Journal vs Ledger: 5 Key Differences

The world of accounting and finance relies on meticulous record-keeping to ensure accurate financial management. Two crucial components of this system are the journal and the ledger. While both serve essential purposes in documenting financial transactions, they differ significantly in terms of structure, purpose, and the information they contain. Understanding these differences is vital for anyone involved in financial operations, whether it's a small business owner, an accountant, or a finance professional.

Defining the Journal and Ledger

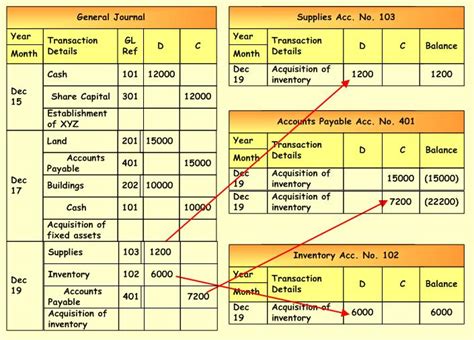

The journal, often referred to as the book of original entry, is the first stop for any financial transaction. It serves as a chronological record, capturing all transactions in a single place. Every financial event, from sales to purchases, payments to receipts, is noted in the journal. This makes the journal an indispensable tool for tracking the flow of money through a business.

On the other hand, the ledger is a more structured and organized book. It is divided into different accounts, each representing a specific type of transaction or financial asset. The ledger provides a detailed view of the financial position of a business, as it contains the aggregated and categorized information from the journal.

5 Key Differences Between a Journal and a Ledger

1. Purpose and Structure

The primary purpose of a journal is to provide a comprehensive record of all financial transactions in chronological order. It acts as a preliminary step in the accounting process, where transactions are first recorded. The journal’s structure is straightforward, typically consisting of columns for the date, transaction description, debit amount, and credit amount.

In contrast, the ledger's purpose is to provide a more detailed and organized view of the financial position. It breaks down transactions into specific accounts, allowing for easier analysis and understanding of the business's financial health. The ledger's structure is more complex, with each account having its own page or section, often with additional columns for transaction details and running balances.

2. Level of Detail

The journal provides a high level of detail for each transaction. It records the date, description, and the debit and credit amounts involved. This level of detail is crucial for ensuring accuracy and providing a complete picture of financial activity.

While the ledger also contains detailed information, it is more focused on specific accounts. Each transaction is summarized and categorized under the appropriate account, providing a consolidated view of the account's activity. This level of detail allows for easier analysis and identification of trends or anomalies.

| Aspect | Journal | Ledger |

|---|---|---|

| Detail | High (individual transactions) | Moderate (summarized under accounts) |

3. Organization and Categorization

The journal is organized chronologically, with transactions listed in the order they occur. This straightforward organization makes it easy to trace the history of financial events.

The ledger, however, is organized by account type. Each account has its own section, allowing for easy reference and comparison. This categorization facilitates analysis and makes it simpler to identify patterns or changes in specific areas of financial activity.

4. Double-Entry System

The journal follows the double-entry system, which is a fundamental concept in accounting. Every transaction is recorded twice, once as a debit and once as a credit. This ensures that the books remain balanced and accurate. The double-entry system is essential for maintaining financial integrity and detecting errors.

The ledger also adheres to the double-entry system. Each transaction is posted to the appropriate account, with debits and credits balanced within each account. This ensures that the ledger accurately reflects the financial position and helps identify any discrepancies.

5. Preparation of Financial Statements

The journal, being the first step in the accounting process, does not directly contribute to the preparation of financial statements. Its role is to provide the raw data that will be used in the subsequent steps of accounting.

The ledger, however, plays a crucial role in the preparation of financial statements. The information in the ledger, which is more organized and categorized, is used to create statements such as the balance sheet, income statement, and cash flow statement. These statements provide a comprehensive view of the business's financial performance and position.

FAQ

How does the double-entry system ensure accuracy in accounting records?

+The double-entry system ensures accuracy by requiring that every transaction be recorded in two different accounts. One account is debited, and the other is credited, ensuring that the total debits equal the total credits. This balance helps identify any errors or discrepancies in the accounting records.

Can a journal be used for analysis or decision-making purposes?

+While a journal provides detailed transaction information, it is not typically used for analysis or decision-making. Its primary purpose is to serve as a record of transactions, which is then used to populate the ledger and other accounting books. The ledger and financial statements are more commonly used for analysis and decision-making.

What happens if a transaction is recorded incorrectly in the journal or ledger?

+If a transaction is recorded incorrectly, it can lead to imbalances in the accounting records. In such cases, accountants use tools like the trial balance to identify and rectify errors. The trial balance is a report that lists all account balances and helps ensure that the total debits equal the total credits.