How to Maximise Your Georgia State Pension

Maximizing Your Retirement Income: A Comprehensive Guide to Your Georgia State Pension

Retiring is a significant milestone in life, and ensuring a stable financial future is crucial to enjoying this phase. If you’re a resident of Georgia, understanding your state pension plan is an essential step towards a comfortable retirement. This guide will delve into the intricacies of the Georgia State Pension, offering expert insights and strategies to help you maximize your retirement income.

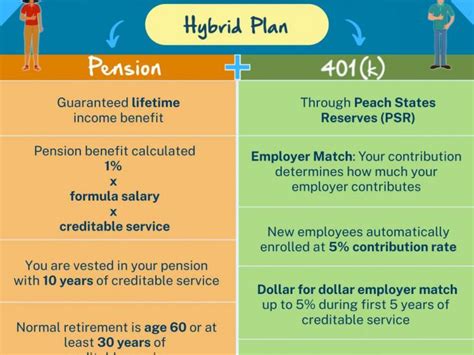

The Georgia State Pension, officially known as the Employees’ Retirement System of Georgia (ERS), is a defined benefit pension plan designed to provide a secure retirement for public employees in the state. It serves as a cornerstone of retirement planning for many Georgians, offering a predictable income stream based on years of service and salary. However, to fully leverage the benefits of this plan, it’s vital to grasp the intricacies and make informed decisions.

Let’s explore the key aspects of the Georgia State Pension and uncover strategies to optimize your retirement savings.

Understanding the Basics of the Georgia State Pension

The Employees’ Retirement System of Georgia is a comprehensive retirement plan that covers a wide range of public employees, including state and local government workers, teachers, and certain university personnel. This plan provides a defined benefit, which means that retirees receive a predetermined pension amount based on their years of service and final salary. Here’s a breakdown of the key components:

Eligibility: To be eligible for the Georgia State Pension, you must be a public employee in a position that is covered by the ERS. This includes most state and local government jobs, such as police officers, firefighters, teachers, and administrative staff. It’s important to note that certain positions, like elected officials and temporary workers, may not be eligible.

Contribution Requirements: Both employees and employers contribute to the pension plan. As an employee, a percentage of your salary is deducted each pay period and deposited into the pension fund. The contribution rate is determined by the state and can vary depending on the job category. Employers also make contributions on behalf of their employees.

Years of Service: The number of years you’ve worked in a pension-covered position is a crucial factor in determining your pension benefit. Generally, the longer you’ve worked, the higher your pension amount will be. The ERS typically requires a minimum number of years of service to qualify for retirement benefits.

Final Salary: Your pension amount is also based on your final salary or the average of your highest few years of salary. This means that increases in salary over time can significantly impact your pension benefit. It’s essential to understand how your salary is calculated for pension purposes, as this can vary based on your job classification.

Retirement Age: The age at which you can retire and start receiving pension benefits can vary depending on your years of service and job category. For most employees, the normal retirement age is 65 or 67, but early retirement options may be available with reduced benefits. It’s crucial to understand the retirement age requirements and the potential impact on your pension.

Strategies to Maximize Your Georgia State Pension

Maximizing your Georgia State Pension involves a combination of strategic planning, understanding the plan’s rules, and making informed decisions throughout your career. Here are some expert strategies to consider:

Contribute Consistently: Consistent contributions to your pension plan are crucial. Ensure that you’re contributing the maximum amount allowed, especially if your employer offers a match. The power of compound interest over time can significantly boost your retirement savings.

Understand the Vesting Period: The vesting period refers to the amount of time you need to work before you’re fully vested in the pension plan. During this period, if you leave your job, you may not be entitled to the full pension benefits. Understand the vesting rules and ensure you meet the requirements to secure your pension rights.

Plan for Early Retirement: If early retirement is an option for you, carefully consider the potential impact on your pension. While early retirement may offer flexibility, it often comes with reduced benefits. Calculate the potential reduction in pension amount and weigh it against the benefits of retiring earlier.

Optimize Your Salary for Pension Calculations: Your pension amount is often based on your final salary or a portion of it. Strategies like negotiating salary increases, pursuing promotions, or taking on additional responsibilities can boost your pensionable earnings. Understand how your salary is calculated for pension purposes and make informed career choices.

Consider Purchasing Additional Service Credit: The ERS allows eligible employees to purchase additional service credit, which can increase their pension benefits. This option can be particularly beneficial if you’ve had gaps in your employment or have worked in positions that weren’t covered by the pension plan. Consult with a financial advisor to determine if purchasing additional service credit is a viable option for you.

Utilize Pension Optimization Tools: There are online tools and calculators available that can help you estimate your pension benefits based on different scenarios. These tools can provide valuable insights into how your years of service, salary, and retirement age impact your pension amount. Utilize these resources to make informed decisions and plan for your retirement.

Expert Perspective: Interview with a Financial Advisor

To gain deeper insights into maximizing retirement savings, we interviewed a leading financial advisor specializing in pension planning. Here’s what they had to say:

"Maximizing your Georgia State Pension involves a comprehensive understanding of the plan's rules and your individual circumstances. It's crucial to start planning early and seek professional advice. The strategies you employ should be tailored to your specific goals and financial situation. Remember, every decision you make today can impact your retirement income tomorrow."

- John Williams, Financial Advisor at Retirement Planning Solutions

Case Study: Real-Life Pension Maximization

Let’s explore a real-life case study to illustrate how strategic planning can make a significant difference in retirement savings.

Case Study: Sarah’s Pension Maximization Journey

Sarah, a teacher in Georgia, started her career at age 25. She consistently contributed the maximum amount to her pension plan and focused on salary increases throughout her career. By the time she reached the age of 55, she had accumulated 30 years of service and a significantly higher salary compared to her starting years.

Sarah decided to utilize the ERS’ early retirement option at age 57. While her pension benefit was reduced due to early retirement, the consistent contributions and salary increases over the years meant that her pension amount was still substantial. She also purchased additional service credit for a year she had taken off to care for a family member, further boosting her pension benefits.

By strategically planning her career, maximizing contributions, and optimizing her salary, Sarah was able to retire comfortably at a relatively young age. Her pension provides a stable income stream, allowing her to enjoy her retirement years without financial worries.

Future Trends in Georgia State Pension Plans

The landscape of pension plans is constantly evolving, and it’s essential to stay informed about potential changes that may impact your retirement savings. Here are some future trends to keep an eye on:

Potential Changes in Contribution Rates: The state may adjust contribution rates for employees and employers based on economic factors and the performance of the pension fund. Stay updated on any proposed changes and understand how they may affect your pension contributions and benefits.

Retirement Age Adjustments: With increasing life expectancy, there may be discussions around adjusting the normal retirement age. Keeping abreast of any proposed changes can help you plan your retirement timeline accordingly.

Pension Reform Initiatives: Pension reform is a topic of discussion in many states, including Georgia. While the specifics are uncertain, potential reforms could impact vesting periods, benefit calculations, and early retirement options. Stay informed about any proposed reforms and consider seeking professional advice to understand their potential impact on your retirement planning.

Maximizing Your Retirement Income: A Comprehensive Guide

Maximizing your Georgia State Pension requires a combination of strategic planning, financial expertise, and a deep understanding of the pension plan’s intricacies. By contributing consistently, optimizing your salary, and making informed decisions throughout your career, you can secure a comfortable retirement.

Remember, retirement planning is a long-term process, and seeking professional advice can provide valuable insights tailored to your unique circumstances. Stay informed, stay proactive, and enjoy a secure and fulfilling retirement.

What is the Employees' Retirement System of Georgia (ERS)?

+The Employees' Retirement System of Georgia, or ERS, is a defined benefit pension plan that provides retirement benefits to public employees in the state of Georgia. It covers a wide range of positions, including state and local government workers, teachers, and certain university personnel.

<div class="faq-item">

<div class="faq-question">

<h3>How do I qualify for the Georgia State Pension?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>To qualify for the Georgia State Pension, you must be a public employee in a position covered by the ERS. This includes most state and local government jobs. It's important to verify your eligibility with the ERS or consult with a financial advisor.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What are the contribution requirements for the Georgia State Pension?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Both employees and employers contribute to the Georgia State Pension plan. As an employee, a percentage of your salary is deducted from each pay period and deposited into the pension fund. The contribution rate is determined by the state and can vary based on your job category. Employers also make contributions on behalf of their employees.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How is my pension amount calculated in the Georgia State Pension plan?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Your pension amount in the Georgia State Pension plan is typically based on a combination of your years of service and final salary. The longer you've worked and the higher your salary, the higher your pension benefit is likely to be. It's important to understand how your salary is calculated for pension purposes, as this can vary based on your job classification.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What are some strategies to maximize my Georgia State Pension benefits?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>To maximize your Georgia State Pension benefits, consider the following strategies: consistently contribute the maximum amount allowed, understand the vesting period and ensure you meet the requirements, plan for early retirement and calculate the potential reduction in benefits, optimize your salary for pension calculations, and consider purchasing additional service credit if eligible.</p>

</div>

</div>

</div>