3 Strategies to Understand Horizontal Integration

Strategy 1: Delve into the Economic Rationale

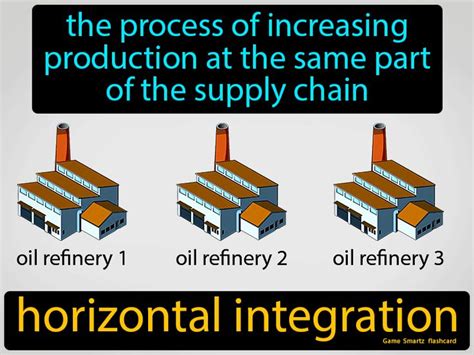

Horizontal integration is a strategic move that involves two or more businesses at the same level of the supply chain merging or partnering to consolidate their market power and resources. To grasp the essence of this concept, we must first understand the economic motivations driving such integrations.

Businesses often seek horizontal integration to achieve economies of scale. By combining operations, companies can reduce their costs by spreading fixed expenses over a larger production volume. This efficiency gain can lead to increased profitability and a stronger competitive position in the market. For instance, consider a manufacturing company that merges with a competitor. By combining their production facilities, they can optimize resource utilization, minimize duplication of efforts, and achieve significant cost savings.

Another key driver is market power. When companies horizontally integrate, they can control a larger share of the market, giving them more influence over pricing and product offerings. This enhanced market power can be particularly advantageous in industries with high barriers to entry or where competition is intense. For example, a software company that merges with a rival can leverage their combined customer base to negotiate better terms with suppliers and potentially dominate the market with their expanded product portfolio.

Furthermore, horizontal integration can foster innovation and enhance product differentiation. By bringing together complementary resources and expertise, companies can develop new products, services, or technologies that are more competitive and appealing to consumers. This innovation advantage can lead to increased market share and improved profitability. Imagine a tech startup specializing in virtual reality merging with a gaming company. The combined entity can leverage their collective skills to create immersive gaming experiences, setting them apart from competitors.

Strategy 2: Explore the Competitive Landscape

Understanding the competitive dynamics within an industry is crucial when analyzing horizontal integration strategies. Businesses must carefully assess the market environment and identify potential synergies that can be achieved through integration.

One key consideration is market concentration. Horizontal integration often occurs in industries with high levels of market concentration, where a few dominant players control a significant portion of the market share. By merging, these companies can further consolidate their power, making it more challenging for new entrants to compete. For example, in the airline industry, where a few major carriers hold a substantial market share, horizontal integration can lead to increased pricing power and reduced competition.

Another aspect to examine is the competitive strategy of existing players. Horizontal integration can be a response to aggressive competitive moves or a proactive measure to stay ahead of the curve. Companies may integrate to defend their market position, gain a strategic advantage, or mitigate the risk of being acquired by a rival. Consider the telecommunications industry, where mergers between mobile network operators can lead to expanded network coverage, improved infrastructure, and enhanced customer service.

Additionally, understanding the regulatory environment is essential. Horizontal integrations may face regulatory scrutiny, especially in industries deemed critical to the economy or where anti-competitive behavior is a concern. Companies must navigate the legal and ethical considerations to ensure their integration strategies align with industry regulations and maintain consumer welfare. In the healthcare sector, for instance, horizontal integration between hospitals or healthcare providers may require careful examination to ensure patient access and fair pricing.

Strategy 3: Assess the Impact on Consumers and Society

While horizontal integration primarily benefits businesses, it is essential to consider the broader implications for consumers and society as a whole. Analyzing the potential effects on market dynamics, consumer choices, and social welfare can provide valuable insights into the long-term sustainability and desirability of such strategies.

One key aspect to consider is the impact on consumer welfare. Horizontal integration can lead to reduced competition, potentially resulting in higher prices, limited product variety, and diminished consumer satisfaction. Businesses must carefully balance their integration strategies with consumer interests to maintain a healthy and vibrant market. For example, in the retail industry, a merger between two large supermarket chains could result in fewer choices for consumers and potentially drive up grocery prices.

Furthermore, horizontal integration can have social and environmental implications. Businesses must consider the potential consequences on employment, community development, and sustainability. Integrating companies may need to address issues such as job displacement, skills retraining, and the environmental impact of their combined operations. In the energy sector, for instance, horizontal integration between oil and gas companies may raise concerns about the transition to renewable energy sources and the potential impact on local communities.

Lastly, the long-term sustainability of horizontal integration strategies should be evaluated. While integration can bring short-term benefits, companies must ensure their combined entities can adapt to changing market conditions, technological advancements, and evolving consumer preferences. Failure to do so may lead to reduced competitiveness and ultimately, the dissolution of the integrated entity. In the technology industry, for example, a merger between two software companies may face challenges keeping up with rapid technological advancements and shifting consumer demands.

By adopting these three strategies - delving into the economic rationale, exploring the competitive landscape, and assessing the impact on consumers and society - stakeholders can gain a comprehensive understanding of horizontal integration and make informed decisions about its implementation and implications.