Everything You Need to Know About FL Resale Certificate

Navigating the Complexities of Florida's Resale Certificate Process

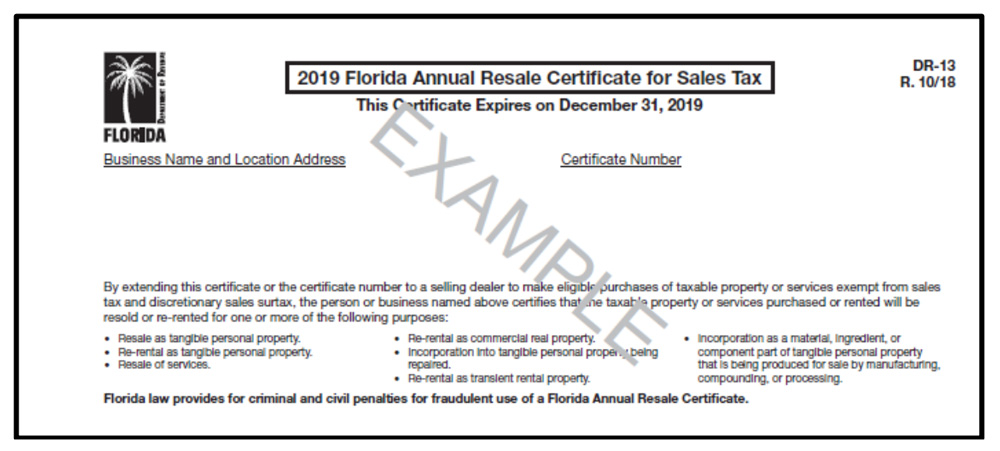

The resale certificate, a crucial component of Florida’s tax system, can be a challenging aspect for businesses to navigate. This intricate process, governed by the Florida Department of Revenue, plays a pivotal role in determining tax liabilities for resellers within the state. Let’s delve into the intricacies of the FL Resale Certificate, exploring its purpose, requirements, and the benefits it offers to eligible businesses.

Understanding the FL Resale Certificate is akin to unraveling a complex puzzle, where each piece must be carefully examined to ensure compliance and maximize potential savings.

What is a Resale Certificate, and Why is it Important?

At its core, a resale certificate is a legal document that serves as proof of a business’s eligibility to purchase goods without incurring sales tax. This certificate is particularly relevant for businesses engaged in reselling, as it exempts them from paying sales tax on their purchases, which they will later collect from the end consumers.

The resale certificate is a powerful tool that empowers businesses to operate more efficiently within the framework of Florida's tax system.

In Florida, the resale certificate holds immense significance for businesses due to the state’s stringent tax regulations. By obtaining this certificate, eligible businesses can avoid paying sales tax on their purchases, thereby reducing their tax liabilities and improving their cash flow.

Eligibility and Application Process

Determining eligibility for a resale certificate is the first step in this process. The Florida Department of Revenue has established specific criteria that businesses must meet to qualify for this certificate. Generally, businesses that meet one or more of the following criteria are eligible:

- Engaged in reselling tangible personal property

- Providing certain services, such as repair or installation

- Leasing tangible personal property

- Acting as an agent or broker for resale transactions

- Manufacturing or producing tangible personal property for resale

The application process for the FL Resale Certificate is relatively straightforward but requires attention to detail. Businesses can apply for this certificate through the Florida Department of Revenue’s website. The application typically requires the following information:

- Business name, address, and contact details

- Federal Tax ID number or Social Security number

- Description of the business's activities and products/services offered

- Details of the business's resale activities

- Sales tax permit or registration number (if applicable)

Once the application is submitted, the Department of Revenue reviews it for accuracy and completeness. Upon approval, the business receives its resale certificate, which is typically valid for a specific period, often ranging from one to five years.

Benefits of Obtaining a Resale Certificate

The benefits of obtaining a resale certificate are multifaceted and can significantly impact a business’s financial health and operational efficiency. Here are some key advantages:

Pros

- Reduced tax liabilities: By purchasing goods without paying sales tax, businesses can save a considerable amount, especially for those with high-volume purchases.

- Improved cash flow: The tax savings can directly contribute to a business's cash flow, providing additional funds for investment or expansion.

- Competitive advantage: With reduced tax liabilities, businesses can offer more competitive pricing, potentially attracting more customers.

- Compliance with tax regulations: The resale certificate ensures that businesses are compliant with Florida's tax laws, avoiding potential penalties and legal issues.

Cons

- Administrative burden: The application and renewal process can be time-consuming and require dedicated resources.

- Record-keeping requirements: Businesses must maintain detailed records of their resale transactions to prove their eligibility and avoid audits.

Understanding the Role of Resale Certificates in Different Industries

The impact and application of resale certificates can vary significantly across different industries. Let’s explore a few examples:

Retail Industry

In the retail sector, resale certificates are particularly beneficial for businesses engaged in the resale of tangible personal property, such as clothing, electronics, or furniture. These businesses can purchase inventory without incurring sales tax, which is then collected from the end consumers at the point of sale.

Manufacturing and Production

Manufacturers and producers often utilize resale certificates to purchase raw materials, components, and equipment without paying sales tax. This can significantly reduce their overhead costs, making their products more competitive in the market.

Service-based Industries

While the focus of resale certificates is primarily on tangible personal property, certain service-based industries can also benefit. For instance, businesses providing repair services, such as auto mechanics or appliance repair companies, can use resale certificates to purchase replacement parts without incurring sales tax.

Case Study: Success Story of a Resale Certificate Holder

To illustrate the practical application and benefits of the FL Resale Certificate, let’s consider the example of a successful business, Eco-Friendly Furnishings, which specializes in sustainable furniture and home decor.

Eco-Friendly Furnishings, upon obtaining their resale certificate, was able to significantly reduce their tax liabilities by purchasing materials and components without paying sales tax. This allowed them to reinvest the savings into their business, expanding their product range and marketing efforts.

As a result, Eco-Friendly Furnishings experienced a boost in sales and market presence, attracting environmentally conscious consumers who appreciated their commitment to sustainability. The resale certificate played a pivotal role in their success, enabling them to compete effectively in a highly competitive market.

Conclusion: Maximizing Opportunities with the FL Resale Certificate

In conclusion, the FL Resale Certificate is a powerful tool that can provide significant benefits to eligible businesses in Florida. By understanding the eligibility criteria, application process, and the role of resale certificates in different industries, businesses can navigate this complex process with confidence.

Obtaining a resale certificate can lead to reduced tax liabilities, improved cash flow, and a competitive edge in the market. However, it’s essential to recognize the administrative and record-keeping requirements associated with this certificate to ensure ongoing compliance and avoid potential pitfalls.

As Florida’s tax landscape continues to evolve, staying informed and adapting to these changes is crucial for businesses looking to thrive in this dynamic environment.

How often do I need to renew my FL Resale Certificate?

+The renewal period for the FL Resale Certificate typically ranges from one to five years, depending on the type of business and its activities. It's crucial to stay informed about the renewal deadline to ensure continuous compliance.

<div class="faq-item">

<div class="faq-question">

<h3>Can I apply for the FL Resale Certificate if I'm a startup or a new business?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Absolutely! New businesses can apply for the resale certificate as long as they meet the eligibility criteria. It's an essential step for startups to establish their tax-exempt status and operate efficiently from the outset.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What happens if I make a purchase without my resale certificate or if I use it incorrectly?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Using the resale certificate incorrectly or failing to provide it when making a purchase can result in the business being charged sales tax. It's crucial to understand the limitations and proper usage of the certificate to avoid unnecessary tax liabilities.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any industries or transactions where the resale certificate doesn't apply?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, there are certain industries and transactions where the resale certificate doesn't apply. For instance, businesses involved in the sale of certain regulated products, like alcohol or tobacco, may not be eligible for the certificate. It's essential to consult with tax professionals to understand these limitations.</p>

</div>

</div>

</div>