Georgia 529 Plan: A Comprehensive Review

Navigating the World of Education Savings: An In-Depth Exploration

In today’s fast-paced financial landscape, planning for your child’s education is an essential yet complex endeavor. Among the myriad of savings options, the Georgia 529 Plan stands out as a beacon of financial security for families seeking to invest in their children’s future. This comprehensive review aims to dissect the plan’s intricacies, highlighting its advantages, potential pitfalls, and everything in between. From the basics of the plan’s structure to its real-world impact, we’ll guide you through the decision-making process, ensuring you’re equipped with the knowledge to make informed choices.

Understanding the Georgia 529 Plan: A Foundation for Education Savings

The Georgia 529 Plan, officially known as the Path2College 529 Plan, is a tax-advantaged savings program designed to help families and individuals save for qualified education expenses. This plan is administered by the Georgia Higher Education Treasury Management Authority (GHETMA) and is available to residents and non-residents alike, making it an accessible tool for anyone with an interest in investing in a child’s education.

At its core, the plan operates as a savings account with a specific focus: funding college and other post-secondary education costs. Contributions to the plan grow tax-free, and when the time comes to use the funds, withdrawals are tax-free as long as they’re used for qualified education expenses. This means that, with careful planning and management, the Georgia 529 Plan can significantly reduce the financial burden of education for families.

Key Features of the Georgia 529 Plan:

- Tax Benefits: One of the plan’s most significant advantages is its tax advantages. Contributions to the plan are made with after-tax dollars, but the growth on those contributions is tax-deferred. Additionally, as long as the funds are used for qualified education expenses, withdrawals are tax-free at the federal level and at the state level for Georgia residents.

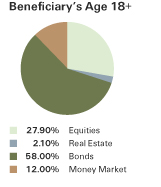

- Flexibility: The Georgia 529 Plan offers flexibility in terms of investment options. Account holders can choose from a variety of investment portfolios, each with a different level of risk and potential reward. This allows for customization based on individual risk tolerance and financial goals.

- Accessibility: The plan is open to anyone, regardless of residency status or income level. This inclusivity ensures that all families have the opportunity to invest in their children’s education, fostering financial security and equality.

- Qualified Education Expenses: The plan covers a wide range of qualified education expenses, including tuition, fees, books, supplies, and even room and board for eligible students. This broad definition of qualified expenses provides account holders with significant flexibility when it comes to using their savings.

Exploring the Benefits and Real-World Impact

The Georgia 529 Plan offers a multitude of benefits that can significantly impact a family’s financial health and educational prospects. By taking advantage of the plan’s tax benefits and flexibility, families can effectively reduce the financial strain associated with education, especially at the college level.

Real-World Impact Scenarios:

- Scenario 1: Tax Savings for the Long Haul: Let’s consider a family that starts saving for their child’s education early on. Over the course of 18 years, they contribute a modest $200 per month to their Georgia 529 Plan account. Thanks to the plan’s tax advantages, this family could potentially save thousands of dollars in taxes over the life of the account.

- Scenario 2: Flexibility in Education Choices: The Georgia 529 Plan’s flexibility extends beyond just investment options. It also allows for a wide range of education choices. Whether a student chooses to attend a traditional four-year college, a technical school, or even an online program, the plan’s funds can be used to cover a variety of expenses, ensuring that educational opportunities are not limited by financial constraints.

- Scenario 3: Accessibility for All: The plan’s accessibility is particularly beneficial for families with limited financial means. By providing a structured savings plan with tax advantages, the Georgia 529 Plan can help level the playing field, ensuring that education is within reach for all, regardless of socioeconomic status.

Navigating Potential Pitfalls and Making Informed Decisions

While the Georgia 529 Plan offers numerous advantages, it’s essential to be aware of potential pitfalls and make informed decisions to maximize the plan’s benefits. Here are some key considerations:

Potential Pitfalls and Decision-Making Strategies:

- Withdrawal Restrictions: While withdrawals for qualified education expenses are tax-free, it’s crucial to understand the plan’s withdrawal restrictions. Early withdrawals for non-qualified expenses may be subject to penalties and taxes, so careful planning is necessary to avoid these pitfalls.

- Investment Risks: The plan’s investment options carry varying levels of risk. It’s essential to choose an investment portfolio that aligns with your risk tolerance and financial goals. Regular reviews of the portfolio’s performance and adjustments as needed can help mitigate potential losses.

- Account Ownership and Control: The Georgia 529 Plan offers flexibility in account ownership and control. However, it’s important to understand the implications of different ownership structures, especially when it comes to financial aid eligibility and potential tax benefits.

- Educational Planning: While the plan provides financial security for education, it’s essential to also plan for the educational aspect. Researching and understanding the various educational options available can help ensure that the funds are used effectively and efficiently.

Conclusion: A Strategic Step Towards Educational Security

The Georgia 529 Plan serves as a powerful tool for families and individuals looking to secure their financial future and invest in their children’s education. With its tax advantages, flexibility, and accessibility, the plan provides a solid foundation for educational savings. However, as with any financial tool, it’s crucial to approach the plan with a strategic mindset, understanding both its benefits and potential pitfalls.

By carefully navigating the plan’s intricacies, conducting thorough research, and seeking professional advice when needed, individuals can make informed decisions that align with their financial goals and educational aspirations. The Georgia 529 Plan is more than just a savings account; it’s a step towards financial security and a brighter future for generations to come.

How does the Georgia 529 Plan compare to other 529 plans in terms of fees and investment options?

+The Georgia 529 Plan boasts competitive fees and a diverse range of investment options. While fees may vary based on the specific investment portfolio chosen, the plan generally offers cost-effective options compared to some other 529 plans. Additionally, the plan’s investment options are designed to cater to various risk tolerances and financial goals, providing account holders with a wide array of choices to suit their individual needs.

Can I use the funds from the Georgia 529 Plan for private school tuition?

+Yes, the Georgia 529 Plan allows for the use of funds for private school tuition, provided that the private school is eligible under the plan’s guidelines. This flexibility extends the plan’s benefits to a broader range of educational choices, ensuring that account holders can tailor their savings to their specific educational goals.

What happens if my child decides not to pursue higher education or receives a scholarship?

+In such cases, the Georgia 529 Plan offers flexibility. Account holders can change beneficiaries, transfer the funds to another eligible family member, or roll the funds over to a different 529 plan without incurring taxes or penalties. This ensures that the savings remain accessible and useful, even if the original beneficiary’s educational plans change.

Are there any income restrictions for contributing to the Georgia 529 Plan?

+No, the Georgia 529 Plan does not have income restrictions. It is open to anyone, regardless of income level, making it an inclusive option for families from all financial backgrounds. This accessibility ensures that all families have the opportunity to save for their children’s education.