1099 Workers: Compulsory Compensation?

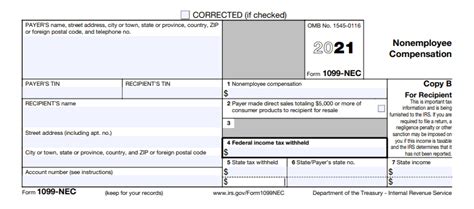

In the realm of employment and tax classifications, the 1099 worker category has been a topic of growing interest and discussion. A 1099 worker, named after the IRS Form 1099, is an independent contractor or freelancer who provides services to a business or client but is not considered an employee. This classification brings with it certain implications and responsibilities for both the worker and the hiring entity, particularly in regard to compensation and benefits.

Understanding 1099 Worker Status

A 1099 worker is essentially self-employed and is responsible for their own taxes and benefits. This classification is often chosen by individuals who want the flexibility and autonomy of working for themselves, setting their own hours, and choosing their clients or projects. From software developers and graphic designers to consultants and writers, the 1099 workforce is diverse and spans across numerous industries.

The distinction between a 1099 worker and an employee (typically classified as a W-2 employee) is crucial. Employees are considered part of the company they work for and are entitled to certain benefits and protections, such as minimum wage, overtime pay, and unemployment insurance. In contrast, 1099 workers are considered independent contractors, which means they are responsible for their own tax obligations and do not receive the same benefits as employees.

Compensation and Benefits for 1099 Workers

The compensation structure for 1099 workers can vary greatly depending on the industry, the nature of the work, and the agreements made between the worker and the hiring entity. Unlike employees, who often receive a set salary or hourly wage, 1099 workers typically charge by the project, by the hour, or through a retainer system. This flexibility in pricing allows them to set their own rates and negotiate contracts based on their skills, experience, and the market demand for their services.

For instance, a software developer might charge a flat fee for a specific project, while a consultant might bill their client on an hourly basis. Some 1099 workers may also opt for a retainer system, where they receive a fixed monthly or yearly amount in exchange for their services, similar to a subscription model. These arrangements provide a level of stability and certainty for both the worker and the client, as the terms of the agreement are clearly defined.

Compulsory Compensation Laws

The question of whether 1099 workers are entitled to compulsory compensation, similar to the minimum wage laws that apply to employees, is a complex one. Currently, there is no federal law that mandates a minimum wage for independent contractors. However, this does not mean that 1099 workers are not protected in any way. Various laws and regulations exist to ensure fair treatment and compensation for these workers, and these laws are continually evolving to keep pace with the changing nature of work.

One key law that affects 1099 workers is the Fair Labor Standards Act (FLSA). While this law primarily applies to employees, it also has provisions that can impact independent contractors. For example, the FLSA establishes minimum wage and overtime pay requirements, and these provisions can sometimes be applied to 1099 workers in certain circumstances. If a 1099 worker is found to be misclassified as an independent contractor when they should have been classified as an employee, they may be entitled to back wages and other benefits.

State-Level Compensation Laws

Beyond federal laws, states also have their own regulations and laws that can impact the compensation of 1099 workers. For instance, some states have enacted laws that set minimum wage requirements for certain types of work, including independent contractors. These laws can vary significantly from state to state, and it is crucial for both 1099 workers and hiring entities to be aware of the specific regulations in their jurisdiction.

| State | Minimum Wage for 1099 Workers |

|---|---|

| California | $14.00 (as of 2023) for businesses with 26 or more employees |

| New York | $14.00 (as of 2023) for most industries |

| Washington | $15.74 (as of 2023) for all industries |

| Massachusetts | $15.50 (as of 2023) for most industries |

These states have taken steps to ensure that 1099 workers are not undervalued or underpaid, and they provide a useful example of how state-level regulations can impact the compensation of independent contractors.

Industry-Specific Compensation Standards

In addition to federal and state laws, industry-specific standards and practices can also influence the compensation of 1099 workers. Many industries have established norms and benchmarks for rates and pricing, which can help ensure that workers are fairly compensated for their skills and expertise. For example, the American Society of Civil Engineers (ASCE) provides guidelines for engineering rates, while the National Association of Broadcasters (NAB) offers suggestions for rates in the broadcasting industry.

These industry-specific standards can be particularly valuable for 1099 workers who are just starting out or who are looking to set their rates in a new field. By following these guidelines, workers can ensure that they are not undervaluing their services and can negotiate rates that are in line with industry expectations.

Benefits and Protections for 1099 Workers

While 1099 workers are not entitled to the same benefits as employees, they still have access to various protections and advantages. For example, 1099 workers are often free to choose their clients and projects, which can lead to more diverse and engaging work. They also have the opportunity to set their own hours and work from anywhere, providing a level of flexibility that many employees do not have.

Additionally, 1099 workers are not subject to the same level of oversight and control as employees. This means they can make their own decisions about how to perform their work, which can be particularly appealing to those who value autonomy and creativity in their careers. Moreover, 1099 workers are not tied to a single employer, which can open up opportunities for building a diverse portfolio of clients and projects.

Health Insurance and Retirement Benefits

One area where 1099 workers may face challenges is in obtaining health insurance and retirement benefits. Because they are not considered employees, they are not eligible for employer-sponsored health insurance plans or retirement benefits, such as a 401(k) plan. However, 1099 workers still have options for securing health insurance and planning for their retirement.

For health insurance, 1099 workers can purchase plans through the Health Insurance Marketplace or directly from insurance providers. These plans are often more expensive than employer-sponsored plans, but they provide essential coverage for medical expenses. Additionally, some states have established health insurance marketplaces specifically for independent contractors, which can offer more affordable options.

When it comes to retirement planning, 1099 workers have a few options. They can open an Individual Retirement Account (IRA) or a Solo 401(k) plan, both of which allow them to save for retirement on a tax-advantaged basis. These plans provide a way for 1099 workers to build retirement savings and take advantage of the same tax benefits that employees enjoy through their workplace retirement plans.

Unemployment Benefits

Another area where 1099 workers may face challenges is in obtaining unemployment benefits. Unlike employees, who are typically eligible for unemployment insurance if they lose their job, 1099 workers are not entitled to these benefits. This is because unemployment insurance is typically funded by employers, and since 1099 workers are considered independent contractors, they are not covered by this system.

However, some states have implemented programs to provide unemployment benefits to certain types of independent contractors, including 1099 workers. For example, California's Employment Development Department (EDD) offers unemployment benefits to certain types of independent contractors, including gig workers and freelancers. These programs can provide a safety net for 1099 workers who face periods of unemployment or reduced work.

The Future of 1099 Work

The rise of the gig economy and the increasing popularity of remote work have led to a significant growth in the number of 1099 workers. This trend is expected to continue, as more individuals seek the flexibility and autonomy that independent contracting offers. As the 1099 workforce expands, there will likely be a greater focus on ensuring that these workers are fairly compensated and have access to the benefits and protections they need.

One key area of focus will be on ensuring that 1099 workers are not misclassified as independent contractors when they should be classified as employees. Misclassification can lead to workers being denied the benefits and protections they are entitled to, and it can also result in tax evasion by employers. To combat this issue, many states and the federal government have implemented stricter guidelines and penalties for misclassification.

Additionally, there is likely to be continued development of laws and regulations that provide specific protections and benefits for 1099 workers. These could include minimum wage requirements, access to healthcare, and retirement savings plans. As the nature of work continues to evolve, policymakers and employers will need to adapt to ensure that all workers, regardless of their classification, are treated fairly and have the support they need to thrive.

Conclusion

The world of 1099 work is complex and constantly evolving. While 1099 workers may not be entitled to the same compulsory compensation and benefits as employees, they still have access to a range of protections and advantages. From the flexibility to set their own rates and choose their projects to the ability to work remotely and take on diverse assignments, 1099 work offers a unique set of opportunities.

As the gig economy continues to grow, it is essential for 1099 workers to understand their rights and responsibilities. This includes being aware of the various laws and regulations that affect their compensation and benefits, as well as taking advantage of the resources and programs available to support their financial and professional well-being. By staying informed and proactive, 1099 workers can ensure that they are fairly compensated for their skills and contributions.

Are 1099 workers entitled to overtime pay like employees?

+No, 1099 workers are not entitled to overtime pay like employees. This is because 1099 workers are considered independent contractors and are not subject to the same labor laws as employees. However, if a 1099 worker is found to be misclassified and should have been classified as an employee, they may be entitled to back wages, including overtime pay.

What happens if a 1099 worker is paid less than the minimum wage set by their state?

+If a 1099 worker is paid less than the minimum wage set by their state, they may have grounds for legal action. While there is no federal law mandating a minimum wage for independent contractors, some states have enacted laws that set minimum wage requirements for certain types of work, including independent contractors. If a 1099 worker believes they have been underpaid, they should consult with an attorney or their state’s labor department for guidance.

Can 1099 workers negotiate their rates and contracts with clients?

+Yes, one of the advantages of being a 1099 worker is the ability to negotiate rates and contract terms with clients. This allows workers to set their own prices based on their skills, experience, and the market demand for their services. It’s important for 1099 workers to be aware of industry standards and benchmarks to ensure they are fairly compensated for their work.