can confirm the payment details.

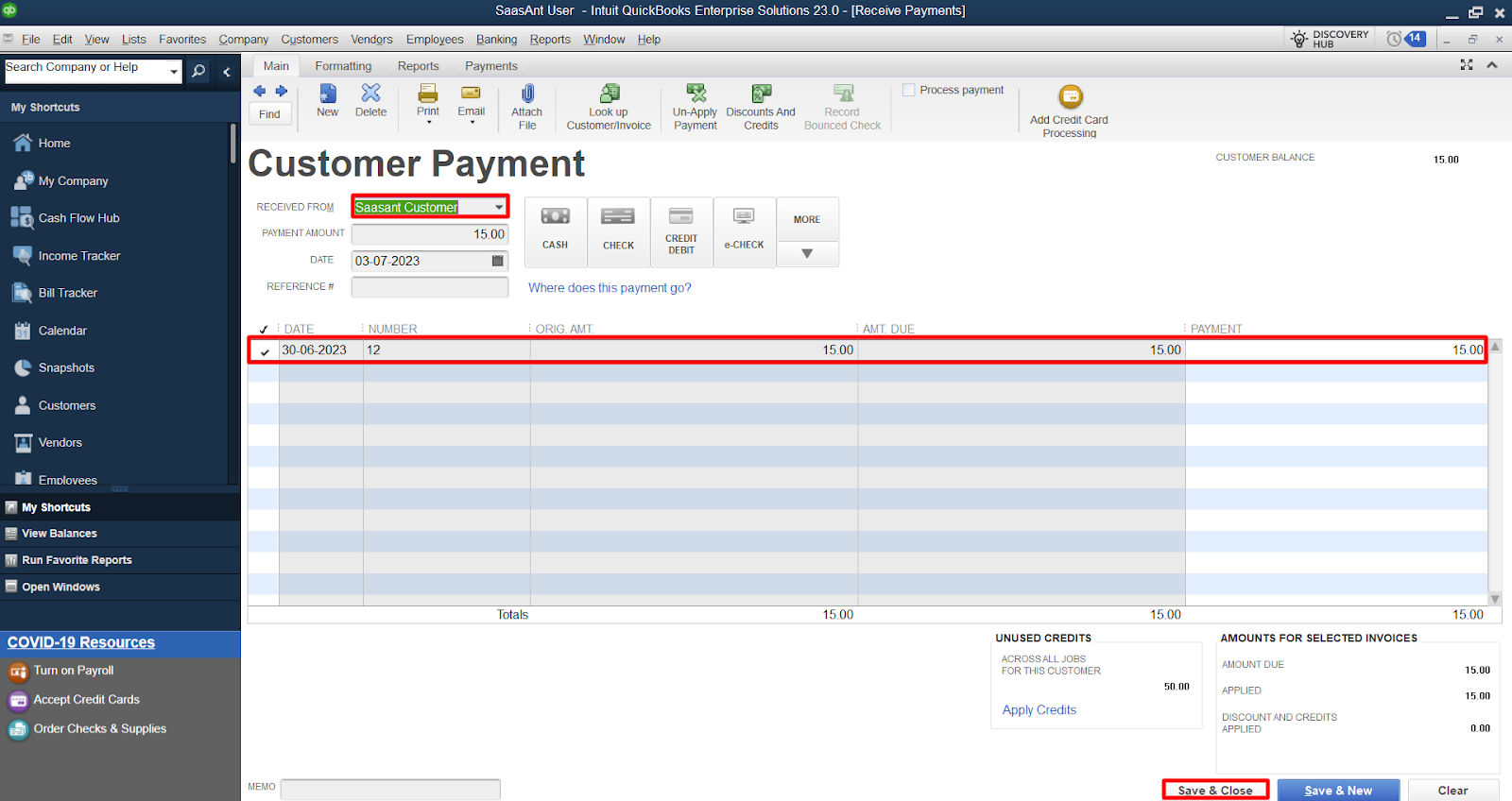

Step 5: Enter Payment Details

In the pop-up window, you’ll need to enter the payment details for the invoices you’re marking as paid. This includes the payment method (such as cash, check, or credit card), the payment date, and the amount received. You can also add a payment reference or memo for additional context.

Step 6: Review and Confirm

Before finalizing the payment, review the details to ensure they are accurate. QuickBooks will provide a summary of the invoices being marked as paid, along with the total amount received. Once you’re satisfied that the details are correct, click “Confirm” to complete the process.

Step 7: Review the Payment Summary

After marking the invoices as paid, QuickBooks will provide a summary of the payment. This summary includes the total amount received, the payment method, and the date of payment. It’s a good practice to review this summary to ensure that the payment details are accurate and match your records.

Benefits of Marking Invoices Paid in QuickBooks

Marking invoices as paid in QuickBooks offers several benefits that contribute to the overall efficiency and accuracy of your financial management.

Accurate Financial Records

By marking invoices as paid, you ensure that your financial records are up-to-date and accurate. This provides a clear picture of your business’s financial health, helping you make informed decisions and plan effectively.

Streamlined Payment Tracking

QuickBooks makes it easy to track payments. By marking invoices as paid, you can quickly identify which invoices have been settled, reducing the time spent on manual payment tracking and reducing the risk of double payments or missed payments.

Enhanced Cash Flow Management

With accurate and up-to-date financial records, you can better manage your cash flow. Marking invoices as paid helps you keep track of incoming payments, allowing you to forecast your cash flow more accurately and make informed decisions about investments, expenses, and future planning.

Improved Customer Relations

Marking invoices as paid also has a positive impact on your customer relations. By keeping accurate records of payments, you can quickly address any payment-related queries from your customers, building trust and maintaining a positive reputation.

Best Practices for Marking Invoices Paid in QuickBooks

While the process of marking invoices as paid in QuickBooks is straightforward, there are some best practices to follow to ensure the accuracy and efficiency of your financial management.

Regularly Review and Update Invoices

Make it a habit to regularly review and update your invoices. This ensures that you’re always working with the most up-to-date information and helps you identify any discrepancies or issues promptly.

Use Payment Reminders and Follow-ups

QuickBooks offers the functionality to send payment reminders and follow-ups to customers. By using these features, you can encourage timely payments and reduce the risk of late or missed payments.

Reconcile Payments Regularly

Reconcile your payments regularly to ensure that your financial records match your bank statements. This helps to identify any discrepancies and ensures the accuracy of your financial data.

Keep Payment Records Organized

Maintain a well-organized system for your payment records. This makes it easier to retrieve information when needed, facilitates audit trails, and helps you stay on top of your financial obligations.

Advanced Features: Taking Your Invoice Management to the Next Level

QuickBooks offers a range of advanced features that can enhance your invoice management and financial operations. These features can streamline your processes, automate tasks, and provide deeper insights into your financial performance.

Invoice Templates and Customization

QuickBooks allows you to create custom invoice templates, ensuring a professional and consistent look for all your invoices. You can also customize your invoices with your company logo, terms and conditions, and other important details, providing a more personalized experience for your customers.

Automatic Payment Reminders and Follow-ups

You can set up automatic payment reminders and follow-ups in QuickBooks, ensuring that your customers receive timely notifications about their invoices. This helps to improve payment compliance and reduce the time spent on manual reminders.

Payment Gateways Integration

QuickBooks integrates with various payment gateways, allowing your customers to pay invoices online. This provides a convenient payment option for your customers and speeds up the payment process, reducing the time between invoicing and receiving payment.

Advanced Reporting and Analytics

QuickBooks offers advanced reporting and analytics features that provide deep insights into your financial performance. These reports can help you identify trends, track key performance indicators, and make data-driven decisions to improve your business operations.

Conclusion: Empowering Your Financial Management with QuickBooks

Marking invoices as paid in QuickBooks is a simple yet powerful task that forms the foundation of accurate financial management. By following this step-by-step guide, you can ensure that your financial records are up-to-date, providing a clear overview of your business’s financial health. Additionally, by utilizing the advanced features of QuickBooks, you can streamline your invoice management, automate tasks, and gain deeper insights into your financial performance.

With QuickBooks, you're empowered to take control of your financial management, making informed decisions, planning effectively, and ensuring the long-term success and stability of your business. By embracing these tools and best practices, you can focus on growing your business while leaving the financial management to QuickBooks.

Can I mark invoices as paid in bulk?

+Yes, you can mark multiple invoices as paid at once. Simply select the invoices you wish to mark as paid, and then use the “Mark Invoices as Paid” action in the “Actions” menu. This saves time and makes it easy to process a batch of payments.

What happens if I mark an invoice as paid by mistake?

+If you mark an invoice as paid by mistake, you can undo the action. In the “Customers” menu, select the invoice you want to undo the payment for, and then choose “Undo Payment” from the “Actions” menu. This will remove the payment from the invoice, allowing you to correct the mistake.

How often should I mark invoices as paid in QuickBooks?

+It’s best to mark invoices as paid as soon as you receive the payment. This ensures that your financial records are up-to-date and accurate. Regularly reviewing and updating your invoices will help you stay on top of your financial obligations and provide a clear overview of your business’s financial health.

Can I set up automatic payment marking in QuickBooks?

+Yes, QuickBooks offers the option to set up automatic payment marking. This feature allows you to automatically mark invoices as paid when a payment is received, saving you time and effort. To set this up, navigate to the “Gear” icon and select “Account and Settings,” then choose “Sales” and enable the “Automatically mark invoices as paid when a payment is received” option.