The Ultimate Guide to Georgia's Durable Power of Attorney

Understanding the Importance of Durable Power of Attorney

When it comes to planning for the future, one crucial legal document that often goes overlooked is the Durable Power of Attorney (DPOA). This powerful tool grants an individual, known as the agent or attorney-in-fact, the authority to make decisions on behalf of another person, referred to as the principal. In Georgia, the DPOA holds significant weight, providing a safety net for individuals who may become incapacitated or unable to make their own decisions.

Imagine a scenario where an elderly loved one, let’s call them Ms. Johnson, suffers a sudden stroke, rendering her incapable of communicating her wishes or managing her affairs. Without a DPOA in place, the family would face a challenging and time-consuming process to gain legal authority over her decisions. This is where the DPOA steps in as a vital safeguard, ensuring that Ms. Johnson’s wishes are respected and her affairs are handled smoothly.

What Sets Georgia’s DPOA Apart?

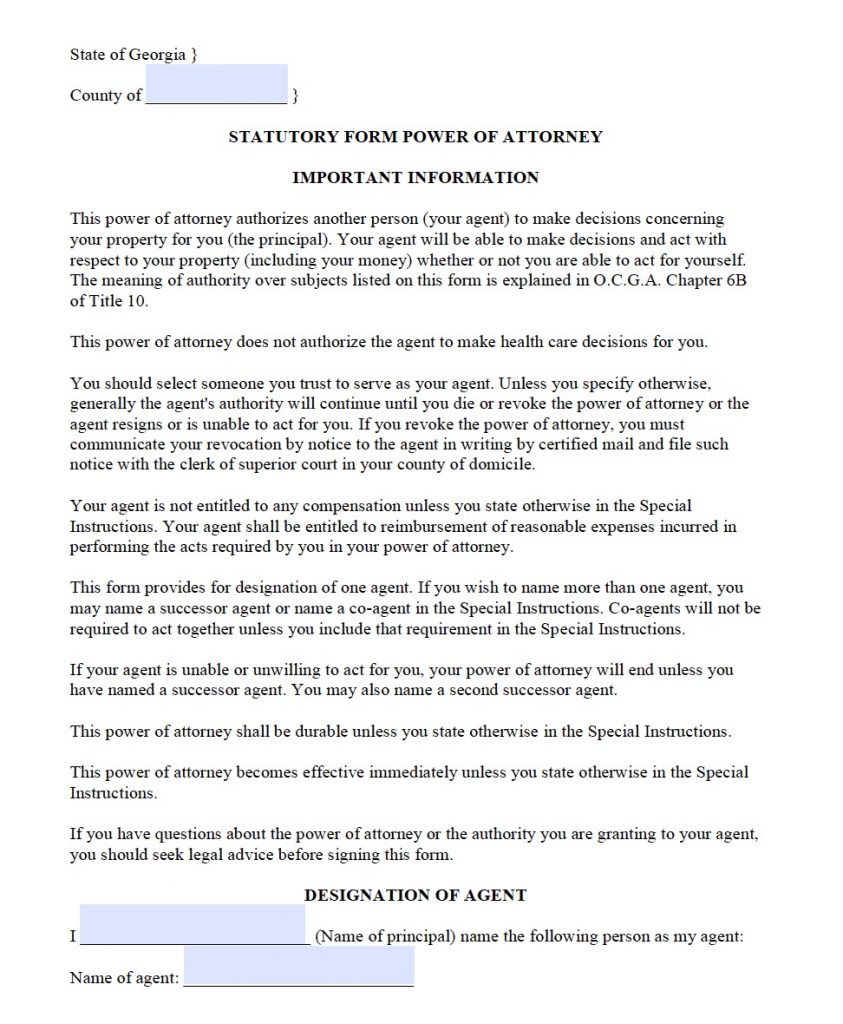

Georgia’s approach to the Durable Power of Attorney is comprehensive and unique, offering a wide range of protections and benefits. Unlike some states, Georgia allows for both “limited” and “general” DPOAs, giving individuals the flexibility to tailor the document to their specific needs. This means that the principal can grant authority over specific areas, such as financial matters or healthcare decisions, or provide a broader scope of power to the agent.

One key advantage of Georgia’s DPOA is its durability. While some states require the DPOA to be updated or revoked upon the principal’s incapacity, Georgia’s DPOA remains valid even if the principal becomes incapacitated. This ensures that the agent’s authority continues uninterrupted, providing stability during a potentially stressful time.

Georgia's commitment to durability in its DPOA reflects a forward-thinking approach, ensuring that individuals' wishes are honored regardless of their physical or mental state.

The Role of the Agent: A Trusted Ally

Choosing the right individual to serve as the agent is a critical decision. The agent holds a position of trust and responsibility, as they will be making decisions that directly impact the principal’s life. Ideally, the agent should be someone who understands the principal’s values, preferences, and wishes intimately. This could be a family member, a close friend, or even a trusted professional.

Consider the story of Mr. Davis, who appointed his daughter, Sarah, as his agent. Sarah, being familiar with her father’s conservative financial approach and his wishes for a dignified healthcare experience, was well-equipped to make decisions that aligned with his values. This level of trust and understanding is crucial for a successful DPOA arrangement.

Financial Matters: Empowering Your Agent

The financial aspect of the DPOA is often a primary concern for individuals. In Georgia, the DPOA can grant the agent the power to manage various financial matters, including:

- Handling bank accounts and investments

- Paying bills and managing debt

- Buying and selling property

- Filing tax returns

- Conducting business transactions

With these powers, the agent can ensure that the principal’s financial affairs are in order, even if they are unable to do so themselves. It’s a way to maintain financial stability and security during challenging times.

Pros of Financial Powers:

- Ensures timely bill payments, preventing late fees and penalties.

- Facilitates investment management, protecting the principal's assets.

- Allows for seamless property transactions, such as selling an unused asset.

Cons to Consider:

- Requires trust in the agent's financial decision-making abilities.

- May involve complex financial matters that demand expertise.

- Carries the risk of abuse if not properly monitored.

Healthcare Decisions: A Compassionate Approach

The healthcare component of the DPOA is just as vital as the financial aspect. In Georgia, the DPOA can grant the agent the authority to make healthcare decisions on behalf of the principal. This includes choices related to:

- Medical treatments and procedures

- End-of-life care decisions

- Admission to healthcare facilities

- Release of medical records and information

Having a trusted agent make these decisions can provide peace of mind, knowing that their wishes will be respected and their care will be guided by someone they trust.

Case Study: A Compassionate Healthcare Decision

Meet Ms. Wright, a retired teacher who appointed her best friend, Linda, as her healthcare agent. When Ms. Wright was diagnosed with a terminal illness, Linda’s role became crucial. She made decisions based on Ms. Wright’s previously expressed wishes, ensuring that her final days were spent comfortably and according to her preferences. This case study highlights the importance of having a compassionate and knowledgeable agent in place.

Revoking and Updating Your DPOA: A Dynamic Process

It’s important to note that the DPOA is not a static document. Life circumstances can change, and so can an individual’s wishes. Georgia’s laws allow for the revocation or modification of the DPOA at any time, provided the principal is of sound mind and capable of making decisions.

Consider the scenario of Mr. Wilson, who initially appointed his son as his agent. Over time, as his health improved, he decided to revoke the DPOA and handle his affairs independently. This flexibility ensures that individuals retain control over their lives and can adapt their plans as needed.

Expert Perspectives: Advice from Legal Professionals

To gain further insights, we reached out to legal experts in Georgia for their perspectives on the DPOA.

"The DPOA is a powerful tool, but it's essential to choose an agent wisely. Ensure they understand the responsibilities and are willing to act in the principal's best interests."

- John Miller, Estate Planning Attorney

Future Trends: Evolving with Georgia’s DPOA

As society progresses, so do legal frameworks. Georgia’s DPOA is no exception, with ongoing discussions and potential future developments. One area of focus is the use of technology in executing and managing DPOAs. Electronic signatures and digital platforms may play a larger role in the future, offering convenience and accessibility.

Conclusion: A Comprehensive Approach to Future Planning

In conclusion, Georgia’s Durable Power of Attorney is a comprehensive and flexible tool that empowers individuals to plan for their future with confidence. By granting trusted agents the authority to make financial and healthcare decisions, individuals can ensure their wishes are respected and their affairs are handled smoothly. Remember, the DPOA is a dynamic process, and it’s important to review and update it as needed to reflect changing circumstances and wishes.

With a well-crafted DPOA in place, individuals can rest assured that their future is secure, and their wishes will be honored. It’s a powerful step towards ensuring peace of mind and a seamless transition during challenging times.

Planning ahead with a Durable Power of Attorney is a proactive approach to safeguarding your future and ensuring your wishes are respected.

Frequently Asked Questions (FAQ)

Can I appoint more than one agent in my DPOA?

+Yes, you can appoint multiple agents to act jointly or separately. This can provide redundancy and ensure decision-making continues if one agent is unavailable.

<div class="faq-item">

<div class="faq-question">

<h3>What happens if I become incapacitated and don't have a DPOA?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>In the absence of a DPOA, a court may appoint a guardian or conservator to make decisions on your behalf. This process can be lengthy and costly, making a DPOA a more efficient and preferred option.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I limit the powers granted to my agent in the DPOA?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Absolutely! Georgia's DPOA allows for customization. You can specify the powers granted to your agent, ensuring they only have authority over the areas you choose.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Is there an age requirement for appointing an agent in Georgia's DPOA?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>No, there is no specific age requirement. However, it's essential that the principal and the chosen agent are both legally competent and capable of understanding the responsibilities involved.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How often should I review and update my DPOA?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>It's recommended to review your DPOA periodically, especially after significant life changes. Regular updates ensure your wishes are accurately reflected and your plan remains current.</p>

</div>

</div>

</div>