Understanding Expansionary Fiscal Policy

Expansionary fiscal policy is a powerful economic tool utilized by governments to stimulate economic growth, combat recession, and achieve specific macroeconomic objectives. This strategy involves increasing government spending, reducing taxes, or a combination of both, to boost aggregate demand and spur economic activity. Understanding the nuances of expansionary fiscal policy is crucial for policymakers, economists, and investors alike, as it can significantly impact the trajectory of an economy and its financial markets.

The Mechanics of Expansionary Fiscal Policy

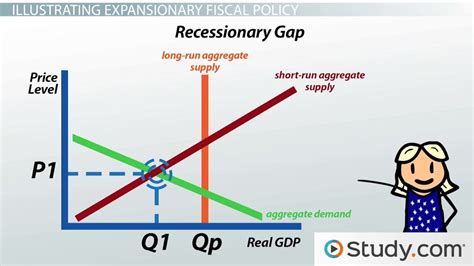

At its core, expansionary fiscal policy is designed to inject more money into the economy, either through direct government spending or by putting more money in the hands of consumers and businesses through tax cuts. This additional spending power can lead to increased consumption, investment, and economic activity, which in turn can help reduce unemployment, boost economic growth, and stabilize the economy during periods of economic downturn.

One of the key advantages of expansionary fiscal policy is its ability to quickly and directly impact the economy. Unlike monetary policy, which often relies on complex financial mechanisms and can take time to filter through the economy, fiscal policy changes can be implemented swiftly and have a direct and immediate effect on spending and investment. This agility makes fiscal policy a critical tool for governments to manage economic downturns and stimulate growth.

Government Spending: A Powerful Stimulus

Increased government spending is a primary component of expansionary fiscal policy. By allocating more funds towards public infrastructure, education, healthcare, or other public services, the government can create jobs, stimulate economic activity, and generate a multiplier effect. This means that for every dollar spent by the government, additional economic activity is generated, as the initial spending ripples through the economy, creating further income and spending opportunities.

For instance, consider a government that invests in a large-scale infrastructure project such as a high-speed rail network. This project would not only create construction jobs but would also generate demand for a range of industries, from steel manufacturers to IT service providers. The economic impact would be felt not only in the initial spending but also in the subsequent increased consumption and investment that the project facilitates.

Tax Cuts: Empowering Consumers and Businesses

Reducing taxes is another key aspect of expansionary fiscal policy. Lower taxes mean more disposable income for consumers, who can then increase their spending on goods and services. This increased demand can lead to higher production, creating more jobs and boosting economic growth. For businesses, lower taxes can mean more profits, which can be reinvested into the business, leading to expanded operations, increased employment, and further economic growth.

A notable example of the power of tax cuts can be seen in the context of the 2003 U.S. tax cuts implemented under President George W. Bush. These tax cuts, which reduced taxes for both individuals and businesses, were credited with contributing to a period of strong economic growth and job creation in the following years. While the long-term impact and efficacy of these cuts are still a subject of debate, they provide a clear illustration of the potential impact of expansionary fiscal policy through tax reduction.

| Year | Economic Growth Rate | Unemployment Rate |

|---|---|---|

| 2003 | 2.5% | 6.0% |

| 2004 | 3.8% | 5.5% |

| 2005 | 3.5% | 5.1% |

The table above shows the economic growth rate and unemployment rate for the years following the 2003 tax cuts. While other factors also played a role, the positive economic trajectory suggests that the tax cuts contributed to a period of economic expansion.

The Role of Expansionary Fiscal Policy in Different Economic Scenarios

Expansionary fiscal policy is often employed by governments to counteract the negative effects of a recession. During a recession, consumer spending and business investment typically decline, leading to reduced economic activity and higher unemployment. By implementing expansionary fiscal measures, governments can attempt to reverse this trend and stimulate economic growth.

Addressing a Recession: A Case Study

Let’s consider the Great Recession of 2007-2009 as an example. In response to this severe economic downturn, many governments worldwide implemented expansionary fiscal policies. The U.S., for instance, enacted the American Recovery and Reinvestment Act (ARRA) in 2009, which included significant government spending on infrastructure, energy efficiency, and social safety net programs, as well as tax cuts for individuals and businesses.

While the effectiveness of the ARRA is still a topic of debate among economists, the U.S. economy did eventually recover, and the unemployment rate began to decline. The ARRA is often cited as a significant factor in this recovery, though other factors such as monetary policy and the natural economic cycle also played a role.

| Year | Economic Growth Rate | Unemployment Rate |

|---|---|---|

| 2008 | -0.3% | 5.8% |

| 2009 | -2.8% | 9.3% |

| 2010 | 2.9% | 9.6% |

| 2011 | 1.6% | 8.9% |

The table above illustrates the economic performance of the U.S. during and after the Great Recession. While the economy contracted significantly in 2009, the implementation of expansionary fiscal policies, such as the ARRA, is believed to have contributed to the eventual recovery and positive economic growth rates seen in the following years.

Managing Economic Growth: Preventing Overheating

Expansionary fiscal policy is not limited to recessionary periods. It can also be used during times of economic growth to manage the pace of that growth and prevent the economy from overheating. If the economy is growing too quickly, it can lead to inflationary pressures, which can be detrimental to long-term economic stability.

In such situations, governments can use expansionary fiscal policy to slow down the pace of economic growth. For example, they can increase taxes, which reduces disposable income and therefore spending, or reduce government spending, which limits the amount of money flowing into the economy. These measures can help prevent the economy from growing too fast and maintain a stable economic environment.

The Challenges and Considerations of Expansionary Fiscal Policy

While expansionary fiscal policy can be a powerful tool for economic management, it is not without its challenges and potential drawbacks. One of the primary concerns is the issue of government debt. Increased government spending and tax cuts can lead to larger budget deficits, which, if not managed properly, can result in significant increases in government debt.

High levels of government debt can have several negative consequences. Firstly, it can lead to higher interest rates as the government needs to offer higher returns to attract investors to buy its debt. This can increase the cost of borrowing for businesses and consumers, potentially slowing economic growth. Secondly, high debt levels can limit the government's ability to respond to future economic shocks, as it may already be burdened with significant debt repayments.

Another challenge associated with expansionary fiscal policy is the potential for inflation. If the economy is already near or at full capacity, increasing aggregate demand through expansionary fiscal measures can lead to inflation as the increased demand outstrips the economy's ability to supply goods and services.

The Trade-Off Between Short-Term Stimulus and Long-Term Sustainability

One of the key trade-offs in expansionary fiscal policy is between the short-term stimulus it provides and the long-term sustainability of the policy. While expansionary measures can effectively stimulate the economy in the short term, they can also lead to long-term challenges if not implemented with a clear strategy for managing the resulting budget deficits and debt.

For instance, consider a government that significantly increases its spending on infrastructure development. While this can create jobs and stimulate economic activity in the short term, if the government does not also take steps to increase revenues or reduce other spending to offset the increased spending, it can lead to a significant increase in the budget deficit and government debt. This could, in turn, increase the government's borrowing costs and limit its ability to respond to future economic challenges.

The Future of Expansionary Fiscal Policy

The future of expansionary fiscal policy is closely tied to the evolving economic landscape and the changing nature of global economic challenges. As economies become more interconnected and face new challenges such as climate change, technological disruptions, and demographic shifts, the role and effectiveness of expansionary fiscal policy may need to adapt.

One potential area of development is the use of expansionary fiscal policy in conjunction with other policy tools, such as monetary policy and regulatory measures. By coordinating these policies, governments may be able to maximize their impact on the economy and achieve their macroeconomic objectives more effectively.

Additionally, as the world moves towards a more sustainable economic model, the role of expansionary fiscal policy in supporting green initiatives and addressing climate change could become more prominent. This could involve using fiscal policy to incentivize the adoption of green technologies, promote sustainable development, and mitigate the economic impacts of climate change.

What is the primary goal of expansionary fiscal policy?

+

The primary goal of expansionary fiscal policy is to stimulate economic growth, reduce unemployment, and stabilize the economy during periods of economic downturn. It does this by increasing government spending and/or reducing taxes to boost aggregate demand and economic activity.

How does expansionary fiscal policy differ from monetary policy?

+

Expansionary fiscal policy involves changes in government spending and taxation, while monetary policy focuses on managing the supply of money and credit in the economy. Fiscal policy changes can be implemented quickly and have a direct impact on spending and investment, whereas monetary policy actions often take longer to filter through the economy.

What are some potential drawbacks of expansionary fiscal policy?

+

Potential drawbacks of expansionary fiscal policy include the risk of increasing government debt and budget deficits, which can lead to higher interest rates and limit the government’s ability to respond to future economic shocks. Additionally, if the economy is already near or at full capacity, expansionary fiscal measures can lead to inflation as increased demand outstrips the economy’s ability to supply goods and services.

How can expansionary fiscal policy be used to manage economic growth?

+

Expansionary fiscal policy can be used to manage economic growth by either slowing it down to prevent overheating or by stimulating growth during periods of economic slowdown. To slow down growth, governments can increase taxes or reduce government spending, limiting the amount of money flowing into the economy. To stimulate growth, governments can increase spending or reduce taxes, boosting aggregate demand.

What are some real-world examples of expansionary fiscal policy in action?

+

One notable example is the American Recovery and Reinvestment Act (ARRA) implemented in the U.S. during the Great Recession of 2007-2009. This act included significant government spending on infrastructure, energy efficiency, and social safety net programs, as well as tax cuts for individuals and businesses. While the exact impact of the ARRA is still debated, it is often credited with contributing to the eventual economic recovery.