Top 5 Strategies for Georgia's 529 Plan Tax Deductions

Unlocking the Power of 529 Plans: A Comprehensive Guide to Maximizing Tax Benefits in Georgia

Let’s dive into the world of 529 plans, a financial tool that can be a game-changer for those looking to invest in their child’s education. Georgia, known for its robust education system and forward-thinking initiatives, offers an excellent opportunity to take advantage of these plans. By understanding the top strategies, you can navigate the complexities of 529 plans and unlock significant tax deductions. This comprehensive guide will explore the best approaches to maximize your benefits and ensure a secure future for your child’s educational journey.

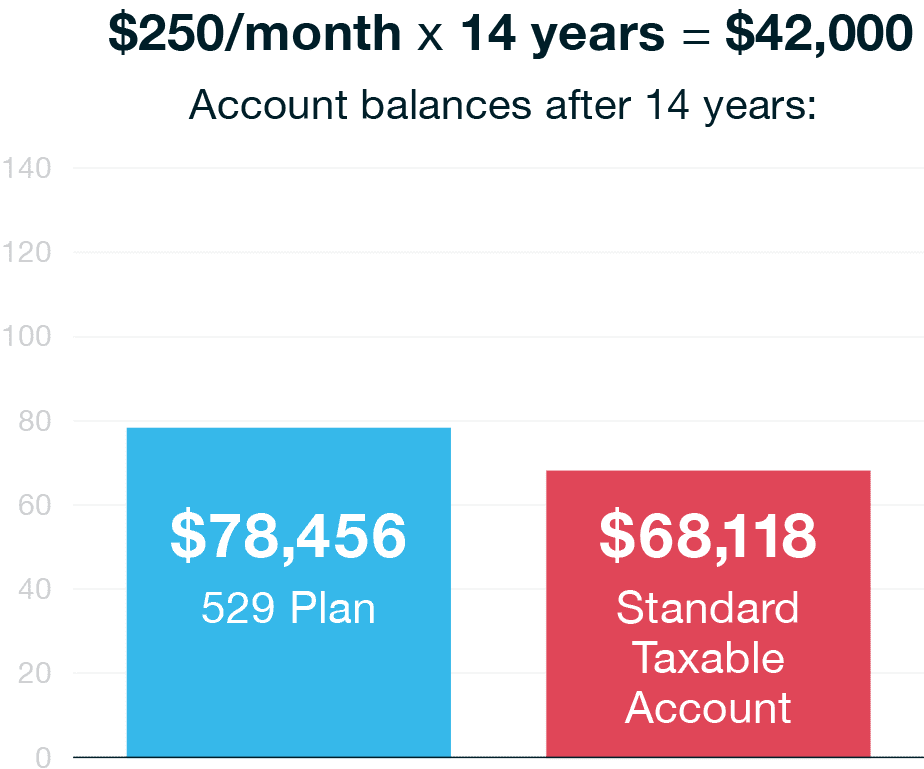

Strategy 1: Understand the Basics of 529 Plans At its core, a 529 plan is a tax-advantaged savings plan designed specifically for education expenses. It allows you to set aside funds for your child’s education, whether it’s for elementary, secondary, or higher education. The beauty of these plans lies in their tax-efficient nature, offering various benefits that can significantly reduce your overall tax burden.

In Georgia, the state’s 529 plan, known as the Path2College 529 Plan, is administered by the Georgia Higher Education Savings Plan Trust Fund. It provides residents with a flexible and secure way to save for education expenses, offering a range of investment options to cater to different risk profiles. Understanding the basic structure and benefits of these plans is the first step towards maximizing your tax deductions.

Strategy 2: Take Advantage of State Tax Deductions One of the most significant advantages of the Georgia 529 Plan is the state tax deduction it offers. Contributions made to the plan are eligible for a state income tax deduction, up to a certain limit. This means that by investing in the plan, you can reduce your taxable income, leading to potential savings on your state tax bill.

For example, let’s consider a hypothetical scenario. If you contribute 5,000 to the Georgia 529 Plan, you could potentially save up to 1,000 on your state taxes, depending on your tax bracket. This is a substantial incentive to start investing in the plan and can make a notable difference in your overall financial planning.

Strategy 3: Utilize Matching Contributions and Grants To further enhance the benefits of the 529 Plan, Georgia offers matching contributions and grants to eligible participants. These incentives are designed to encourage families to save for their child’s education and provide an additional boost to their savings.

For instance, the Georgia Student Finance Commission (GSFC) provides a matching grant program for eligible low- to moderate-income families. This program matches a portion of the family’s contributions, up to a certain limit, effectively doubling their savings. By taking advantage of these grants, families can accelerate their savings and reach their educational goals more efficiently.

Strategy 4: Diversify Your Investment Portfolio One of the key strengths of 529 plans is the flexibility they offer in investment options. The Georgia 529 Plan provides a range of investment portfolios, from conservative to aggressive, catering to different risk tolerances and time horizons. By diversifying your investment portfolio, you can potentially maximize your returns and minimize risks.

Consider a balanced approach, investing in a mix of stocks, bonds, and cash equivalents. This strategy can help you navigate market fluctuations and ensure a steady growth of your savings over the long term. Regularly reviewing and rebalancing your portfolio is crucial to adapt to changing market conditions and ensure your investments align with your goals.

Strategy 5: Explore Additional Tax Benefits Beyond the state tax deductions and matching contributions, the Georgia 529 Plan offers additional tax benefits that can further enhance your savings. For example, earnings and withdrawals from the plan are federal tax-free when used for qualified education expenses.

Additionally, Georgia provides an income tax deduction for contributions made to ABLE accounts, which are designed for individuals with disabilities. This deduction can be combined with the 529 plan deduction, providing an even more substantial tax benefit for eligible individuals.

By exploring these additional tax benefits, you can maximize your savings and ensure a comprehensive financial strategy for your child’s education.

Conclusion: A Secure Future Starts with Smart Planning The Georgia 529 Plan offers a wealth of opportunities to secure your child’s educational future while also providing significant tax benefits. By understanding the plan’s structure, taking advantage of state tax deductions, utilizing matching contributions, diversifying your investments, and exploring additional tax benefits, you can navigate the complexities of the plan and maximize your savings.

Remember, starting early and staying consistent are key to building a robust education fund. With the right strategies and a well-thought-out plan, you can provide your child with the gift of education and set them up for a successful and fulfilling future.

Now, let’s delve into some frequently asked questions to further enhance your understanding of the Georgia 529 Plan and its tax deductions.

What is the maximum state tax deduction for contributions to the Georgia 529 Plan?

+The maximum state tax deduction for contributions to the Georgia 529 Plan is 2,000 for single filers and 4,000 for joint filers.

Are there any income limits to qualify for the state tax deduction?

+No, there are no income limits to qualify for the state tax deduction. However, the deduction is subject to phase-out at higher income levels.

Can I contribute to both the 529 Plan and an ABLE account for the same beneficiary?

+Yes, you can contribute to both the 529 Plan and an ABLE account for the same beneficiary. This allows you to maximize your tax benefits and savings.

Are there any penalties for early withdrawals from the 529 Plan?

+Yes, early withdrawals from the 529 Plan may be subject to penalties and taxes. However, the penalties are waived if the funds are used for qualified education expenses.

Can I use the 529 Plan funds for K-12 expenses?

+Yes, the 529 Plan funds can be used for qualified K-12 expenses, including tuition, books, and required fees.