Understanding Georgia's Server Minimum Wage

Unraveling the Complexities of Georgia's Server Minimum Wage

In the intricate landscape of labor laws, the topic of server minimum wage in Georgia stands out as a multifaceted issue. This article delves deep into the specifics, offering a comprehensive guide to navigate this unique aspect of Georgia's employment regulations.

Historical Evolution of Server Minimum Wage in Georgia

To truly grasp the current scenario, we must first trace the historical evolution of server minimum wage in Georgia. This state, much like others, has undergone significant legislative changes over the years, shaping the present-day policies.

The journey began with the introduction of the Fair Labor Standards Act (FLSA) in 1938, which set the federal minimum wage. However, the story doesn't end there. Over time, states like Georgia acquired the autonomy to set their own minimum wage rates, including those specific to tipped employees like servers.

The early 2000s saw a pivotal shift when Georgia, in an attempt to stimulate its economy, opted for a server minimum wage that was lower than the federal rate. This move, although controversial, aimed to encourage businesses to hire more servers, creating a potential boost in employment opportunities.

Current Status and Key Provisions

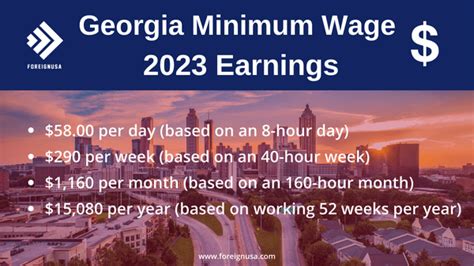

As of the most recent legislative updates, the server minimum wage in Georgia stands at $5.15 per hour, significantly lower than the federal minimum wage of $7.25 per hour. This discrepancy is allowed under the FLSA, which permits states to set their own minimum wage for tipped employees as long as the wage plus tips amount to at least the federal minimum.

Here's a breakdown of the key provisions surrounding Georgia's server minimum wage:

- Tip Credit: Employers are allowed to take a tip credit of up to $2.10 per hour, which is the difference between the federal and state minimum wages. This credit is conditional on servers receiving enough tips to make up the difference.

- Mandatory Tip Pooling: Georgia law requires restaurants to implement a tip pooling system, ensuring that servers share their tips with other employees, such as cooks and bussers. This practice aims to foster a more cohesive work environment.

- Tip Retention: Servers in Georgia are legally entitled to retain all tips they receive from customers, provided they report these earnings to their employers. This policy protects servers from any form of tip appropriation by the restaurant management.

Expert Perspective: An Interview with Labor Law Attorney, Sarah Jones

To gain deeper insights into the complexities of Georgia's server minimum wage, we reached out to labor law expert Sarah Jones. Here's what she had to say:

"Georgia's server minimum wage is a delicate balance between promoting employment opportunities and ensuring fair wages. While the lower rate might seem unfavorable at first glance, it's crucial to consider the tip credit and the state's robust tip pooling system. These provisions ensure that servers have the potential to earn significantly more than the minimum wage, fostering a dynamic and competitive workforce."

Sarah's perspective sheds light on the nuanced nature of these policies, emphasizing the importance of a holistic understanding rather than a singular focus on the minimum wage rate.

Case Study: The Impact on Server Earnings

Let's consider a real-world scenario to understand the practical implications of Georgia's server minimum wage. Meet Jennifer, a server at a popular restaurant chain in Atlanta.

On a typical week, Jennifer works an average of 30 hours and receives an average of $15 in tips per hour. Here's how her earnings break down:

Base Earnings: $5.15/hour x 30 hours = $154.50

Tip Earnings: $15/hour x 30 hours = $450

Total Weekly Earnings: $154.50 + $450 = $604.50

As this case study illustrates, even with a lower minimum wage, servers like Jennifer have the potential to earn significantly more than the federal minimum wage due to the generous tip culture and the state's supportive labor laws.

Future Trends and Potential Reforms

Looking ahead, the future of Georgia's server minimum wage remains a topic of ongoing debate. While some advocate for aligning the state's minimum wage with the federal rate, others argue for maintaining the status quo, citing the positive impact on employment opportunities.

Potential reforms might include adjusting the tip credit rate or introducing more stringent regulations on tip pooling practices. These changes could significantly impact the earnings and work dynamics of servers across the state.

Georgia's server minimum wage is a complex policy, shaped by historical context and designed to balance economic stimulation and fair labor practices. While it presents unique challenges and opportunities, a comprehensive understanding of the associated provisions is essential for employers, employees, and policymakers alike.

Frequently Asked Questions (FAQs)

What is the current server minimum wage in Georgia?

+The current server minimum wage in Georgia is 5.15 per hour, which is lower than the federal minimum wage of 7.25 per hour.

How does Georgia’s tip credit work?

+Georgia allows employers to take a tip credit of up to $2.10 per hour, which is the difference between the federal and state minimum wages. This credit ensures that servers’ earnings, including tips, meet or exceed the federal minimum wage.

Are servers in Georgia allowed to keep all their tips?

+Yes, servers in Georgia are legally entitled to retain all tips they receive from customers, provided they report these earnings to their employers. This policy protects servers’ rights to their earned tips.

What are the potential reforms being discussed for Georgia’s server minimum wage?

+Potential reforms include adjusting the tip credit rate or introducing stricter regulations on tip pooling practices. These changes aim to ensure fair practices and potentially increase server earnings.