5 Simple Steps to Complete GA State Form 500

Step 1: Gather Your Information

Completing the GA State Form 500, also known as the Georgia Individual Income Tax Return, requires gathering essential documents and information beforehand. Here’s a checklist to ensure you have everything you need:

Wage and Income Statements: Collect your W-2 forms from all employers, 1099-MISC forms for miscellaneous income, and any other documents detailing your income sources. This includes earnings from part-time jobs, freelance work, or self-employment.

Deduction Details: Compile records of eligible deductions. This may include mortgage interest payments, charitable donations, medical expenses exceeding 7.5% of your adjusted gross income, and state and local taxes paid. Ensure you have receipts, bank statements, or other proof of these expenses.

Dependency Information: If you’re claiming dependents, such as children or elderly relatives, gather their Social Security numbers and details about their relationship to you. You’ll also need to provide their birth dates and information about any support you provided throughout the year.

Previous Year’s Return: It’s helpful to have your previous year’s tax return as a reference. This can guide you in filling out similar sections and ensure you don’t miss any carryover deductions or credits.

Documentation for Credits: Georgia offers various tax credits, like the Hope Scholarship Credit or the Georgia Higher Education Tax Credit. If you believe you qualify for any, gather the necessary documentation, such as tuition receipts or proof of qualifying expenses.

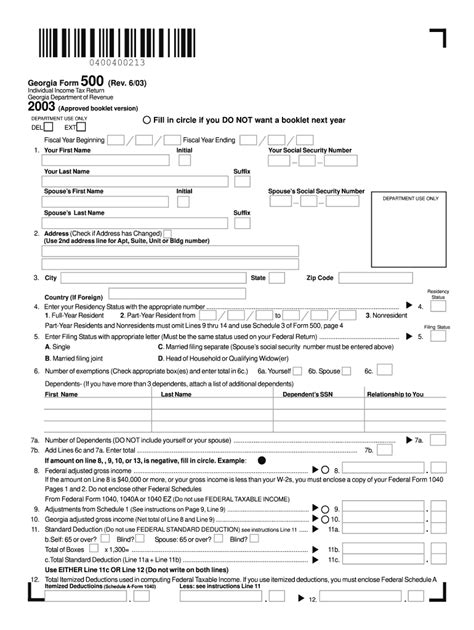

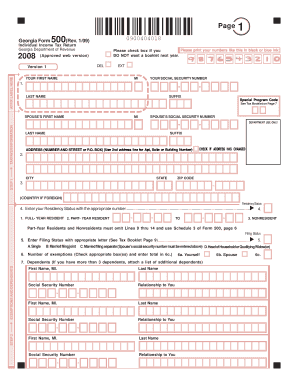

Step 2: Understand the Form Sections

The GA State Form 500 is divided into several sections, each serving a specific purpose. Familiarize yourself with these sections to streamline the completion process:

Income: This section requires you to report all taxable income, including wages, salaries, tips, interest, dividends, capital gains, and business income. Ensure you understand the different types of income and how to categorize them accurately.

Adjustments to Income: Here, you can claim certain deductions, such as student loan interest, moving expenses, and contributions to retirement accounts. Understanding which adjustments apply to your situation is crucial for reducing your taxable income.

Deductions: Georgia offers both standard and itemized deductions. Choose the option that provides the most tax benefits for your circumstances. Itemized deductions may include medical expenses, state and local taxes, charitable contributions, and mortgage interest.

Credits: Georgia provides tax credits for various expenses, including education, disabilities, and certain types of business investments. Review the eligibility criteria for each credit and gather the necessary documentation to claim them.

Tax Computation: This section calculates your total tax liability based on your taxable income and deductions. It’s essential to understand the different tax brackets and how they affect your tax rate.

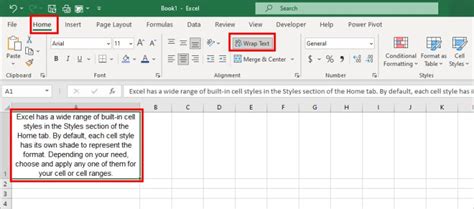

Step 3: Complete the Form Accurately

With your information and understanding of the form sections, it’s time to start filling out the GA State Form 500:

Personal Information: Begin by providing your personal details, including your name, address, Social Security number, and filing status. Ensure these details match those on your government-issued identification.

Income Reporting: Transfer your income figures from your W-2 and 1099 forms into the appropriate sections of the form. Double-check that you’ve categorized your income correctly to avoid errors.

Deductions and Credits: Claim eligible deductions and credits by entering the appropriate amounts in the designated sections. Remember to retain supporting documentation in case of an audit.

Compute Your Tax: Using the tax computation section, calculate your total tax liability. This will involve applying the relevant tax rates and brackets to your taxable income. Ensure you double-check your calculations to avoid overpayment or underpayment.

Payments and Refunds: If you owe taxes, follow the instructions on the form to make your payment. If you’re due a refund, complete the necessary sections to request it. Consider the different refund options, such as direct deposit or check, and provide the required banking information.

Step 4: Review and Double-Check

Before submitting your GA State Form 500, it’s crucial to review it thoroughly for accuracy:

Check for Errors: Review each section of the form to ensure you haven’t made any mistakes in transferring numbers or calculating deductions and credits. A single error can impact your tax liability, so be meticulous in your review.

Verify Personal Details: Double-check your personal information, including your name, address, and Social Security number. Incorrect details can delay processing or result in your return being rejected.

Review Supporting Documents: Ensure you have all the necessary documentation to support your deductions and credits. Keep these documents organized and readily accessible in case of an audit.

Step 5: Submit and Stay Informed

After completing and reviewing your GA State Form 500, it’s time to submit it:

Submission Methods: You can choose to file your return electronically or mail it to the Georgia Department of Revenue. Electronic filing is often faster and provides confirmation of receipt. If you choose to mail your return, ensure you use the correct address and allow sufficient time for processing.

Track Your Refund: If you’re expecting a refund, you can track its status online using the Georgia Taxpayer Access Point (GTAP) system. This allows you to monitor the progress of your refund and receive updates on any potential delays.

Stay Informed: Keep yourself updated on any changes to tax laws or regulations in Georgia. The state may introduce new credits or deductions, or adjust existing ones, which could impact your tax liability. Stay connected with reputable tax resources to ensure you’re aware of any updates.

By following these five simple steps, you can complete the GA State Form 500 with accuracy and confidence. Remember, taking the time to gather the right information, understand the form sections, and review your work can make the process smoother and help you maximize your tax benefits.