The Ultimate Guide to Georgia's Education Savings

The world of education savings can seem daunting, especially for those new to the process. With a range of options and various plans, it’s easy to feel overwhelmed. But fear not, as we delve into the specifics of Georgia’s Education Savings program, you’ll find a comprehensive and accessible system designed to support your child’s future educational endeavors.

Education savings is a crucial step towards securing your child's future and ensuring they have the necessary financial backing for their academic journey.

Understanding the Basics of Education Savings

Education savings, simply put, is a dedicated financial strategy to cover the costs associated with your child’s education. This can include tuition fees, books, supplies, and even accommodation for higher education. By starting early and utilizing the right tools, you can ensure a smooth and financially secure transition into higher education for your child.

In Georgia, the Education Savings program offers a structured and tax-efficient way to save for your child’s education. The program, backed by the state government, provides a range of benefits and incentives to encourage parents and guardians to start saving early.

The Georgia Education Savings Plan

The Georgia Education Savings Plan, often referred to as the GES Plan, is a 529 college savings plan. Named after Section 529 of the Internal Revenue Code, these plans are tax-advantaged and specifically designed to encourage savings for future education expenses.

The GES Plan offers a flexible and accessible way to save, allowing you to contribute as much or as little as you can afford. The plan is open to anyone, regardless of residency or income, making it an inclusive option for all Georgia families.

Benefits of the GES Plan

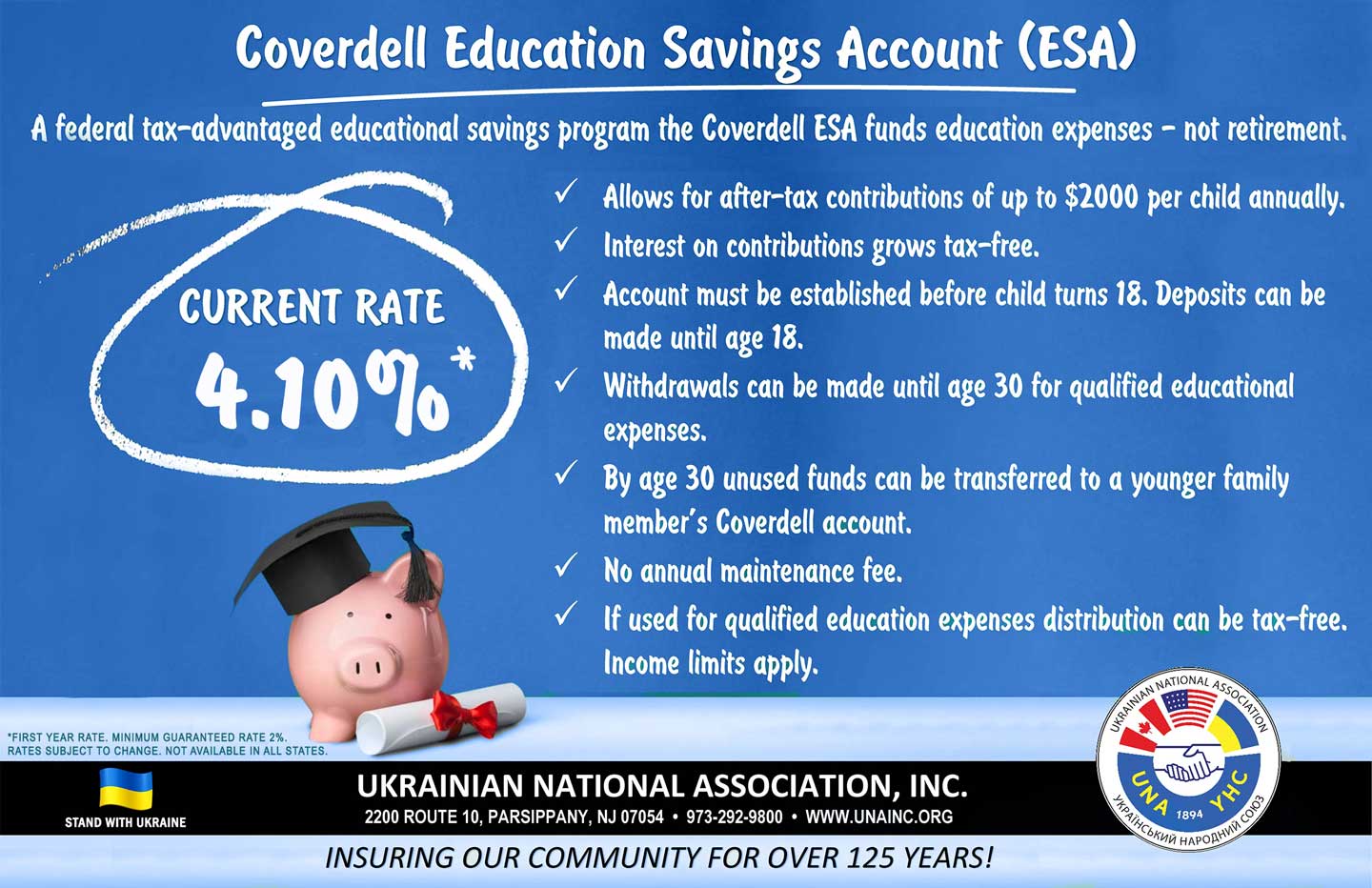

Tax Advantages: One of the key benefits of the GES Plan is the tax efficiency. Contributions to the plan grow tax-free, and withdrawals for qualified education expenses are also tax-free at the federal and state level. This means that the money you save is allowed to grow faster, providing a substantial advantage over traditional savings accounts.

Flexibility: The GES Plan offers flexibility in terms of contributions and investment choices. You can choose from a range of investment options, including age-based portfolios, static portfolios, and individual funds. This allows you to tailor your savings strategy to your risk tolerance and financial goals.

No Income Restrictions: Unlike some other savings plans, the GES Plan does not have income restrictions. This means that regardless of your income level, you can still benefit from the plan and start saving for your child’s education.

Portability: The plan is portable, meaning you can use the savings for any eligible educational institution in the country. This includes traditional colleges and universities, as well as technical and vocational schools.

How the GES Plan Works

The GES Plan operates through a simple process:

Opening an Account: You can open an account online or through a financial advisor. You’ll need to provide basic information about yourself and the beneficiary (your child).

Contributions: You can contribute any amount, from a one-time lump sum to regular monthly contributions. The plan allows for contributions from anyone, including grandparents, relatives, and friends.

Investment Choices: Once you’ve opened an account, you’ll select your investment options. The plan offers a range of age-based portfolios, which automatically adjust their asset allocation as your child gets closer to college age.

Growth and Management: Over time, your contributions will grow based on the performance of your chosen investments. You can monitor and manage your account online, making changes as needed.

Withdrawal for Education: When your child is ready for college, you can start withdrawing funds for qualified education expenses. These include tuition, fees, books, supplies, and even room and board.

Expert Perspective: Interview with a Financial Advisor

To gain further insights into the GES Plan, we spoke to Ms. Emma Johnson, a certified financial planner with extensive experience in education savings.

Q: What are the key advantages of the GES Plan for Georgia families?

Ms. Johnson: The GES Plan offers a unique opportunity for Georgia families to save for their children’s education with significant tax benefits. The plan’s flexibility allows families to start saving early, even with small contributions, and watch their savings grow tax-free. This is a powerful incentive for long-term planning.

Q: Are there any potential drawbacks or challenges?

Ms. Johnson: One potential challenge is understanding the eligibility criteria for tax-free withdrawals. While the plan offers a wide range of qualified education expenses, it’s important to stay informed about what expenses are eligible. Additionally, families should be aware of the potential impact of the plan on financial aid eligibility. It’s a delicate balance, but with proper planning, these challenges can be navigated successfully.

Q: How can families ensure they’re making the most of the GES Plan?

Ms. Johnson: Education is key. Families should take the time to understand the plan’s features, tax benefits, and investment options. Regular reviews of the account, especially as college approaches, can help ensure the savings are on track and aligned with the beneficiary’s educational goals. It’s also beneficial to seek professional advice to tailor the plan to your specific financial situation and goals.

Real-Life Case Study: A Success Story

Meet the Williams family, who utilized the GES Plan to save for their daughter, Sarah’s, education.

The Williams family started early, opening a GES Plan account when Sarah was just a toddler. They opted for regular monthly contributions, automatically deducted from their bank account. Over the years, they watched their savings grow, with the help of the plan’s tax advantages.

As Sarah approached college age, the Williams family reviewed their account and made adjustments to the investment strategy, moving towards more conservative options. This ensured their savings were protected and ready for withdrawal when needed.

When Sarah was accepted into her dream college, the Williams family was ready. They withdrew funds from the GES Plan to cover Sarah’s tuition, fees, and even a portion of her room and board. The process was smooth, and they were able to provide substantial financial support for Sarah’s education.

Sarah, now a college graduate, is incredibly grateful for her family’s foresight and planning. The GES Plan allowed her to focus on her studies without the stress of financial burden, and she’s now pursuing her dream career.

Future Trends: Education Savings in Georgia

As the cost of education continues to rise, the importance of education savings plans like the GES Plan will only grow. The plan’s flexibility and tax advantages make it an attractive option for families looking to secure their child’s future.

Looking ahead, we can expect to see continued development and innovation in education savings. The GES Plan is likely to evolve to meet the changing needs of Georgia families, offering new investment options and potentially expanded benefits.

Practical Application Guide: Getting Started with the GES Plan

Now that you understand the benefits and workings of the GES Plan, here’s a step-by-step guide to getting started:

Step 1: Research and Understand: Take the time to thoroughly research the GES Plan. Understand the tax advantages, investment options, and eligibility criteria. The Georgia State Treasury’s website offers a wealth of information to get you started.

Step 2: Open an Account: Visit the GES Plan website and open an account. You’ll need basic information about yourself and the beneficiary. Consider seeking advice from a financial advisor to ensure you’re making the right choices for your financial situation.

Step 3: Choose Your Investment Strategy: Select your investment options based on your risk tolerance and financial goals. Age-based portfolios are a popular choice, as they automatically adjust over time.

Step 4: Start Saving: Begin contributing to your GES Plan account. You can contribute any amount, and you have the flexibility to adjust your contributions as your financial situation changes.

Step 5: Regular Reviews: Set a schedule to review your account. As your child gets closer to college age, you may want to adjust your investment strategy to protect your savings. Stay informed about eligible expenses and potential changes to the plan.

Conclusion

The GES Plan offers a powerful and accessible way for Georgia families to save for their child’s education. With tax advantages, flexibility, and portability, it’s a comprehensive solution for long-term education planning. By starting early and staying informed, you can ensure your child’s future educational goals are within reach.

Remember, education is an investment in your child’s future, and the GES Plan provides a structured and rewarding way to make that investment. So, take the first step today and begin your journey towards a financially secure educational future for your child.

What is the minimum and maximum contribution allowed in the GES Plan?

+There is no minimum contribution required to open a GES Plan account. However, the maximum contribution limit is set at $400,000 per beneficiary. This limit is designed to ensure the plan remains accessible and affordable for all families.

<div class="faq-item">

<div class="faq-question">

<h3>Can I use the GES Plan for private school expenses?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, the GES Plan can be used for qualified expenses at private elementary, middle, and high schools. This includes tuition, fees, and other eligible expenses. However, it's important to note that the plan's primary focus is on higher education expenses, such as college and vocational schools.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any income restrictions for opening a GES Plan account?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>No, there are no income restrictions for opening a GES Plan account. The plan is open to anyone, regardless of income level, making it an inclusive option for all Georgia families. This inclusivity ensures that every family has the opportunity to save for their child's education.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I use the GES Plan for my child's education if they attend college outside of Georgia?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Absolutely! The GES Plan is portable, meaning you can use the savings for any eligible educational institution in the country. Whether your child attends college in Georgia or elsewhere, the plan's tax advantages and flexibility remain the same.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any penalties for withdrawing funds for non-qualified expenses?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Withdrawing funds for non-qualified expenses may result in certain penalties and taxes. It's important to understand the eligibility criteria for tax-free withdrawals to avoid any potential penalties. Seeking professional advice can help ensure you navigate these complexities successfully.</p>

</div>

</div>

</div>