Salaried Employees: 7 Georgia Labor Law Insights

The Basics: Defining Salaried Employees

Salaried employees are a distinct category within the workforce, typically characterized by their fixed annual salary and the expectation of a full-time commitment. Unlike hourly workers, their compensation is not directly linked to the number of hours worked but rather is based on an agreed-upon salary package. This distinction brings about several key differences in the way labor laws apply.

Understanding the unique position of salaried employees is essential, as it forms the foundation for comprehending their rights and the responsibilities of employers under Georgia's labor laws.

Compensation and Overtime: A Complex Equation

One of the most critical aspects for salaried employees is the question of overtime pay. Under the Fair Labor Standards Act (FLSA), salaried employees who meet certain criteria are considered exempt from overtime pay requirements. This means that even if they work beyond the standard 40-hour workweek, they are not entitled to additional compensation for those extra hours.

Pros of Exempt Status

- Exempt status can provide employees with a sense of job security, as their salary is not dependent on the number of hours worked.

- It allows for a degree of flexibility in managing workloads, as employees are not penalized for occasional longer workdays.

Cons of Exempt Status

- Exempt employees may feel obligated to work excessive hours without additional compensation, potentially leading to burnout.

- The lack of overtime pay can be a disadvantage for employees who prefer a more structured work schedule and compensation model.

Determining Exempt Status: The FLSA Criteria

To be classified as exempt under the FLSA, salaried employees must meet specific criteria:

- Salary Basis: Employees must receive a fixed salary that is not subject to reduction due to variations in the quality or quantity of work performed.

- Job Duties: Their primary duties must involve executive, administrative, or professional work, as defined by the FLSA.

- Minimum Salary Threshold: The employee's salary must meet a certain threshold, which is periodically adjusted by the Department of Labor.

Non-Exempt Salaried Employees: A Different Scenario

Not all salaried employees are exempt from overtime pay. If a salaried employee fails to meet one or more of the FLSA criteria, they are considered non-exempt and are entitled to overtime pay for hours worked beyond the standard workweek.

Calculating Overtime for Non-Exempt Salaried Employees

- Determine the employee's regular hourly rate by dividing their annual salary by 52 weeks and then by the average number of hours worked per week.

- Multiply the regular hourly rate by 1.5 to find the overtime rate.

- Calculate the overtime pay by multiplying the overtime rate by the number of hours worked beyond 40 in a workweek.

Vacation and Sick Leave Policies

Another critical aspect for salaried employees is the treatment of vacation and sick leave. Unlike hourly workers, who often accrue paid time off based on hours worked, salaried employees’ paid time off policies can vary widely.

Can salaried employees be required to use paid time off for sick days?

+While there is no federal law mandating paid sick leave, some states and local governments have implemented such requirements. In Georgia, there is no statewide mandate for paid sick leave, but employers may choose to offer it as a benefit. However, if an employer does provide paid sick leave, they cannot force employees to use it exclusively for sick days. Employees should have the flexibility to use their paid time off for personal or family needs as well.

Employment Contracts and Termination

Salaried employees often have more detailed and specific employment contracts compared to hourly workers. These contracts outline the terms of employment, including salary, benefits, and termination policies.

It is crucial for both employers and employees to carefully review and understand these contracts, as they define the rights and responsibilities of each party. In the event of termination, the terms outlined in the contract will guide the process and any associated severance or notice periods.

Conclusion: Navigating the Complexities

Understanding the unique dynamics of salaried employment under Georgia labor laws is a multifaceted task. From compensation structures to paid time off policies and employment contracts, there are numerous considerations for both employers and employees.

By familiarizing themselves with these laws and staying informed about their rights and responsibilities, salaried employees can ensure they are treated fairly and legally. Similarly, employers can create a compliant and harmonious work environment by adhering to the state's labor regulations.

What happens if an employer misclassifies an employee as exempt when they should be non-exempt?

+Misclassification can lead to significant legal consequences for employers. If an employee is found to have been misclassified as exempt, the employer may be liable for unpaid overtime wages, liquidated damages, and attorney's fees. It is essential for employers to carefully evaluate each employee's position to ensure proper classification and avoid potential legal issues.

<div class="faq-item">

<div class="faq-question">

<h3>Are there any exceptions to the FLSA criteria for exempt status?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, there are certain exceptions and exemptions to the FLSA criteria. For example, certain computer professionals and outside sales employees may be exempt even if they do not meet all the criteria. Additionally, certain industries and professions may have specific exemptions. It is important for employers and employees to consult with legal experts to understand the specific exemptions that may apply to their situation.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can salaried employees request flexibility in their work schedules to accommodate personal needs?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Absolutely! While salaried employees are expected to fulfill their job responsibilities, they can certainly request flexibility in their work schedules. Many employers understand the value of work-life balance and are open to accommodating reasonable requests. However, it is important to maintain open communication with supervisors and ensure that any schedule adjustments do not negatively impact job performance or the employer's operations.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any state or local laws in Georgia that provide additional protections for salaried employees beyond the FLSA?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

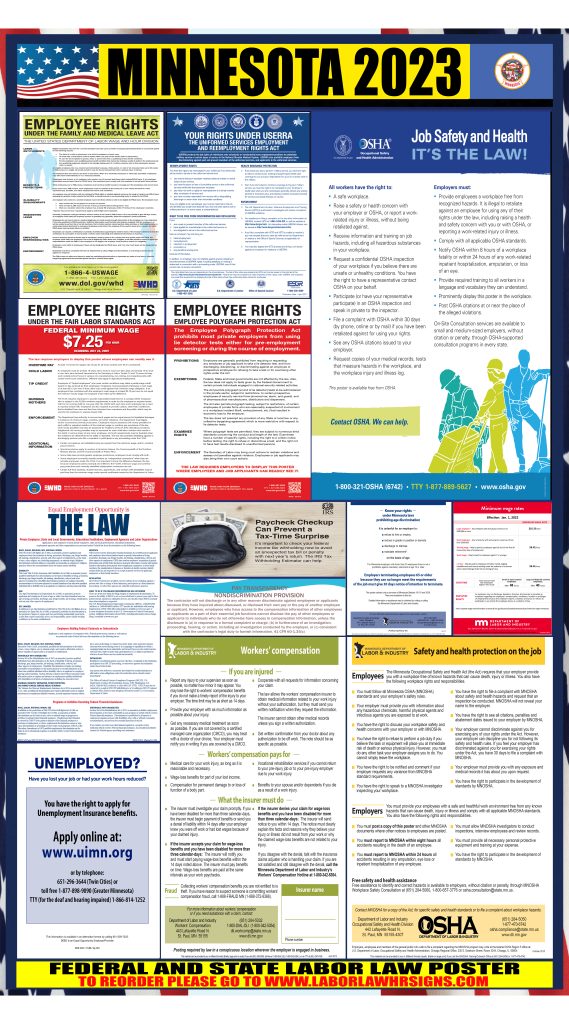

<p>Yes, Georgia has its own set of labor laws that provide protections for all employees, including salaried workers. For instance, the Georgia Minimum Wage Act ensures that employees are paid at least the state minimum wage, which is currently $7.25 per hour. Additionally, Georgia's anti-discrimination laws, such as the Georgia Equal Employment for Persons with Disabilities Code, offer protections against discrimination based on various factors.</p>

</div>

</div>