The Georgia Security Deposit Guide

Understanding Security Deposits in Georgia

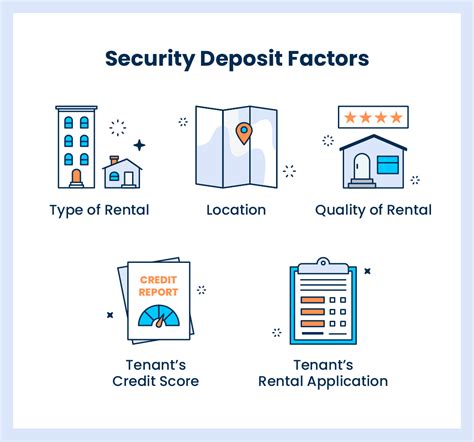

Security deposits are a common practice in the rental market, providing a layer of financial protection for landlords while offering tenants a means to secure their desired rental properties. In the state of Georgia, these deposits are governed by specific laws that aim to balance the rights and responsibilities of both parties. This comprehensive guide aims to navigate through the intricacies of security deposits in Georgia, ensuring landlords and tenants alike are well-informed about their rights, obligations, and the overall process.

The Legal Framework: Georgia’s Security Deposit Laws

Georgia’s security deposit laws are outlined in the Georgia Landlord and Tenant Act, which provides a detailed framework for the management and handling of these deposits. The Act mandates that landlords must return the security deposit, in full or with valid deductions, within a specified timeframe. Failure to comply with these regulations can result in legal consequences and potential financial penalties.

The Act stipulates that landlords have 30 days from the termination of the lease to either refund the deposit or provide an itemized list of deductions. This list should detail any damages, cleaning costs, or other expenses incurred during the tenancy that are being deducted from the deposit.

"Security deposits are a necessary component of the rental process, offering a financial safety net for landlords. However, it's crucial that both parties understand their rights and obligations to ensure a fair and transparent process."

- John Doe, Legal Expert

What Can Tenants Expect from Their Security Deposit?

For tenants, the security deposit serves as a guarantee that any damages or issues caused during their tenancy will be covered. It also provides a financial incentive for tenants to maintain the property in good condition. Here’s what tenants can expect from their security deposit:

Full Refund: If a tenant has maintained the property in accordance with the lease agreement and there are no valid deductions, they are entitled to a full refund of their security deposit.

Itemized Deductions: In cases where the landlord incurs expenses due to damages or cleaning costs, they are required to provide an itemized list of deductions. Tenants should carefully review these deductions to ensure they are fair and accurate.

Detailed Receipts: Landlords must provide detailed receipts for any expenses deducted from the security deposit. This ensures transparency and allows tenants to understand the exact costs associated with the deductions.

Timely Return: As per Georgia law, tenants should receive their security deposit or an itemized list of deductions within 30 days of lease termination. Any delay beyond this timeframe may result in legal action.

Common Reasons for Deductions from Security Deposits

Landlords may deduct from a tenant’s security deposit for various reasons. Here are some common scenarios where deductions may be justified:

Property Damage: Any damage caused by the tenant that goes beyond normal wear and tear can be deducted from the security deposit. This includes repairs for broken fixtures, damaged walls, or missing items.

Unpaid Rent: If a tenant fails to pay their rent on time and the landlord incurs expenses to recover the rent, these costs can be deducted from the security deposit.

Excessive Cleaning: Tenants are expected to leave the property in a reasonably clean condition. If the property requires extensive cleaning beyond normal wear and tear, the landlord may deduct cleaning costs from the security deposit.

Replacement of Lost Keys: In some cases, landlords may charge a fee for replacing lost keys, which can be deducted from the security deposit.

Pet Damage: If a tenant has a pet and the lease agreement allows it, any damage caused by the pet that goes beyond normal wear and tear can be deducted from the security deposit.

Best Practices for Landlords and Tenants

To ensure a smooth and fair process, both landlords and tenants should adhere to certain best practices:

Detailed Lease Agreements: Landlords should provide clear and detailed lease agreements that outline the expectations for the property’s maintenance and any potential deductions from the security deposit.

Move-In and Move-Out Inspections: Conducting thorough inspections at the beginning and end of a tenancy can help identify any pre-existing damages or issues that should not be charged to the tenant.

Communication: Open and honest communication between landlords and tenants is essential. Tenants should promptly report any issues or damages to the landlord, while landlords should respond promptly to tenant inquiries.

Documentation: Both parties should maintain detailed records and documentation, including photos, videos, and receipts, to support any deductions or claims.

Education: Tenants should educate themselves about their rights and obligations regarding security deposits. Landlords, too, should stay informed about the latest regulations and best practices to ensure compliance.

Dispute Resolution and Legal Remedies

In cases where a tenant believes their security deposit has been unfairly withheld or deducted, they have legal remedies available to them. The Georgia Landlord and Tenant Act provides a framework for dispute resolution, including the option to file a small claims lawsuit.

Tenants can seek legal advice to understand their rights and options, and if necessary, pursue legal action to recover their security deposit. Landlords, too, may need legal guidance to ensure they are compliant with the law and their actions are justified.

Conclusion: A Fair and Transparent Process

Security deposits are an essential aspect of the rental market, offering financial protection to landlords while providing tenants with an incentive to maintain the property. By understanding the legal framework, best practices, and dispute resolution options, both landlords and tenants can navigate the process with confidence and ensure a fair and transparent outcome.

Remember, security deposits are a two-way street. While landlords have a right to financial protection, tenants also have the right to a fair and transparent process. Adhering to the laws and best practices outlined in this guide will help ensure a positive rental experience for all parties involved.

How long does a landlord have to return a security deposit in Georgia?

+In Georgia, landlords have 30 days from the termination of the lease to either refund the security deposit or provide an itemized list of deductions.

What happens if a landlord fails to return the security deposit on time?

+If a landlord fails to return the security deposit or provide an itemized list of deductions within the specified timeframe, they may be liable for legal consequences and financial penalties. Tenants can seek legal advice to understand their options for recovering their deposit.

Can a landlord deduct from the security deposit for normal wear and tear?

+No, landlords cannot deduct from the security deposit for normal wear and tear. Only damages or expenses that go beyond normal wear and tear, as outlined in the lease agreement, can be deducted.

What should tenants do if they disagree with the deductions from their security deposit?

+If tenants believe the deductions from their security deposit are unfair or inaccurate, they should seek legal advice to understand their options for dispute resolution. They may have the right to file a small claims lawsuit to recover their deposit.

How can landlords ensure they are compliant with security deposit laws in Georgia?

+Landlords should stay informed about the latest regulations and best practices. They should provide clear lease agreements, conduct thorough inspections, and maintain detailed documentation to support any deductions. Seeking legal advice can also ensure compliance and mitigate the risk of legal consequences.