Navigate Georgia LLC Annual Fees

Georgia, a vibrant state known for its diverse landscapes and thriving businesses, requires Limited Liability Companies (LLCs) to fulfill annual compliance obligations to maintain their legal standing. Understanding and managing these annual fees is crucial for any business owner operating within the state’s borders. Let’s dive into the intricacies of navigating Georgia’s LLC annual fees and the steps involved in ensuring compliance.

The annual fee for Georgia LLCs is an essential part of the state’s revenue generation and serves as a means to regulate and maintain records of active businesses. This fee, though mandatory, offers a straightforward and predictable aspect to the operational costs associated with running an LLC in Georgia. It’s important to note that these annual fees are distinct from the initial registration fees and other one-time costs, providing a clear annual financial commitment for LLC owners.

The annual fee structure in Georgia is designed to be straightforward and easy to understand, making it a relatively simple aspect of business ownership for LLCs. However, the exact amount and due date of these fees can vary depending on the specific circumstances of your LLC, including the date of formation and the nature of your business activities. This guide will help you understand the basics of Georgia’s LLC annual fees and provide you with the necessary tools to ensure timely and accurate compliance.

Pro Tip: Keeping accurate records of your LLC's formation date and any subsequent changes to your business structure or activities is crucial for calculating and managing your annual fees accurately.

Understanding the Annual Fee Structure

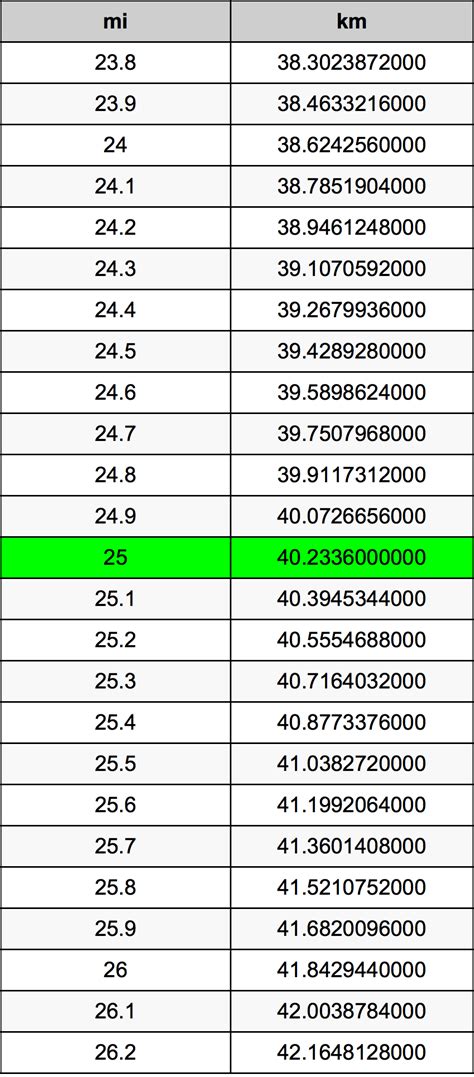

Georgia’s annual fee structure for LLCs is designed to be straightforward and predictable, ensuring that business owners can plan their financial commitments with ease. The fee is calculated based on a simple formula that considers the number of months your LLC has been active during the calendar year. This means that the longer your LLC has been operational, the higher the annual fee will be.

For example, if your LLC was formed on January 1st of the current year, you will be charged the full annual fee for that year. However, if your LLC was formed on July 1st, you will only be charged for the remaining months of the year, resulting in a lower fee for that specific year. This formula ensures that the fee is proportional to the amount of time your LLC has been active, providing a fair and equitable system for all businesses.

The fee is due annually, on the last day of the month in which your LLC was formed. For instance, if your LLC was formed on March 15th, the annual fee would be due on March 31st of each subsequent year. This due date system ensures that all LLCs have a clear and consistent deadline for their annual fee payments, making it easier to manage and plan for these financial obligations.

How much is the annual fee for an LLC in Georgia?

+The annual fee for an LLC in Georgia is based on a formula that considers the number of months your LLC has been active during the calendar year. For the year 2023, the fee is $50 for the first year and $100 for each subsequent year. It's important to note that these fees are subject to change, so it's advisable to check with the Georgia Secretary of State's office for the most up-to-date information.

Managing Your Annual Fee Payment

Ensuring that your LLC’s annual fee is paid on time is crucial to maintaining your business’s good standing with the state of Georgia. Timely payment not only ensures that your business remains compliant but also avoids additional penalties and fees associated with late payments or non-compliance.

To manage your annual fee payment effectively, it’s recommended to set reminders and allocate funds accordingly in your business budget. Many business owners find it helpful to create a dedicated annual fee payment calendar or utilize accounting software that can automatically generate reminders and track payment due dates.

Additionally, staying informed about any changes to the annual fee structure or due dates is essential. The Georgia Secretary of State’s office regularly provides updates and notifications regarding these matters, so it’s advisable to subscribe to their mailing list or regularly check their website for the latest information.

Benefits of Timely Payment

- Ensures your LLC remains in good standing with the state.

- Avoids additional penalties and late fees.

- Maintains a positive business reputation.

Consequences of Late Payment

- Risk of administrative dissolution.

- Potential for additional fees and penalties.

- Negative impact on your business's creditworthiness.

Late Payment Penalties and Non-Compliance

While the annual fee structure in Georgia is designed to be straightforward and easy to manage, late payments or non-compliance can result in significant penalties and consequences for your LLC. It’s important to understand the potential repercussions to ensure that your business remains compliant and avoids unnecessary financial burdens.

If your LLC fails to pay the annual fee by the due date, you may be subject to late fees and penalties. The exact amount of these penalties can vary depending on the specific circumstances and the duration of the late payment. Additionally, repeated instances of late payment or non-compliance can result in the administrative dissolution of your LLC, which means your business will no longer be recognized as a legal entity in the state of Georgia.

Administrative dissolution can have severe consequences for your business, including the loss of legal protection for your personal assets, the inability to conduct business in the state, and potential tax implications. To avoid these detrimental effects, it’s crucial to prioritize timely payment of your annual fees and stay informed about any changes to the fee structure or due dates.

What happens if I forget to pay my LLC's annual fee in Georgia?

+If you forget to pay your LLC's annual fee in Georgia, you may be subject to late fees and penalties. The exact amount of these penalties can vary depending on the duration of the late payment. Repeated instances of late payment or non-compliance can result in the administrative dissolution of your LLC, which means your business will no longer be recognized as a legal entity in the state. It's crucial to prioritize timely payment to avoid these consequences.

Annual Report Requirements

In addition to the annual fee, Georgia LLCs are also required to file an annual report with the Secretary of State’s office. This report serves as a way for the state to maintain accurate and up-to-date records of active businesses and their key information. The annual report provides an opportunity for LLCs to update any changes to their business structure, ownership, or registered agent information.

The annual report must be filed within a specific timeframe, usually within a few months of the LLC’s anniversary date. Failure to file the annual report on time can result in penalties and may also impact your LLC’s good standing with the state. It’s important to note that the annual report and the annual fee are two separate obligations, and both must be fulfilled to maintain compliance.

To streamline the annual report filing process, many LLCs utilize online filing services or accounting software that can generate the necessary forms and guide you through the filing process. Additionally, staying informed about any changes to the annual report requirements or filing deadlines is crucial to ensure that your LLC remains in compliance.

What information is required in the annual report for Georgia LLCs?

+The annual report for Georgia LLCs typically requires information such as the LLC's name, registered agent details, principal office address, and any changes to the LLC's management or ownership structure. It's important to provide accurate and up-to-date information to maintain compliance. Utilizing online filing services or accounting software can simplify the process and ensure that all necessary information is included.

Conclusion

Navigating Georgia’s LLC annual fees is an essential aspect of business ownership in the state. By understanding the fee structure, managing your payments effectively, and staying informed about compliance requirements, you can ensure that your LLC remains in good standing with the state. Remember, timely payment of annual fees and the submission of annual reports are crucial to maintaining your business’s legal status and avoiding unnecessary penalties and consequences.

Stay organized, set reminders, and prioritize these annual obligations to continue operating your LLC with confidence and compliance in Georgia.