FL Title Insurance Costs: An Easy Guide

Title insurance is an essential component of any real estate transaction, providing protection and peace of mind to both buyers and lenders. In Florida, understanding the costs associated with title insurance is crucial for making informed decisions during the home-buying process. This comprehensive guide will delve into the specifics of FL title insurance costs, offering a detailed breakdown and insights to help you navigate this important aspect of your real estate journey.

Understanding FL Title Insurance Costs

Title insurance in Florida is unique in its structure and pricing, and it’s vital to grasp the key components to make an informed choice. Unlike other states, Florida has a standardized rate structure for title insurance, which is regulated by the Florida Department of Financial Services. This means that the cost of title insurance is consistent across the state, providing a transparent and predictable pricing model for homebuyers.

The cost of title insurance in Florida is primarily determined by the purchase price or the current fair market value of the property, whichever is greater. This value is used as the basis for calculating the premium, ensuring that the coverage provided is adequate for the property's worth. The premium is then calculated as a percentage of this value, with the rate depending on whether it's a lender's policy or an owner's policy.

| Policy Type | Rate |

|---|---|

| Lender's Policy | 0.56% of the loan amount (up to $500,000) + 0.28% for amounts over $500,000 |

| Owner's Policy | 0.65% of the property's value |

It's important to note that these rates are subject to change, and it's always advisable to consult with a reputable title insurance company or an attorney to obtain the most current and accurate information. Additionally, there may be additional fees associated with the title insurance process, such as search fees, recording fees, and other administrative costs.

Factors Influencing Title Insurance Costs in Florida

While the rate structure in Florida provides a standardized framework, there are several factors that can influence the overall cost of title insurance:

- Property Value: As mentioned earlier, the value of the property is a key determinant. Higher-value properties will generally result in higher insurance premiums.

- Location: The location of the property can impact insurance costs. Areas with a higher risk of title defects or complex ownership histories may incur additional fees.

- Property Type: The type of property, such as residential, commercial, or vacant land, can affect the premium. Commercial properties, for instance, may require more extensive title searches and therefore higher fees.

- Policy Coverage: The extent of coverage chosen can impact the premium. Enhanced coverage options, such as extended coverage or additional endorsements, may increase the cost.

- Reissue Rate: If you've owned the property before or had a prior mortgage, you may be eligible for a reissue rate, which offers a discounted premium. The reissue rate is typically available if the new policy is issued within 10 years of the previous policy and there have been no changes to the ownership or title.

The Importance of Title Insurance in Florida Real Estate Transactions

Title insurance plays a critical role in Florida’s real estate market, offering protection against a range of potential title issues that could impact your ownership rights. These issues can include:

- Forged Documents: Title insurance can protect against forged or fraudulent documents that could impact the validity of your ownership.

- Undisclosed Liens: Unrecorded liens or judgments against the previous owner can be discovered after the sale, potentially affecting your property rights.

- Boundary Disputes: Title insurance can provide coverage for disputes over property boundaries, which are common in Florida's diverse and dynamic real estate landscape.

- Unknown Heirs: If a previous owner passed away without a will, their heirs may come forward later, claiming ownership or seeking compensation.

- Clerical Errors: Mistakes made during the recording of deeds or other documents can lead to issues with the title. Title insurance can provide coverage for such errors.

The Benefits of Title Insurance

Title insurance offers several key benefits that make it an indispensable part of any real estate transaction:

- Peace of Mind: By purchasing title insurance, you can rest assured that your ownership rights are protected against potential title defects.

- Cost-Effective Protection: Title insurance is a one-time premium that provides ongoing coverage for the duration of your ownership, making it a cost-effective solution.

- Professional Expertise: Title insurance companies employ a team of experts who conduct thorough title searches and reviews, ensuring that any potential issues are identified and addressed.

- Legal Defense: In the event of a title dispute, title insurance provides legal representation and coverage for any legal fees and costs associated with resolving the issue.

- Enhanced Property Value: A clear and insured title can enhance the value of your property, making it more attractive to potential buyers should you decide to sell.

The Process of Obtaining Title Insurance in Florida

Obtaining title insurance in Florida involves a series of steps that ensure a thorough review of the property’s title history. Here’s a simplified breakdown of the process:

- Order Title Insurance: After the sales contract is signed, the buyer or their real estate agent will typically order title insurance. This is often done in conjunction with other real estate services, such as home inspections and appraisals.

- Title Search: The title insurance company will conduct a comprehensive search of public records to identify any potential issues with the title. This includes reviewing deeds, mortgages, liens, judgments, and other documents that could impact the property's title.

- Title Examination: A team of experts, including title examiners and attorneys, will review the search results to identify any potential defects or issues. They will also ensure that all relevant documents are properly recorded and that there are no undisclosed liens or judgments.

- Title Commitment: Once the title search and examination are complete, the title insurance company will issue a title commitment. This document outlines any issues found during the search and the conditions that must be met for the policy to be issued. It also provides the buyer with an opportunity to address any identified issues.

- Policy Issuance: After the conditions in the title commitment have been satisfied, the title insurance company will issue the policy. This policy provides coverage for the buyer against any title defects that may arise after the purchase.

Working with a Title Insurance Company

When selecting a title insurance company, it’s essential to choose a reputable and experienced provider. Look for a company with a strong track record in Florida and a comprehensive understanding of the state’s unique real estate market and title insurance regulations. Consider factors such as their customer service, expertise, and the range of services they offer. Additionally, it’s beneficial to work with a company that can provide a seamless and efficient process, ensuring a smooth closing and a stress-free experience.

FAQs

What is the average cost of title insurance in Florida for a single-family home?

+

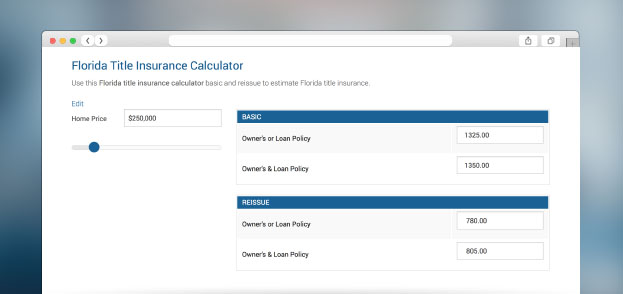

The average cost of title insurance for a single-family home in Florida can vary based on the property’s value. For a 250,000 home, the owner's policy might cost around 1,625, while the lender’s policy could be approximately $1,400. These are average estimates and actual costs may differ based on various factors.

Can I negotiate the price of title insurance in Florida?

+

No, the rates for title insurance in Florida are regulated and standardized, so you cannot negotiate the price. However, you can compare quotes from different title insurance companies to ensure you’re getting the best value.

Are there any discounts available for title insurance in Florida?

+

Yes, Florida offers a discounted reissue rate if you’re purchasing a title insurance policy within 10 years of a previous policy and there have been no changes to the ownership or title. This can save you up to 20% on your premium.

Do I need title insurance if I’m purchasing a new construction home in Florida?

+

Yes, title insurance is still essential for new construction homes. While the risk of title defects may be lower for a brand new property, it’s important to have protection against potential issues that could arise, such as construction liens or undisclosed easements.

How long does the title insurance process typically take in Florida?

+

The title insurance process can take anywhere from a few days to a couple of weeks, depending on the complexity of the title search and the number of issues that need to be resolved. It’s important to start the process early to ensure a smooth closing.