5 Tips for Calculating Employee Costs

Managing employee costs is a critical aspect of running a successful business. It involves more than just calculating salaries; it's about understanding the total cost of employment, which includes various expenses such as benefits, taxes, and overhead. Accurate calculation of these costs is essential for financial planning, budgeting, and making informed decisions about staffing and operations. In this comprehensive guide, we will explore five expert tips for calculating employee costs effectively.

1. Identify and Understand All Components of Employee Compensation

Employee compensation goes beyond the basic salary or hourly wage. It encompasses a range of elements that contribute to the total cost of employing an individual. These include:

- Base Salary or Wages: The primary form of compensation, often determined by the employee's position, experience, and skill level.

- Bonus and Incentives: Performance-based payments or rewards offered to employees, which can significantly impact total compensation.

- Commissions: A percentage of sales or revenue generated by the employee, common in sales-oriented roles.

- Benefits: A crucial aspect of employee compensation, benefits can include health insurance, retirement plans, paid time off, and other perks. These expenses are typically shared between the employer and the employee.

- Overhead Costs: Indirect costs associated with employing someone, such as office space, equipment, and supplies. These costs are often spread across multiple employees.

- Training and Development: Costs incurred for employee training, professional development, and education.

- Taxes and Payroll Costs: These include employer contributions to Social Security, Medicare, and unemployment insurance, as well as any state and local taxes.

Understanding the Total Compensation Package

To accurately calculate employee costs, it’s essential to grasp the entire compensation package. This involves recognizing the direct and indirect costs associated with each employee. For instance, while the base salary is a direct cost, benefits and overhead costs are typically spread across multiple employees, making them indirect costs.

| Component | Description |

|---|---|

| Base Salary | Annual or monthly salary paid to the employee. |

| Benefits | Health insurance, retirement plans, paid leave, etc. |

| Overhead | Office rent, equipment, supplies, and other shared costs. |

| Taxes | Employer contributions to Social Security, Medicare, and other taxes. |

2. Determine the Allocation of Indirect Costs

Indirect costs, such as overhead and certain benefits, are not directly tied to individual employees. These costs are typically spread across the entire workforce or allocated based on specific criteria. Here’s how to determine the allocation:

Overhead Costs Allocation

Overhead costs, including rent, utilities, and office supplies, are often shared among all employees. To allocate these costs, you can use a simple formula:

\[ \begin{equation*} \text{Overhead Cost Per Employee} = \frac{\text{Total Overhead Cost}}{\text{Number of Employees}} \, . \end{equation*} \]

For example, if your total overhead cost for the year is $100,000 and you have 50 employees, the overhead cost per employee would be $2,000.

Benefits Allocation

Benefits like health insurance, retirement plans, and paid time off can be allocated based on various factors. Common methods include:

- Equal Allocation: Benefits are distributed evenly among all employees, regardless of their position or salary.

- Salary-Based Allocation: Benefits are allocated based on the employee's salary, with higher-paid individuals contributing more.

- Position-Based Allocation: Certain benefits may be tied to the employee's position or level within the organization.

It's important to review your benefits program and determine the most appropriate allocation method for each benefit.

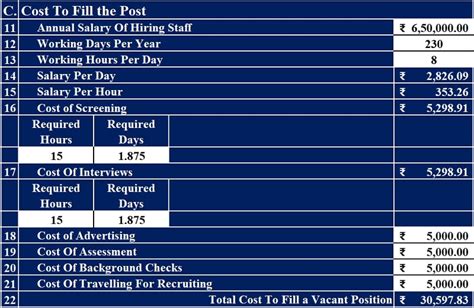

3. Calculate the Total Cost of Employment

Now that you’ve identified all the components of employee compensation and determined the allocation of indirect costs, you can calculate the total cost of employment. This calculation takes into account all direct and indirect costs associated with an employee.

Formula for Total Cost of Employment

The formula for calculating the total cost of employment is as follows:

\[ \begin{equation*} \text{Total Cost of Employment} = \text{Base Salary} + \text{Benefits} + \text{Overhead} + \text{Taxes} + \text{Other Costs} \, . \end{equation*} \]

Here's a breakdown of each component:

- Base Salary: This is the annual or monthly salary paid to the employee.

- Benefits: Include health insurance, retirement plans, and other benefits.

- Overhead: Represents the allocated overhead costs per employee.

- Taxes: These are the employer's contributions to Social Security, Medicare, and other taxes.

- Other Costs: Additional costs like training, professional development, and any other expenses specific to the employee.

For instance, if an employee's base salary is $50,000, their allocated benefits cost is $10,000, overhead is $2,000, taxes are $4,000, and other costs are $2,000, the total cost of employment would be $70,000.

4. Analyze and Compare Employee Costs

Once you’ve calculated the total cost of employment for each employee, it’s crucial to analyze and compare these costs. This step helps you identify trends, assess the efficiency of your compensation structure, and make informed decisions about staffing and budgeting.

Key Considerations for Analysis

- Performance and Productivity: Evaluate the relationship between employee costs and performance. Are high-cost employees delivering exceptional results? Are there opportunities to improve efficiency?

- Staffing Strategy: Assess whether your current staffing levels are optimal. Consider factors like workload, skill sets, and the potential for cross-training.

- Budgetary Constraints: Analyze how employee costs align with your overall budget. Identify areas where costs can be optimized without compromising performance.

- Benefits and Perks: Review the cost and value of the benefits and perks you offer. Are they competitive and aligned with your company’s culture and goals?

Comparative Analysis

Comparing employee costs within your organization and against industry benchmarks can provide valuable insights. This analysis can help you identify areas for improvement and ensure your compensation structure is competitive and fair.

| Position | Base Salary | Benefits | Overhead | Taxes | Total Cost |

|---|---|---|---|---|---|

| Manager | $60,000 | $12,000 | $3,000 | $5,000 | $80,000 |

| Sales Representative | $45,000 | $9,000 | $2,000 | $3,500 | $60,000 |

| Assistant | $35,000 | $7,000 | $1,500 | $2,500 | $47,000 |

5. Regularly Review and Adjust Employee Costs

Employee costs are not static; they evolve with changing business needs, market conditions, and employee performance. Regular reviews of employee costs are essential to ensure your business remains competitive, efficient, and financially healthy.

Factors to Consider in Reviews

- Market Rates and Competition: Stay updated on industry trends and salary benchmarks to ensure your compensation remains competitive.

- Performance and Productivity: Assess whether employee costs align with performance. Consider rewarding high performers and reevaluating underperforming employees.

- Budgetary Constraints: Regularly review your budget and make adjustments to employee costs as necessary. This may involve negotiating with employees, adjusting benefit plans, or optimizing overhead expenses.

- Changing Business Needs: As your business evolves, so might your staffing needs. Regular reviews allow you to adapt to these changes and ensure you have the right talent in place.

Implementing Adjustments

When adjustments to employee costs are necessary, it’s important to handle them with care and transparency. Here are some strategies to consider:

- Open Communication: Keep employees informed about any changes to their compensation or benefits. Explain the reasons behind these adjustments and how they benefit the company and the employees.

- Performance-Based Adjustments: Tie adjustments to employee performance. This could mean rewarding high performers with increased compensation or benefits, or having constructive conversations with underperformers about expectations and potential improvements.

- Benefits Review: Periodically review your benefits program to ensure it remains competitive and cost-effective. Consider offering a mix of traditional benefits and perks that align with employee preferences and needs.

Conclusion: Effective Employee Cost Management

Calculating employee costs accurately is a critical aspect of financial planning and business strategy. By understanding the components of employee compensation, allocating indirect costs effectively, and regularly reviewing and adjusting these costs, you can ensure your business operates efficiently and competitively. Remember, employee costs are not just about numbers; they are about recognizing and valuing the contributions of your workforce.

How often should I review employee costs?

+It’s recommended to review employee costs at least annually, but more frequent reviews may be necessary, especially during periods of significant business growth or economic changes. Regular reviews ensure your compensation structure remains competitive and aligned with your business goals.

What if an employee’s performance doesn’t justify their cost?

+In such cases, it’s important to have open and honest conversations with the employee. Discuss performance expectations, provide feedback, and offer support to improve. If performance doesn’t improve, you may need to consider other options, such as reallocating responsibilities or making changes to the compensation structure.

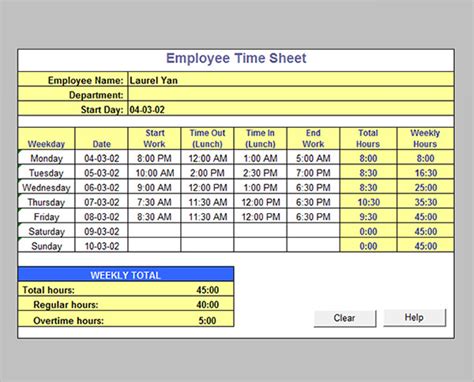

How can I improve the accuracy of my employee cost calculations?

+To enhance accuracy, ensure you have comprehensive and up-to-date data on all components of employee compensation. Regularly review and update your records, and consider using specialized software or tools designed for calculating employee costs. Additionally, stay informed about industry trends and benchmarks to ensure your calculations are aligned with market realities.